ECB Rate Decision and Press Conference

As the ECB approaches the one year anniversary of its long-awaited bond buying program, the eurozone finds itself back in deflation and investors are once again looking to the central bank to provide more monetary stimulus and offer a lift to the region. More stimulus could come in the form of an extension to the current program beyond next September, an increase in the number and variety bonds it buys or even another interest rate cut, something Mario Draghi has previously suggested is no longer an option. While it would be understandable if the ECB pulled the trigger at today’s meeting, the market is not expecting anything just yet so we will instead be looking for a clue as to when it will come.

The euro has been fairly steady against the dollar so far this week in anticipation of today’s event. It has been well supported against the dollar for much of this year as the markets have increasingly priced out a Fed rate hike. The euro has also emerged as a perceived safe haven or risk-off trade which has lifted it to higher levels than the ECB and eurozone members would ideally like. While central banks have committed to not taking exchange rates into consideration when making their decisions, the negative inflation in the eurozone currently does give the ECB a viable reason for easing again. Especially as the elevated euro is likely to weigh further on this.

If Draghi hints at more QE or a rate cut at today’s press conference then we could see the pair fall quite aggressively, taking it through the ascending trend line – 7 August lows – and begin a move back towards 1.11, where it found support throughout September. If Draghi shrugs off the need for further stimulus then we could see it head back into the resistance region between 1.14 and 1.15.

UK Retail Sales Smashes Expectations

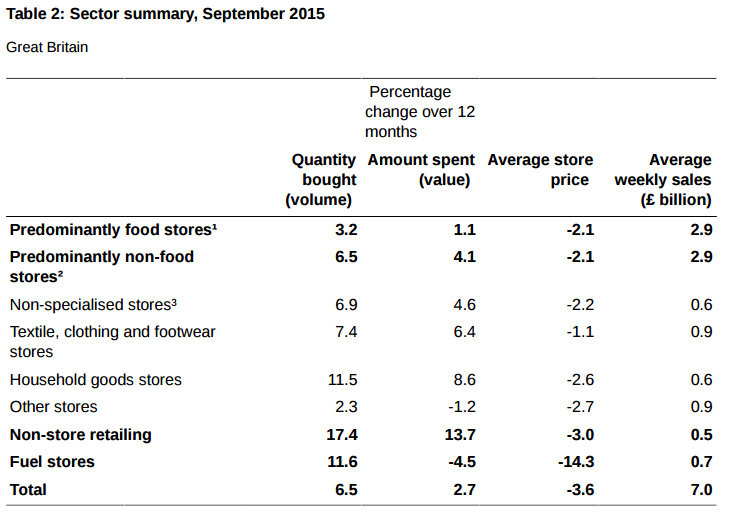

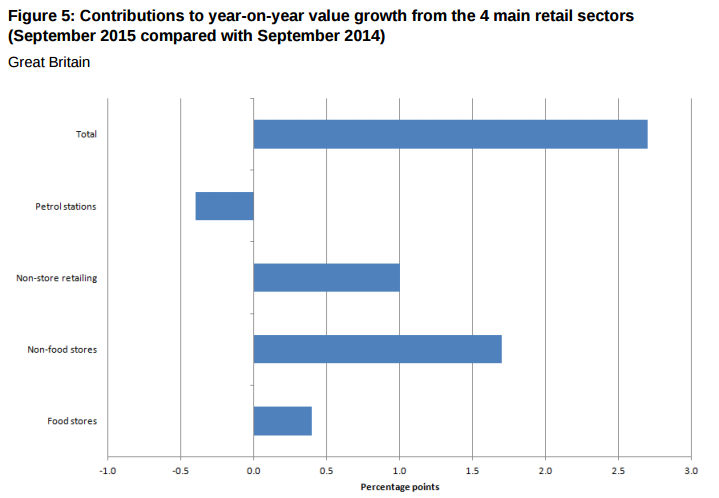

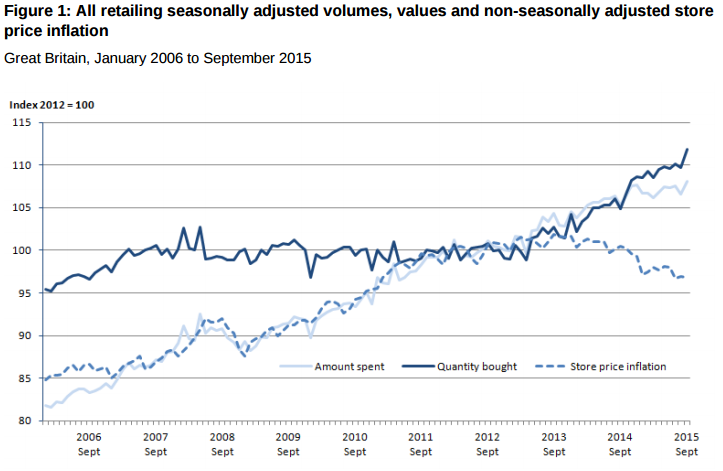

UK retail sales far exceeded expectations in September which despite being driven by one-off factors – notably the extra bank holiday and rugby world cup – gave a strong lift to the pound. These factors aside, the numbers were very encouraging especially as they showed that purchases by volume are continuing to grow at a good rate, particularly in discretionary goods. This is evidence of what the Bank of England has alluded to previously that the additional disposable income from lower oil prices will act as a stimulus for the economy. The strong growth in wages on top has also been a welcome additional, on top of lower inflation.

Source – ONS Retail Sales Report

Cable responded very positive to the data but was unable to break out of the trading range it has found itself within for a little over a week now. The pair has found strong resistance to the upside at 1.55 while 1.5410 to the downside has offered constant support. We’ve had a retracement in the pair since the release and we could now see it push on back towards those highs. If we see it break through here, it could find resistance around 1.5570 but the next key level would be 1.5650, the highs from September.