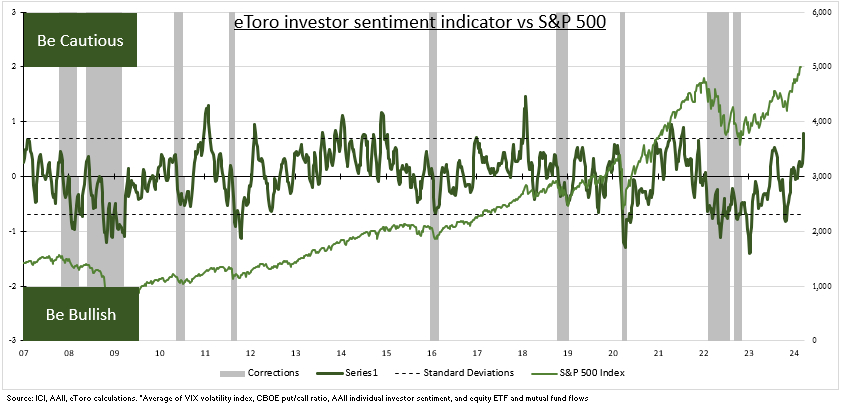

MARKET: Investor sentiment has seen a sharp increase in the past six weeks, according to our proprietary indicator. Now at the highest levels in near two years (see chart) and a flashing yellow warning. Its the first sign of investor FOMO or Fear Of Missing Out, with the indicator surge driven by large performance-chasing fund inflows. The twin bull market pillars will be tested this quarter. As Q1 earnings start April 12th and June is set for the first ECB and Fed interest rate cuts. Markets are due a breather or 5% pullback, and this sentiment surge adds to our conviction. But with fundamentals strong and cash on the sidelines it shouldn’t be feared.

SENTIMENT: The sentiment index spike has been driven by rebounding ETF flows. With significant inflows for four straight weeks, focused on US large caps. We are not surprised by this. With the large amounts of cash on the sidelines and the remorseless fundamentally driven rally we have seen since November. VIX volatility has also fallen back towards historic lows, and AAII retail investor sentiment is near the most bullish levels of the year. Only the equity put/call ratio remains near average. This sentiment indicator spike is a contrarian signal of lower returns ahead. But not of sharp weakness. It historically works better at signaling bull not bear markets.

INDICATOR: Our proprietary eToro investor sentiment indicator tracks the VIX, fund flows, retail sentiment, and the put/call ratio. A low number is contrarian bullish, with more investors left to turn positive the market. Whilst a high number is a signal for contrarian caution, with investors already bullish. It’s typically been a better buy than sell signal. It is specifically made of 1) Equity mutual fund and exchange traded fund (ETF) flows. 2) Long-running American Association of Individual Investors (AAII) sentiment survey. 3) The VIX index of expected 30- day S&P 500 volatility. 4) S&P 500 put/call ratio, proportion of put buying (option to sell) vs calls (to buy).

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FOMO makes a return to markets

Published 02/04/2024, 07:58

Updated 09/02/2024, 07:53

FOMO makes a return to markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.