Investors Remain in Reflection Mode as Quiet Week Continues

European equity markets are poised to open relatively flat on Thursday, as we near the end of what has so far been a rather quiet week in the markets.

Broadly speaking investors have been in reflection mode this week, given the blockbuster week that preceded this and in the absence of any major economic events. While we haven’t been short of notable political stories – more woes for Theresa May, Saudi corruption crackdown and Donald Trump’s visit to Asia – as of yet none of these have had much market impact.

NZD Edges Higher as RBNZ Acknowledges Inflationary Impact of Weaker Currency

The two central bank decisions this week came from two of the few that are not particularly interested in shaking things up at the moment, with the Reserve Bank of New Zealand overnight leaving monetary policy unchanged with a fairly neutral statement, much in the same way that the Reserve Bank of Australia did earlier in the week.

The RBNZ decision overnight did lift the kiwi dollar a little despite an acknowledgement from the central bank that monetary policy will remain accommodative for a considerable period. This is perhaps an acknowledgement that tradable inflation has increased due to a weaker currency, with the kiwi having fallen close to 10% against the greenback from its July highs.

Chinese Inflation Beats Expectations But Remains Below Target

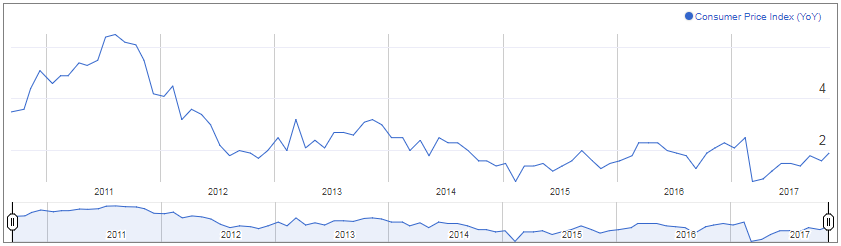

Chinese inflation data released overnight is having little impact on markets this morning, despite CPI accelerating more than expected to 1.9%, which is still below target. Higher fuel costs and a moderation in pork price declines was primarily responsible for the higher inflation reading, both of which can be very volatile.

Brexit Talks Resume But is Anyone Optimistic at This Point?

Looking ahead to today, there’s isn’t much on the data front with the UK NIESR GDP estimate due out this morning and US jobless claims this afternoon. The European Commission is expected to release new economic forecasts but this isn’t typically a market moving event, although it may be of interest given the continued improvement in the region.

The UK and EU are expected to resume Brexit talks today although I doubt many are optimistic on progress given how previous meetings have gone. Time is fast running out for both sides to agree to move onto transition and trade talks before businesses begin planning for no deal worst case scenario. This would be particularly problematic for the UK so any sign that we’re headed in this direction could be bad for the pound. It will be interesting to see how vulnerable sterling is to these talks over the next couple of days.

Disclaimer: This article is for general information purposes only. It is not investment advice, an inducement to trade, or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. Ensure you fully understand all of the risks involved and seek independent advice if necessary. Losses can exceed investment.