The major currency pair is rather neutral early in another week of August. EUR/USD is mostly trading at 1.0180.

The labour market statistics published by the US last Friday were in favour of the USD. For example, the unemployment rate was 3.5% in July against the expected reading of 3.6%. The NFP showed 528K, while market expectations implied 250K.

Earlier, when tightening its monetary policy, the US FOMC on several occasions mentioned that the labour market was stable and strong. As long as the country’s employment remains fine, the regulator won’t change its stance.

The Fed’s next meeting is scheduled for 21 September, and investors have already priced in the possibility of a 50-point rate hike.

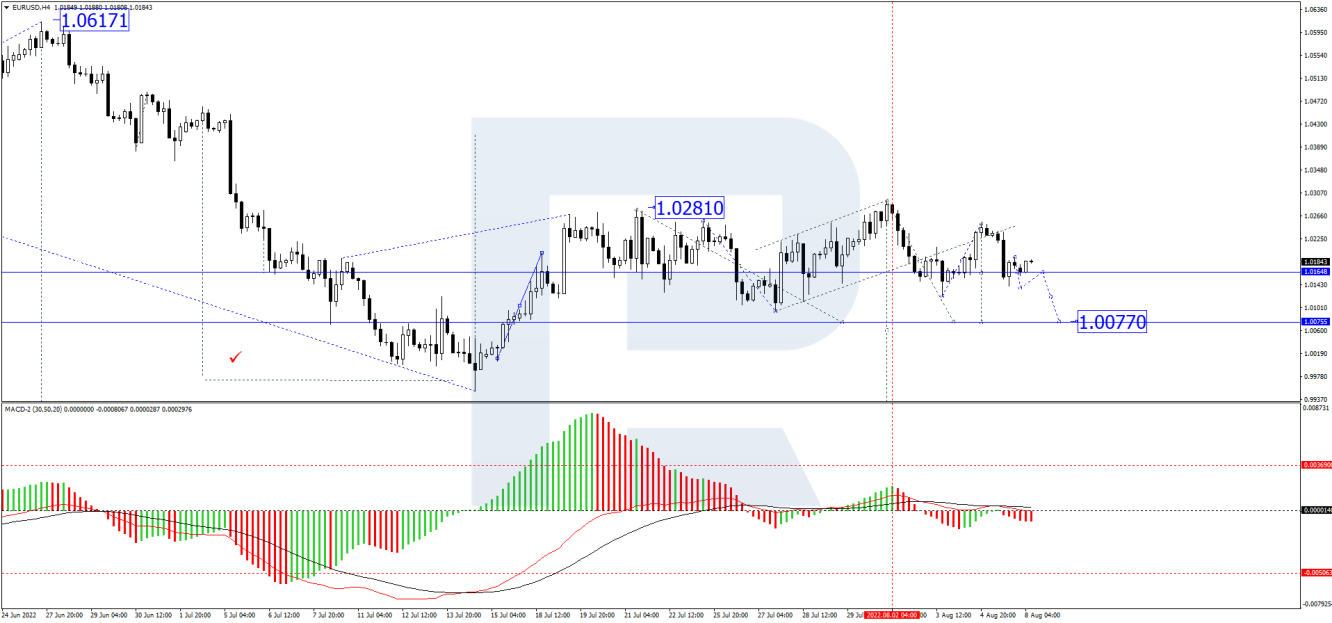

On the H4 chart, after breaking the bullish channel downwards at 1.0185, EUR/USD is still consolidating around this level. Possibly, the pair may continue the correction down to 1.0077 and may later resume trading upwards with the target at 1.0222. From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is moving at 0. In the future, it may resume falling to update the lows.

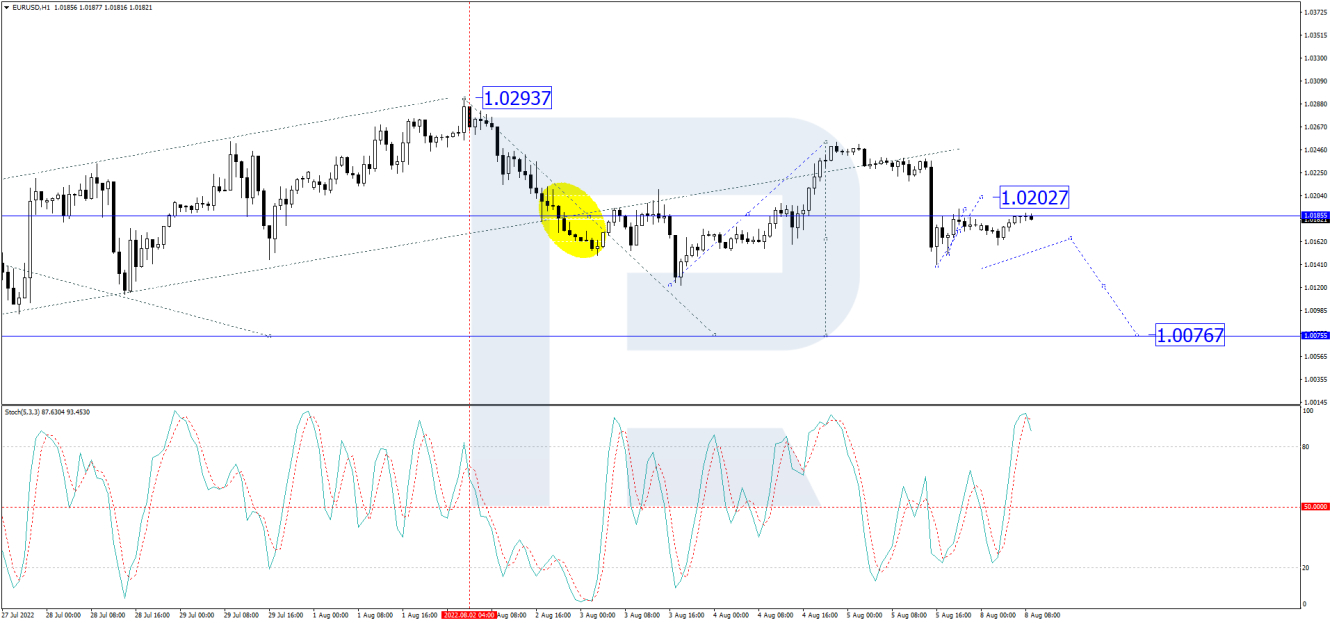

As we can see in the H1 chart, having finished the descending structure at 1.0150, EUR/USD has returned to 1.0185. Today, the pair may grow to reach 1.0202 and then resume trading downwards with the target at 1.0077. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: its signal line is moving above 80. In the future, the line may fall to break 50 and continue falling to reach 20.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.