Bitcoin and other cryptocurrencies (digital assets that exist on computerised ledgers and trade online) have taken a wild ride over the past year, with big ups and downs. But the ups have seemingly garnered far more attention, spurring enthusiasm. Fisher Investments UK hears from many investors who are interested in bitcoin and want to know our take. We aren’t inherently for or against many investments outright, but we do think there are a few things you should think carefully about before buying cryptocurrencies. Here are some considerations we think are important to weigh.

1. Why are you interested?

In Fisher Investments UK’s view, most interest stems from bitcoin’s well-publicised big returns, like its 1,197.4% return from its pandemic-era low on 12/03/2020 through its most recent high on 08/11/2021. In our experience, those seduced by such astronomical figures tend to gloss over things that happened when they didn’t own the asset, like bitcoin’s roughly -50% decline over two months this past spring. But when they do own the asset in question, their reaction can be another story altogether. We will return to that huge volatility momentarily, but for now, consider: bitcoin’s price is still quite elevated, and it can move hugely in a single day. Buying after a big run seems to us therefore largely a greater fools argument – the belief that even if you buy high, someone else will happily buy from you at an even higher price. This isn’t a solid thesis to own something, in our view: it isn’t something you can assign a probability to and isn’t driven by anything fundamental.

2. Can you identify fundamental forces that drive cryptocurrencies’ returns?

Bitcoin is just over 11 years old, as we write – a very, very short history compared to stocks and bonds. In Fisher Investments UK’s view, that lack of history means no fundamental thesis to own cryptocurrencies has enough evidence to prove whether it does or doesn’t work. We think an investment thesis should hold across multiple bull markets (long periods of overall rising equity prices) and ensuing bear markets (typically long, fundamentally driven declines exceeding -20%) in order to prove itself valid. It needn’t work all the time, but to us, there should be times it worked. We don’t have that with bitcoin. For instance, many commentators we follow view it as an inflation hedge – an investment that rises when prices are broadly rising across the economy, maintaining your money’s purchasing power. Yet until this summer, bitcoin’s existence has coincided with one of the lowest-inflation spells in modern history. During that span, bitcoin has boomed and busted multiple times, which doesn’t match what one would logically expect of an inflation hedge. A proper inflation hedge should have a steady, repeating correlation with price movement, in Fisher Investments UK’s view. Furthermore, we don’t yet know if bitcoin’s high near-term volatility is paired with high long-term returns. We simply don’t have enough data on the latter to know.

3. How comfortable are you with volatility?

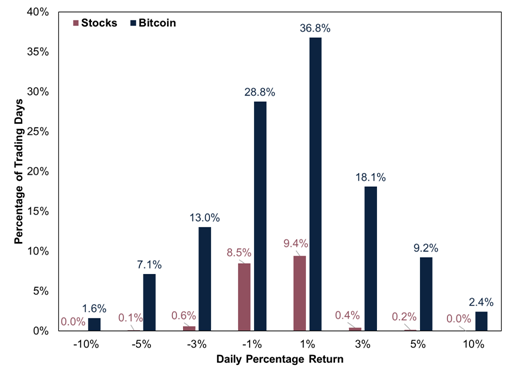

As mentioned earlier, bitcoin has enjoyed some huge booms and catastrophic busts, suggesting to us that one must be an impeccable market timer or have nerves of steel to reap long-term returns. To see this another way, consider the following exhibit, which compares bitcoin and MSCI World Index daily price movement over the 10-year period from 30 November 2011 to 30 November 2021. As you will see, it has had far, far more big moves up and down than stocks during this span. Are you comfortable with your investment’s value falling -10% in a single day? Bitcoin has achieved that dubious milestone 60 times in the last decade, or 1.6% of the time. Global stocks? None.

Exhibit: Bitcoin’s Daily Volatility Dwarfs Stocks’

Source: Global Financial Data and FactSet, as of 04/06/2021. Bitcoin and MSCI World Index daily price returns, 30/11/2011–30/11/2021.

4. Have you considered thieves?

Bitcoin is largely unregulated, which according to some proponents is part of its appeal – but there is a dark side. According to widespread media reporting we follow, cryptocurrencies are big in the criminal underworld because they are designed to be untraceable. There have also been several high-profile thefts of bitcoin, which is an irreversible transaction with little recourse. The same goes for those whose cryptocurrency holdings live on an exchange that collapses, as those who used an old exchange called Mt Gox learned the hard way several years back. We are aware that some traditional brokerages and banks have started to get involved in custody of cryptocurrencies, but this is very new and niche at this point.

5. How good are you with passwords?

A lot of people likely made big money on bitcoin over the last year. Unfortunately, some may never be able to access it because they lost their passwords, and many of the exchanges don’t have password-retrieval features. That is another major difference with traditional brokerage accounts, which have plenty of fail-safes to ensure you have access to your financial property. Again, we have found some traditional brokerages are starting to get involved in the custody of bitcoin and others. But it isn’t very common as yet.

We aren’t inherently against bitcoin. But we think it is important to consider all facets of an investment before you take the plunge, carefully weighing the potential risks and rewards.

Disclaimer:

Get exclusive stock market knowledge in your Markets Commentary guide as the first of our ongoing insights.

Follow the latest market news and updates from Fisher Investments UK:

Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square (NYSE:SQ) SQ, Canary Wharf, London, E14 5AX, United Kingdom.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[1] Source: CoinMarketCap.com. Statement based on daily prices of bitcoin and other cryptocurrencies.

[1] Source: Global Financial Data, as of 06/12/2021. Bitcoin price return, 12/03/2020–08/11/2021.

[1] Ibid. Bitcoin price return, 13/04/2021–25/06/2021.

[1] See Note i.

[1] Source: FactSet and Federal Reserve Bank of St. Louis, as of 06/12/2021. Statement based on eurozone harmonised Consumer Price Index (CPI) rates and US CPI, January 1996–November 2021.

[1] Source: Global Financial Data, as of 06/12/2021. Statement based on bitcoin price return, 30/11/2011–30/11/2021.

[1] “South African Brothers Disappear Along With $3.6 Billion in Bitcoin,” Chris Morris, Fortune, 24/06/2021.

[1] “The Long Shadow of the Mt Gox Collapse,” Michael Bacina, Medium, 06/03/2019.

[1] Source: Global Financial Data, as of 06/12/2021. Statement based on bitcoin returns, 30/11/2020–30/11/2021.