Rollover in tech/momentum continues as rising rates splits the pack. Nasdaq lower, S&P 500 and Dow mildly higher on energy and banks. United States 10-Year rates hit 1.67% yesterday from 1.54% on Friday, before retreating to 1.64% this morning. All this comes in the wake of the reappointment of Jay Powell as Fed Chair and expected path of tightening.

Tech, momentum, consumer discretionary names in the firing line – ARK Innovation ETF (NYSE:ARKK) down big again, -11% the last 5 session, Zoom (NASDAQ:ZM) –25% over the same period, Peloton (NASDAQ:PTON) –18, and Robinhood (NASDAQ:HOOD) is another standout underperformer – down 20% in the last 5 sessions. There are two main things happening – a total pullback from the high growth speculative momentum names, and an unwieldy rotation out megacap quality tech into cyclicals and financials, i.e. those that do well from higher rates.

Overall, the broad market is keeping its end up thanks to the rotation – no great signs of stress yet and the market continues to trade near its all-time high, though the Vixx hit a month-and-a-half high above 21.

More of the same? Bank of America forecasts the S&P 500 at 4600 by year-end 2022 (-2% from here). It argues for a higher discount rate for stocks from the Fed’s taper and eventual rate hike plus increased rate and stock volatility. The theme for next year is therefore inflation-protected yield so dividends can keep pace with govt bonds. As such BoA likes energy and financials, which offer inflation-protected yield, and healthcare which offers growth and yield at a ‘reasonable price’. What they are talking about for the year ahead is what we are seeing in this rate-repricing-rotation.

It’s a challenging picture regards Covid in Europe, but the main bourses are firmer this morning. The FTSE 100 has reclaimed the 7,300 level and the DAX made an attempt to regain the 16k level before retreating into the red on some soft Ifo business sentiment data. German business sentiment fell in November, and could fall a lot more as the number of Covid cases and the government’s draconian response make life difficult for businesses.

Meanwhile Germany’s three coalition partners have agreed a deal that clears the path for Olaf Scholz, the current finance minister, to become Chancellor. A press conference is due later – watch for anything on Nord Stream 2 and potential for nat gas markets.

There is a lot of US data to watch for in the session ahead of tomorrow’s Thanksgiving holiday. First up the second reading for Q3 GDP is expected to be revised up to 2.2% from 2.0%. The PCE deflator, which includes food and energy, rose at a 4.4% in September, the fastest since 1991. Core inflation, the Fed’s preferred gauge as it excludes volatile items like food and energy, increased at 3.6%, which was also the fastest pace in 30 years. We could see the headline print above 5% and core above 4% for the October reading, which is released today.

We think the Fed seems to be a little more wary of the risks of persistently high inflation than they were a couple of months ago, which means a super-hot reading will have market reaction. The kneejerk moves higher in the dollar and rates on the Powell announcement have held, but a similar jump today could be one to fade.

Finally, we will be watching for the minutes from the last FOMC meeting for clues about the likely path of monetary policy, specifically how worried about inflation are policymakers, and how close do they think the labour market is to being strong enough to warrant raising rates.

FX markets are still anchored by the strong dollar, with US Dollar Index holding onto the Powell announcement gains at 96.50. GBP/USD made a fresh yearly low yesterday at 1.3342, as the sellers remain in charge. The euro also continues to come under heaps of downwards pressure and is just holding the key support at the 1.1230 area, but has just made a fresh 16-month low this morning as the bears hold sway. If this area doesn’t get breached soon, though, we could see a bump up to 1.14. Turkey’s lira continued to plunge and traded at 13 this morning, a new record low. New Zealand’s dollar fell against the USD despite the RBNZ hiking rates again. Whilst sounding hawkish about the outlook, some had anticipated the RBNZ to go for more than just a 25bps hike.

Strategic oil reserves were released by the US and others in a coordinated effort, but crude prices rose as the move had been well anticipated and priced in. WTI (Jan) rallied for a third day to retake $79 as the coalition of the willing released 50m barrels – somewhat short of the 100m Goldman Sachs says the market had priced. 50m barrels is about half a day’s worth of demand – it was never going to do much. API data showed oil inventories climbing by 2.3m barrels last week vs the expected decline of 500k.

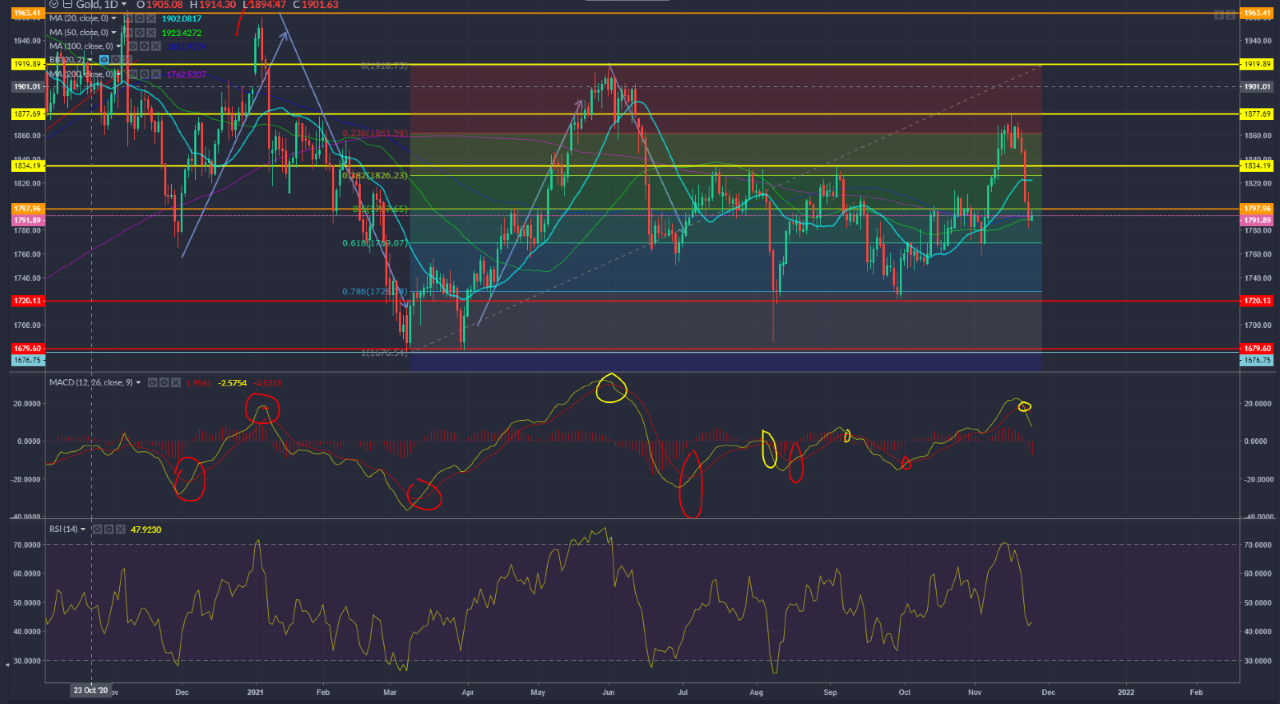

Gold is trying to hold the $1,790 level but remains under a lot of pressure. A bearish MACD crossover was the big signal on Monday and with rate expectations moving up but cooler energy market (for now) seeing inflation expectations come back a bit, it’s a tough picture. Breach here could open up path to $1,770 area. Recovery of $1,800 (hot inflation reading?) could see retest of old horizontal resistance around $1,834.