EUR/USD is falling again; on Monday, it is balancing at 1.0040. The “greenback” is supported by the US bond yield rally.

The USD is also supported by a global escape from risks after the US stock market found itself “in the red” at the end of last Friday’s trading session.

At the same time, investors started doubting the economic outlook for the US after the country released several rather mixed reports last Thursday, but the logic eventually outweighed the emotions. The US Fed is highly unlikely to start cutting the rate right after raising it quite aggressively. It means that after a “skyrocketing” phase, the market can expect a period of the rate staying at local highs.

Apart from everything else, expectations of the Fed’s decision during its September meeting are extended. If last week market players were expecting a rather small rate hike (below 50 basis points), then now they believe it might be a 75-point hike. This is another factor that supports the “greenback.”

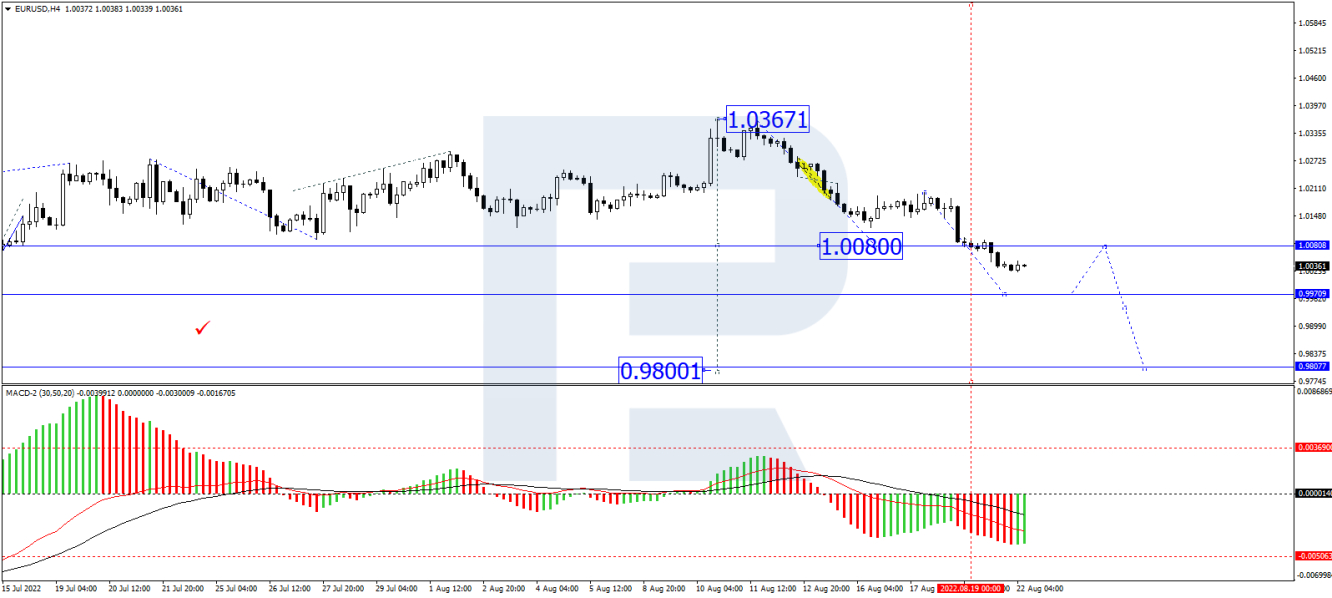

On the H4 chart, after completing the descending wave at 1.0080 and forming a new consolidation range there, EUR/USD has broken it to the downside and may continue falling towards 0.9960. Later, the market may correct to test 1.0080 from below and then resume trading downwards with the target at 0.9800. From the technical point of view, this scenario is confirmed by the MACD Oscillator: having broken 0 downwards, its signal line continues falling to update the lows.

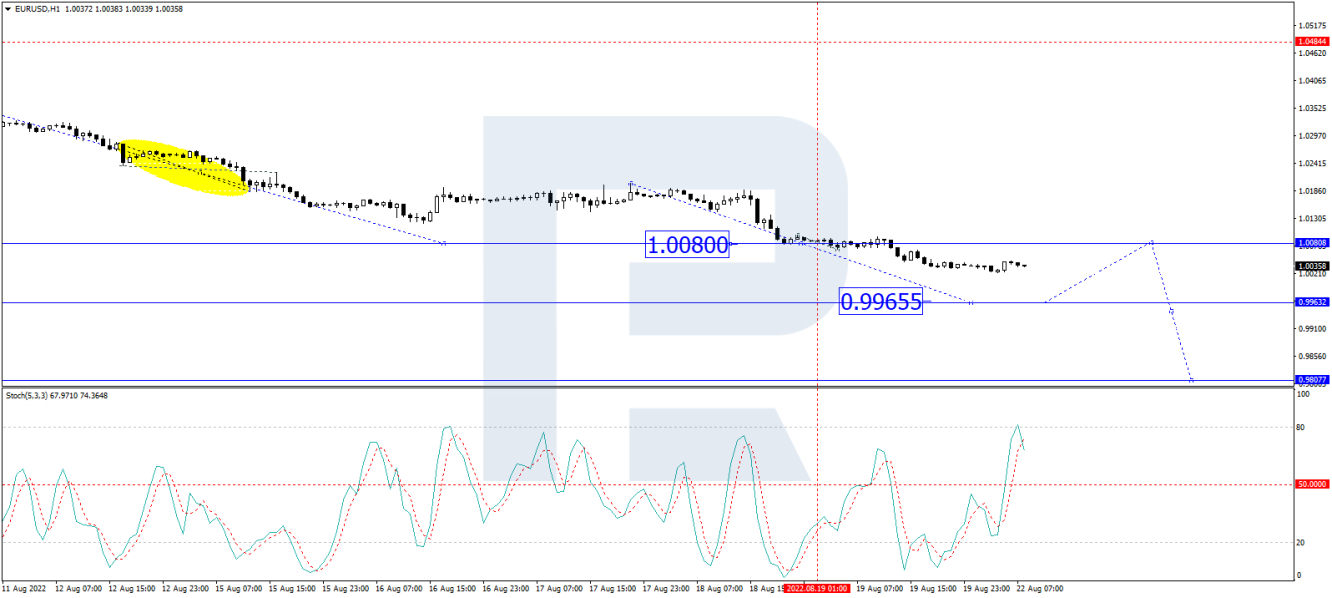

As we can see in the H1 chart, having finished the descending structure at 1.0080 and forming a new consolidation range there, EUR/USD has broken it downwards; right now, it is still falling and forming the second half of the descending wave towards 0.9963. After that, the instrument may start a new correction to return to 1.0080. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: its signal line is falling towards 50. In the future, the line may fall to break this level and continue falling to reach 20.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.