The EUR/USD currency pair is cautiously trading at 1.0670 as it enters a pivotal week. All eyes are on the upcoming Federal Reserve meeting, scheduled to conclude on Wednesday with a highly-anticipated interest rate decision. Market consensus points to a 97% likelihood of rates remaining unchanged at 5.5% per annum.

The focus will then shift to the Federal Reserve's subsequent statement, which is expected to address key economic indicators including inflation rates, labor market health, and the overall business climate. This will equip investors with essential insights into what they can anticipate for November. As of now, the market is bracing for a probable interest rate hike in November, before a temporary pause. Any details from the Federal Reserve will be scrutinized closely.

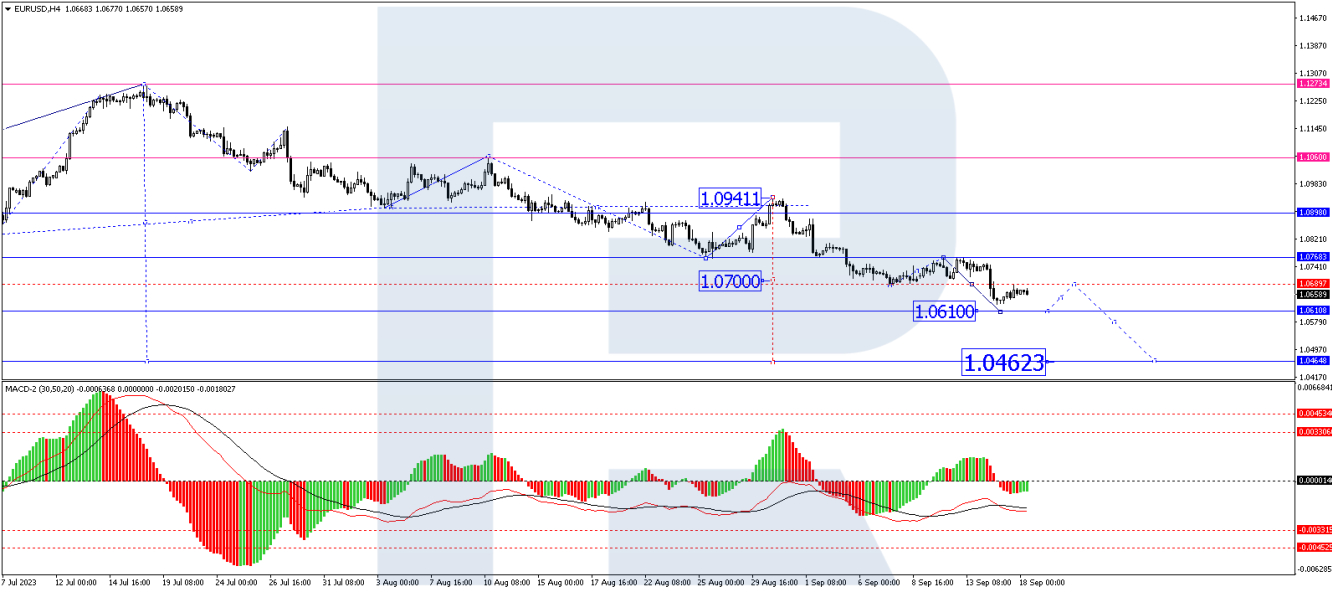

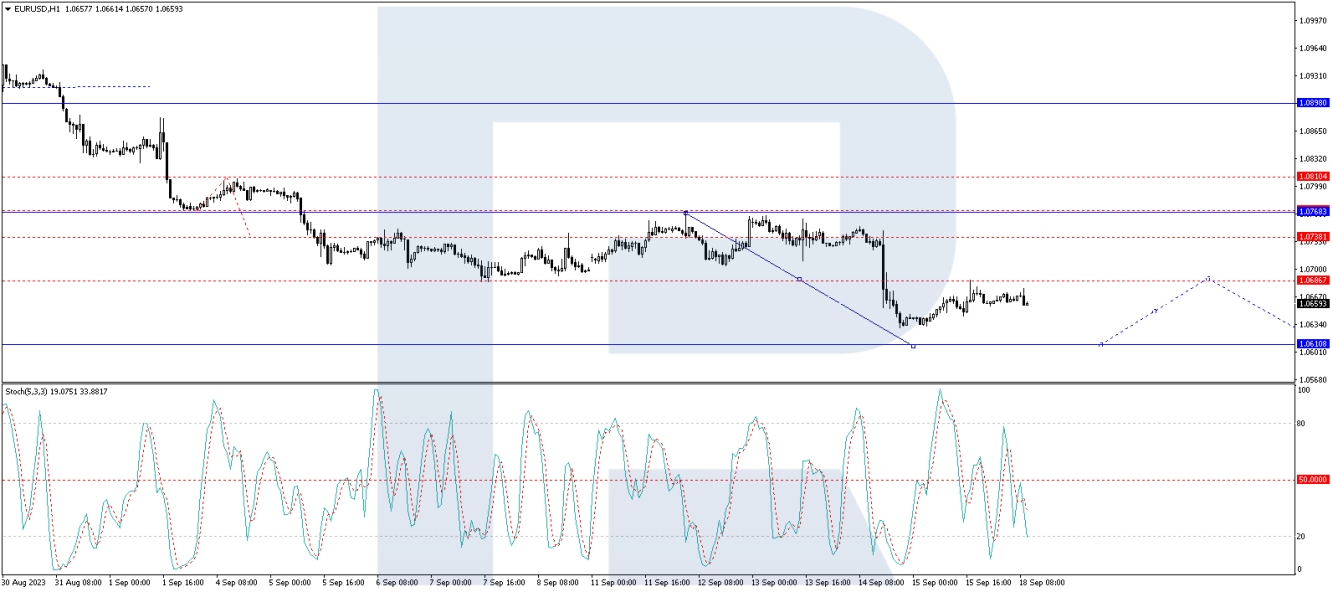

Technical Analysis of EUR/USD price chart

The 4-hour chart for EUR/USD indicates that a declining wave which started at 1.0686 has reached a temporary pause at 1.0768. The market is expected to resume this downward trend, targeting a new low at 1.0610. Upon reaching this level, a corrective movement back to 1.0686 is conceivable. The next target for the downward wave is 1.0463. The Moving Average Convergence Divergence (MACD) corroborates this scenario, with its signal line positioned below zero and pointing downward.

On the 1-hour chart, a consolidation phase has been observed around 1.0686. The market has since extended this range downwards, and a decline to 1.0610 could be imminent. If this level is hit, a subsequent rally to 1.0686 is possible. The Stochastic oscillator supports this view, as its signal line has recoiled from the 80 level and is trending downward, suggesting it could plummet to as low as 20.

In summary, the EUR/USD pair remains sensitive to the Federal Reserve's upcoming decisions and statements. Technically speaking, both short and mid-term indicators suggest a bearish outlook. Market participants will be parsing every word from the Federal Reserve for cues on the economic landscape and, consequently, future interest rate movements.

By RoboForex Analytical Department

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.