The EUR/USD’s sluggish start to the year continued in the first half of Wednesday’s session, with investors showing a preference for the US dollar ahead of key data releases from the world’s largest economy.

The EUR/USD has also been hurt by a poor start to the year for equities, with major indexes extending their losses for the second day.

Expectations for a dovish shift by the Federal Reserve boosted risk assets at the end of 2023. However, this momentum has slowed in early 2024. Investors doubt if rate cuts will match market expectations.

The market anticipates up to 160 basis points in cuts this year, double the Fed's projection. Some investors feel that the market may be overestimating the rate cuts and are thus reversing their trades or taking profit on long-risk positions.

FOMC minutes may provide more insights into the Fed’s stance

Investors will watch economic data for clues and will be reassessing the likelihood of significant cuts. Today’s releases of the FOMC’s December meeting minutes will provide insight into the central bank's stance.

The FOMC minutes might reveal more about the Fed's 2024 rate cut strategy. The rates market indicates a 75% chance of a March cut. Last year, expectations of 2024 rate cuts weakened the US dollar, but the minutes may not confirm the hoped-for dovish signals.

Though the Fed hinted at 2024 rate cuts, Chair Powell provided few details on timing and scale. The market might have prematurely anticipated next year's cuts. Disappointing minutes could boost USD, further weighing on the EUR/USD in the short-term

Upcoming key US data could move the dollar sharply

The ADP private payrolls report and weekly jobless claims on Thursday will shed some more light on the labor market, ahead of the official nonfarm payrolls report on Friday.

As it is all about when the Fed will start cutting rates in 2024, the December jobs report could have significant implications on those expectations.

Last time, the jobs report was quite strong with both the headline jobs growing more than expected at nearly 200K and average hourly earnings printing 0.4% m/m.

If employment continues to remain strong, then the Fed may have to delay its rate cuts to prevent inflation from accelerating again. The market will be looking for evidence of a soft landing.

Meanwhile, the economic calendar in Europe is light. We had labor market data from Germany and Spain earlier.

German unemployment rose by 5K compared to 20K expected, while Spanish unemployment fell by a larger-than-expected 27.4K vs. -15.7K eyed.

The positive labor market data comes a day after the Eurozone manufacturing PMI was revised a touch high to 44.4 from 44.2.

Looking ahead, the key European data release will be the German CPI on Thursday, with the Eurozone inflation figures to come a day later on Friday.

EUR/USD key technical levels to watch

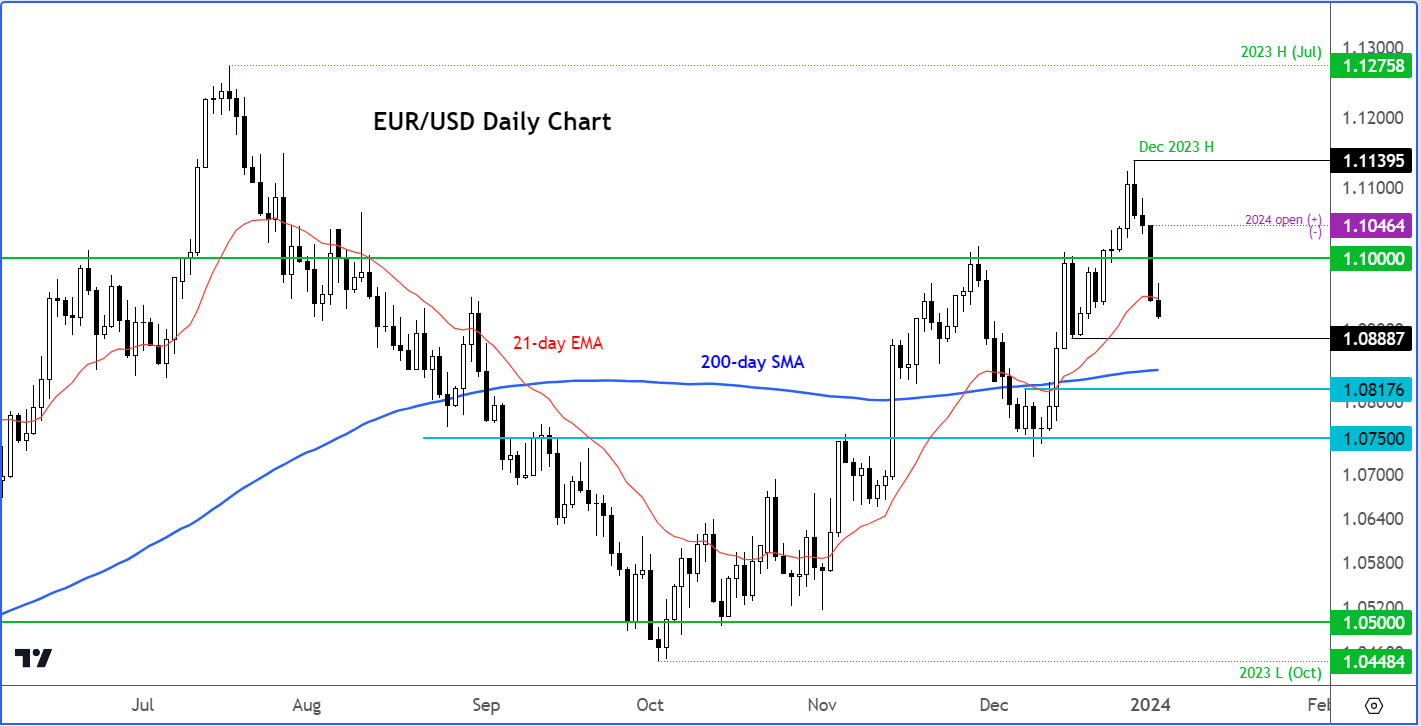

Source: TradingView.com

The technical outlook on the EUR/USD is still bullish on the longer-term time frames, given that the price is still holding above the 200-day average.

But in the short-term, we are continuing to see bearish price action, ever since it failed to make a new high for 2023 in December.

Therefore, it may be best for the bulls to wait for a bullish signal first rather than blindly bid price at potential support levels, a strategy that tends to be favored in more established and strong bullish trends.

The EUR/USD peaked at 1.1140 in December and therefore unable to take out the high of 1.1275 from July.

These levels will be the main upside objective for the EUR/USD bulls, in the event we see the resumption of the bullish trend.

Short-term resistance is now seen around the 1.1000 area, which failed to hold as support for now. Another reference point to watch is this year’s opening price is at 1.1046.

Given the fact that the EUR/USD ended a two-year losing run in 2023, a move above this year’s opening price would signal the resumption of the multi-month bullish trend.

There are plenty of potential support levels to watch. So far some of these levels have failed to hold, including 1.0950 which ties in with the 21-day exponential moving average.

The longer-term 200-day simple average comes in at 1.0845. But as mentioned, let’s wait for a confirmed bullish signal in light of the EUR/USD’s sluggish start to the year.

Read my articles at City Index

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.