The US dollar weakened a little ahead of US CPI release, as polls pointed to Harris having done better than Trump in the first presidential debate. The EUR/USD managed to rebound a touch after starting the week on the back foot, following the drop on Friday when a weaker US jobs report was not enough to send the US dollar further lower.

The EUR/USD’s downside could be limited from here on ahead of US CPI inflation data later on today and a rate decision by the European Central Bank on Thursday, despite its recent struggles and not-so-great Eurozone data.

Why has the EUR/USD struggled in recent days?

A quiet start to this week’s economic calendar allowed the dollar to find some support against nearly major currencies except the yen, putting mild downward pressure on the EUR/USD. This came after a drop on Friday when the latest US jobs data confirmed the Fed’s concerns about employment weakening.

The Fed Chair had already confirmed in August that interest rates were going to be trimmed from September, so the jobs report itself was not weak enough for investors to price in a 50-basis point cut, resulting in a mild dollar recovery. Initially, Friday’s soft jobs report caused a stir in the rates markets, but sentiment quickly shifted toward a more cautious 25 basis point cut for the upcoming FOMC meeting.

However, there is now growing anticipation for more aggressive rate cuts later in the year and early 2025, especially after a Fed official floated the idea of "front-loading" cuts. But with US data weakening, crude oil prices falling, and the Fed turning dovish, the EUR-to-USD currency pair forecast remains moderately bullish unless we see a major surprise in this week’s upcoming macro events. Speaking of…

US CPI coming up

As we transition to the second half of this week, key macro events are eagerly anticipated on the economic data calendar, including the latest US inflation report today and a rate decision from the European Central Bank tomorrow. After last week’s jobs data, I continue to hold a bearish outlook on the dollar ahead of the upcoming CPI release. The market remains split on the size of the expected rate cut, with no clear consensus. The Fed, aiming to prevent a significant shift in the dollar when it meets next week, will be hoping that this week's inflation data helps settle the market's uncertainty.

With US CPI trending towards the Fed’s target, Powell has already signaled approval for a rate cut at the September 18 FOMC meeting. This CPI report will be the final significant data point before that meeting, guiding policymakers on whether to opt for a 50 basis point cut or stick with the usual 25.

As a result, it could attract considerable attention, particularly if the numbers differ significantly from expectations. Inflation slowed for the fourth straight month in July, hitting 2.9% year-over-year, the lowest level since March 2021. In August, it is projected to decline further to 2.6%, while core CPI is anticipated to remain steady at 3.2% year-over-year.

ECB rate decision loom large

So far, it appears as though analysts are in agreement that the European Central Bank is unlikely to accelerate interest rate cuts in response to the weakening eurozone economy. Following a 25-basis point rate cut in June, the ECB is expected to implement a similar reduction on Thursday.

The Eurozone is grappling with sluggish economic growth and persistent inflation, with Germany—its largest economy—facing challenges from a struggling manufacturing sector and cautious consumer spending. These concerns were highlighted for example by a surprise 2.4% m/m drop in German industrial production last week, and a deterioration in investor confidence, as per Monday’s release of the Sentix Investor Confidence index which fell to -15.4 from -13.9. Given these conditions, market sentiment remains relatively cautious towards the ECB's actions.

EUR/USD technical analysis and trade ideas

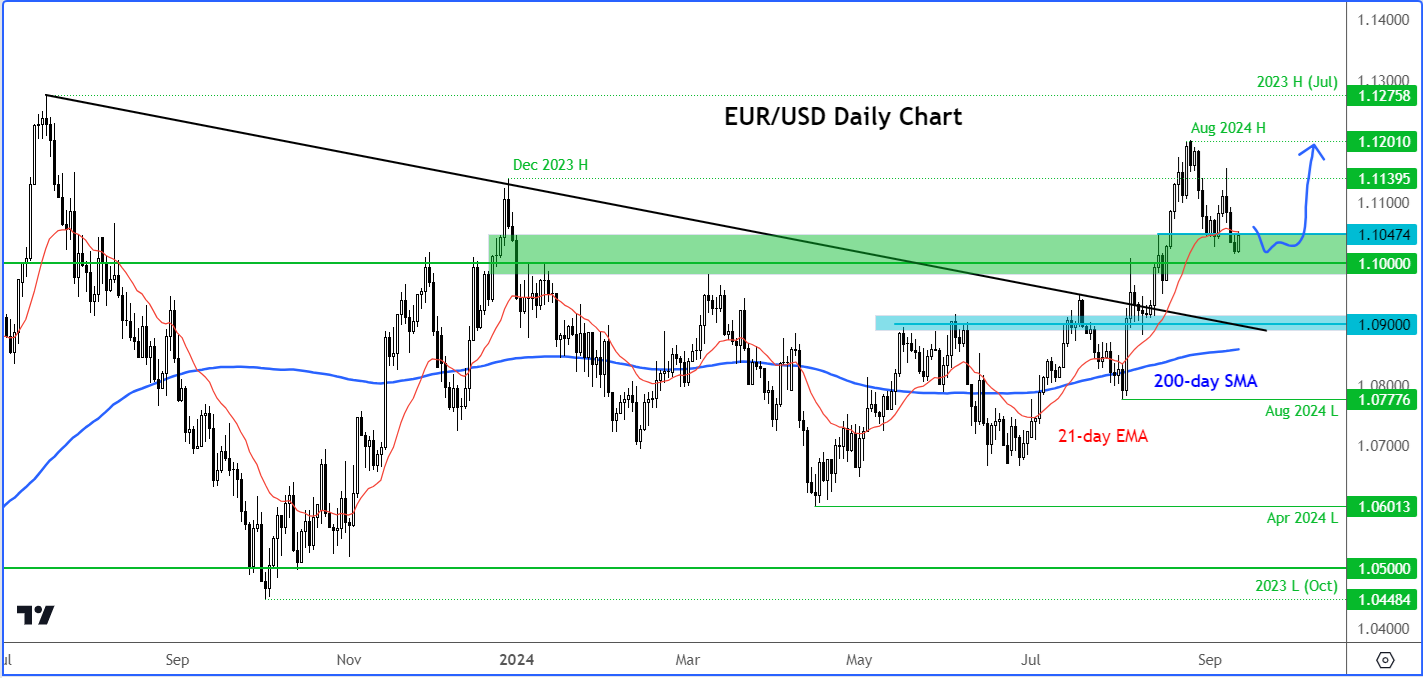

The loss of bullish momentum means the EUR/USD is not looking as rosy as it did towards the end of August. However, it hasn’t yet created a bearish reversal pattern to suggest that the bullish trend has ended.

Source: TradingView.com

Since hitting a low in April, the EUR/USD has exhibited bullish price action, forming a series of higher lows and highs, with the 200-day moving average starting to slope upward. The pair has also broken through several resistance levels and bearish trend lines, indicating that the path of least resistance has been bullish.

So, unless we see a significant reversal pattern or a breakdown in the market structure of higher lows, neither of which has occurred yet, the EUR/USD is still arguably inside a larger bullish trend. Therefore, the technical outlook for EUR/USD is far from bearish.

The key support area for EUR/USD is now between 1.1000 and 1.1045, an area that previously acted as resistance. The 21-day exponential moving average is also just above this zone. Traders are watching for a bullish price candle to form here this week, to potentially signal a continuation of the uptrend. If this doesn’t materialize—perhaps due to unexpectedly strong US CPI data or a dovish ECB —it could lead to a deeper pullback towards the next support level around 1.09.

On the resistance side, potential levels are seen at 1.1100 and 1.1140, with the August high of 1.1200 serving as the next major target for the bulls if those levels are breached.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.