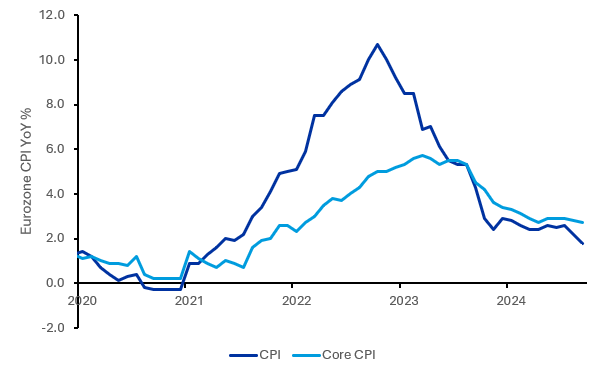

Headline inflation in the eurozone cooled to 1.8% in September, a sharp drop from the 2.2% recorded in August.

More to the point, this leaves price growth across the bloc tracking below the ECB’s target for the first time since June 2021. This news comes just a day after President Lagarde suggested growing optimism regarding the inflation outlook. With this in mind, we continue to look for the ECB to step up their pace of easing, projecting a rate cut later this month, and then again in December.

Admittedly, much of the drop-off seen in this latest set of data stems from volatile components.

Looking at core inflation, price growth fell 0.1pp to 2.7% YoY, down from 2.8% the month prior, matching consensus expectations. Nevertheless, this is hardly a surprise, a point also remarked on by President Lagarde yesterday, noting that “Inflation might temporarily increase in the fourth quarter of this year as previous sharp falls in energy prices drop out of the annual rates, but the latest developments strengthen our confidence that inflation will return to target in a timely manner”.

As we have argued for some time, the ECB should be able to draw growing certainty from the impact of slowing economic growth.

Recent PMI indicators for the eurozone have slowed alarmingly, with the signs that price growth should follow suit. Indeed, this underpinned further comments from Lagarde yesterday, saying that “Disinflation has been accelerating over the last two months” and that “the recovery is facing headwinds”.

With today’s data in hand, confirming that view, there seems little reason for the ECB to stand pat later this month, or in December.

Price growth is now comfortably on the way back to target and downside risks are growing. We now expect a series of 25bp rate cuts for eurozone rates, else the ECB is likely to find itself once again behind the curve. Markets have reached a similar conclusion early this week too. Swaps now price six consecutive ECB rate cuts, a development that is seeing EURUSD trade under pressure, dipping towards 1.11 this morning.

Eurozone inflation continues to cool, which should prompt a succession of rate cuts from the ECB in coming months

.

.

This content was originally published by our partners at Monex Europe.