Tariffs take their toll on investors

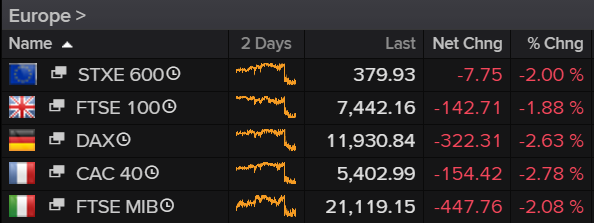

It goes without saying that Trump’s latest batch of tariffs are taking their toll on markets at the end of the week, with Europe deep in negative territory and the US on course for another bumpy session.

The announcement, which came after a week of talks in Shanghai, came as a bit of a shock to investors, not because we weren’t preparing for the possibility of more or because we were optimistic about the outcome of this week, but the knee jerk nature of it. How bad could this week have gone that it warranted such a speedy announcement and what does it mean for the chances of a deal in the future.

Trump is no stranger to strong arm tactics to get what he wants but this feels a little impulsive even for him. It’s clear he wants this wrapped up soon rather than having it hang over next year’s election, especially if the economy continues to falter as a result, but he’s now taking big risks because if China doesn’t play ball, he’ll have to go all in and that could cost him.

Investors are clearly not taking the news well, even with a US rate cut in September being almost fully priced in, which had previously been supporting the markets. Between this and the Fed clearly being reluctant to ease as aggressively as the White House and markets want it to, it could be an interesting month for equity markets as the risk piles up.

Gold bulls looking a little smug right now

Gold naturally very much enjoyed Trump’s announcement, rallying as risk aversion quickly spread throughout the markets and the dollar sold off in anticipation of rate cuts. It was testing $1,400 earlier in the day but was back at its recent peak where we’ve seen some profit taking in today’s session. Gold bulls may be feeling quite smug at the moment as everything seems to be lining up for them but central banks seem to want to keep us on our toes which may continue to make things interesting.

Gold Daily Chart

Dead cat bounce doesn’t bode well for oil

Oil tumbled as Trump pulled the rug from underneath it. Few things scare oil traders more than a significant threat to the global economic outlook, especially when China is at the front of the queue. WTI found support around the $53.50-54 range and could fall further if efforts aren’t made to play down the new tariffs. At the moment, the rebound today is looking more like a dead cat bounce, which doesn’t bode well.

Brent Daily Chart

Economic Calendar

Disclaimer: This article is for general information purposes only. It is not investment advice, an inducement to trade, or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. Ensure you fully understand all of the risks involved and seek independent advice if necessary. Losses can exceed investment.