Needy investors reassured

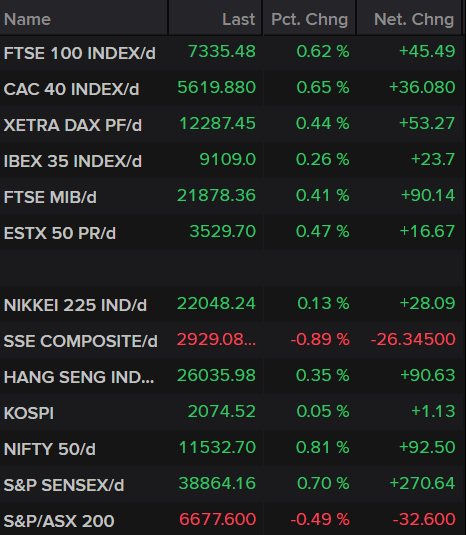

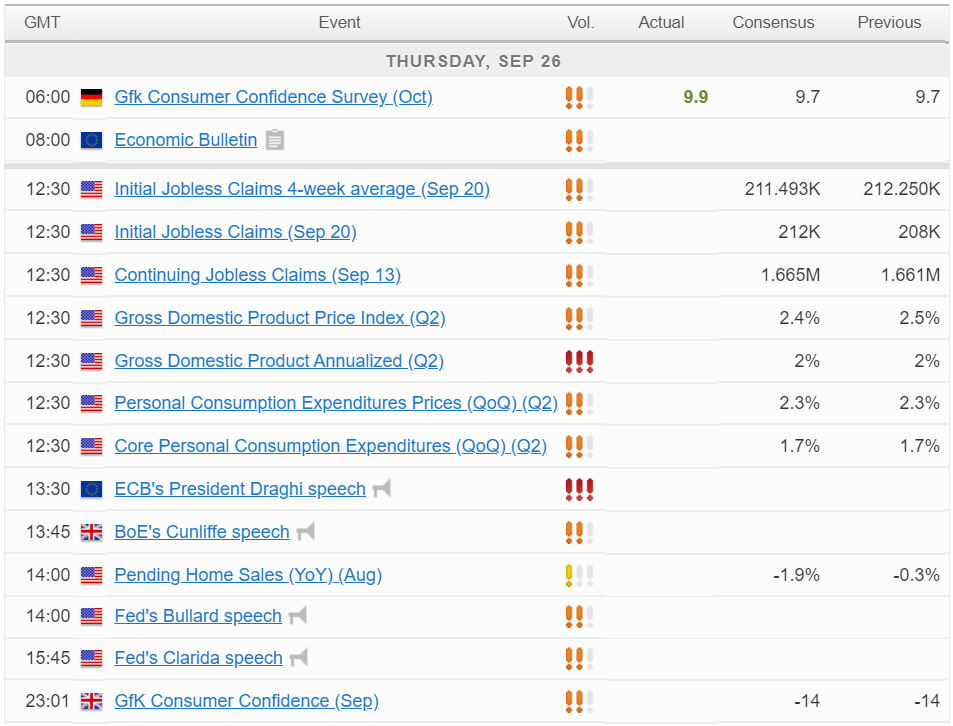

Europe is slightly higher on the open on Thursday, as Trump seeks to divert attention from impeachment to trade.

Let’s face it, trade deals are what investors are really interested in, impeachment is just a political distraction from what is really unsettling investors and policy makers around the world. It may make for an interesting read and, who knows, maybe if it gains some traction it could make next year’s election more interesting but I think that’s about it.

A trade deal between the US and Japan is the more important story for investors. The deal may not cover everything or completely remove tariffs, and I’m not convinced by verbal reassurances from the President about tariffs on cars, but it is a step forward.

Trump was also keen to talk up the prospects of a trade deal with China, claiming it could happen sooner than you think. It amazes me that these soothing tones still draw investors in given how often we’ve heard them in the past but then, they can be a needy bunch, seeking constant reassurance that everything is going to be ok.

Sterling slides as Boris attempts to provoke opposition into early election

Boris Johnson is often compared to Trump and he certainly gave a Trump-esque performance on his return to the Commons on Wednesday, admitting no guilt, offending many and delivering a Rocky-like performance off the ropes.

Many people will be disgusted by his performance but many others will have thoroughly enjoyed it and they’re the ones Boris is interested in. It’s this kind of ugly divisive politics that has got him to the most powerful position in the country, why would he change now?

Sterling did not enjoy its best day but that built up from early on in the session. It remains extremely vulnerable to negative Brexit news and perhaps traders feel that the opposition is being goaded into the early election the Boris team clearly craves.

Gold looking vulnerable after latest failure

Gold is looking very vulnerable once as it plunged on Wednesday having failed to break beyond the $1,530-1,535 resistance. The yellow metal had been on a good run until that point but it just couldn’t take the all-important next step that may have drawn gold bulls back in.

Instead, buoyed by trade news, traders dumped the safe haven and sent it tumbling back to $1,500. It may be paring some of these losses today but a test of $1,480 looks on the cards and I don’t fancy its chances. Gold has looked primed for a correction for a while and the failure to capitalise on the rally may have been the last straw.

Gold Daily Chart

What risk premium?

Technical traders can sometimes become obsessed with gaps being filled but I’m not sure many expected it to happen so fast in the case of oil. After spiking 20% on the news of the attack on Saudi Arabian oil facilities, there was a belief that risk premium wasn’t being properly factored into price and that it may now be so more accurately.

Well that didn’t last long as Saudi efforts to bring the facilities rapidly back online have seen prices fall back close to where they were before the attacks. This was aided by yesterday’s update as well as an unexpected increase in inventories, reported by EIA. Still, at a little more than 3% above pre-attack levels, it seems we’re back to risk premium not being a concern for oil traders.

Brent Daily Chart

Economic Calendar

Disclaimer: This article is for general information purposes only. It is not investment advice, an inducement to trade, or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. Ensure you fully understand all of the risks involved and seek independent advice if necessary. Losses can exceed investment.