European Central Bank Set to Release Monetary Policy Decision

Markets will be looking toward a busy day today with the ECB's monetary policy review, retail sales numbers from the UK and Canada and the weekly US unemployment claims being the main events to watch.

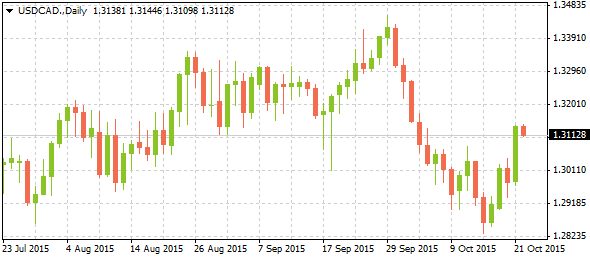

Bank of Canada Leaves Policy Unchanged

The Bank of Canada opted to leave interest rates unchanged as was widely expected by consensus estimates. In its monetary policy statement, the BoC noted that the Canadian economy rebounded as projected and that it was evidence of growth coming from the non-resource sectors. The BoC raised the third-quarter growth forecast to annualized expansion of 2.50% compared to earlier expectations of 1.50% while lowering fourth-quarter projections to 1.50% from 2.50%. The Central Bank also cut its 2016 guidance for GDP growth from 2.30% to 2.00%. On inflation, the BoC expects price growth to be around 1.20% in third quarter on the headline and 2.10% for the core figure. The Canadian dollar initially strengthened on the news only to give back its gains as USD/CAD closed with a daily gain of 1.23% for the day at 1.3130.

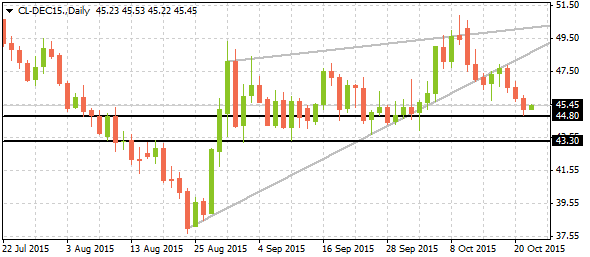

Crude oil Futures Fall on Inventory Build

The weekly Department of Energy crude oil inventories report showed a surprisingly larger than expected build of crude-oil stockpiles, sending WTI prices substantially lower on the report. For the day, WTI closed was down -1.46% to settle at $45.22 per barrel. The more interesting development contained in the Energy Information Administration release was the production numbers, which showed North American output steady after several consecutive weeks of declines. Earlier this week, OPEC and non-OPEC member countries met in Vienna to discuss market developments, but with lack of any concrete steps being taken to curb the oversupply issue, the energy outlook remains bearish. WTI futures for December delivery broke out from a rising wedge pattern which could signal further downside if support at $44.80 through $43.30 gives way, potentially seeing a decline back to the previous lows near support between $38.75 and $37.20.

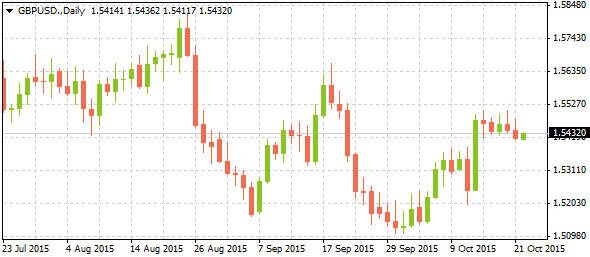

UK Retail Sales Set the Tone

The British Pound has stalled after trading near the highs of 1.5490 on the back of renewed expectation of the Bank of England preparing to tighten monetary policy ahead of other advanced economies. Nevertheless, absent any new fundamental development, the GBP/USD currency pair has been trading relatively for nearly for 4-consecutive sessions. Today’s retail sales numbers could likely break the sideways trend at least in the short-term. Expectations are for retail sales in September to have increased 0.30%, up from the 0.20% recorded in the prior month. A boost to the retail sales numbers could potentially help GBP as it would signal some support for inflation amid deflationary pressures. However, in the event sales estimates are missed, GBP/USD could possibly decline lower in the near-term. GBP/USD continues to trade flat ahead of the numbers.

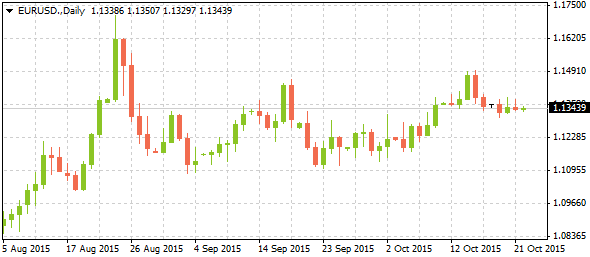

Eyes on ECB Press Conference

The European Central Bank meets today for its monthly monetary policy review followed up by the ECB Press Conference with President Mario Draghi. Expectations for today’s ECB meeting are divided in light of the deteriorating fundamental outlook. Certain market participants are anticipating the announcement of expanded quantitative easing in light of subdued growth and deflationary pressures while on the other hand, consensus estimates are for the ECB to stand pat on policy, while using the press conference as a means to strike a dovish tone for markets. In previous meetings, the ECB President has reiterated that it was too early to talk about the expanded or extended asset purchases and it is likely that Draghi will stick to this narrative at the ECB’s press conference later. The Euro is likely to be very volatile into today’s ECB event after closing the prior session at 1.1330.

Economic Calendar

|

Time |

Currency |

Event |

Forecast |

Previous |

| 09:30 GMT | GBP | Retail Sales (MoM) |

0.30% |

0.20% |

| 09:30 GMT | GBP | Core Retail Sales (MoM) |

0.30% |

0.10% |

| 12:45 GMT | EUR | Interest Rate Decision |

0.05% |

0.05% |

| 13:30 GMT | EUR | ECB Press Conference | ||

| 13:30 GMT | CAD | Core Retail Sales (MoM) |

0.10% |

0.00% |

| 15:00 GMT | USD | Existing Home Sales (September) |

5.38M |

5.31M |