The euro has felt the wrath of the bullish US dollar over the past week, as the hawkish rhetoric from the Federal Reserve starts to bite. However, what has been an orderly retreat could become a rout as the euro nears a key technical level and the bears come out to play.

Despite the growing selling activity swirling around the currency pair, the EUR/USD has so far managed to remain relatively buoyant, trading around the 1.0760 level. However, the pair has been as low as 1.0672 during the early part of the American session yesterday and remains firmly entrenched within the bearish zone.

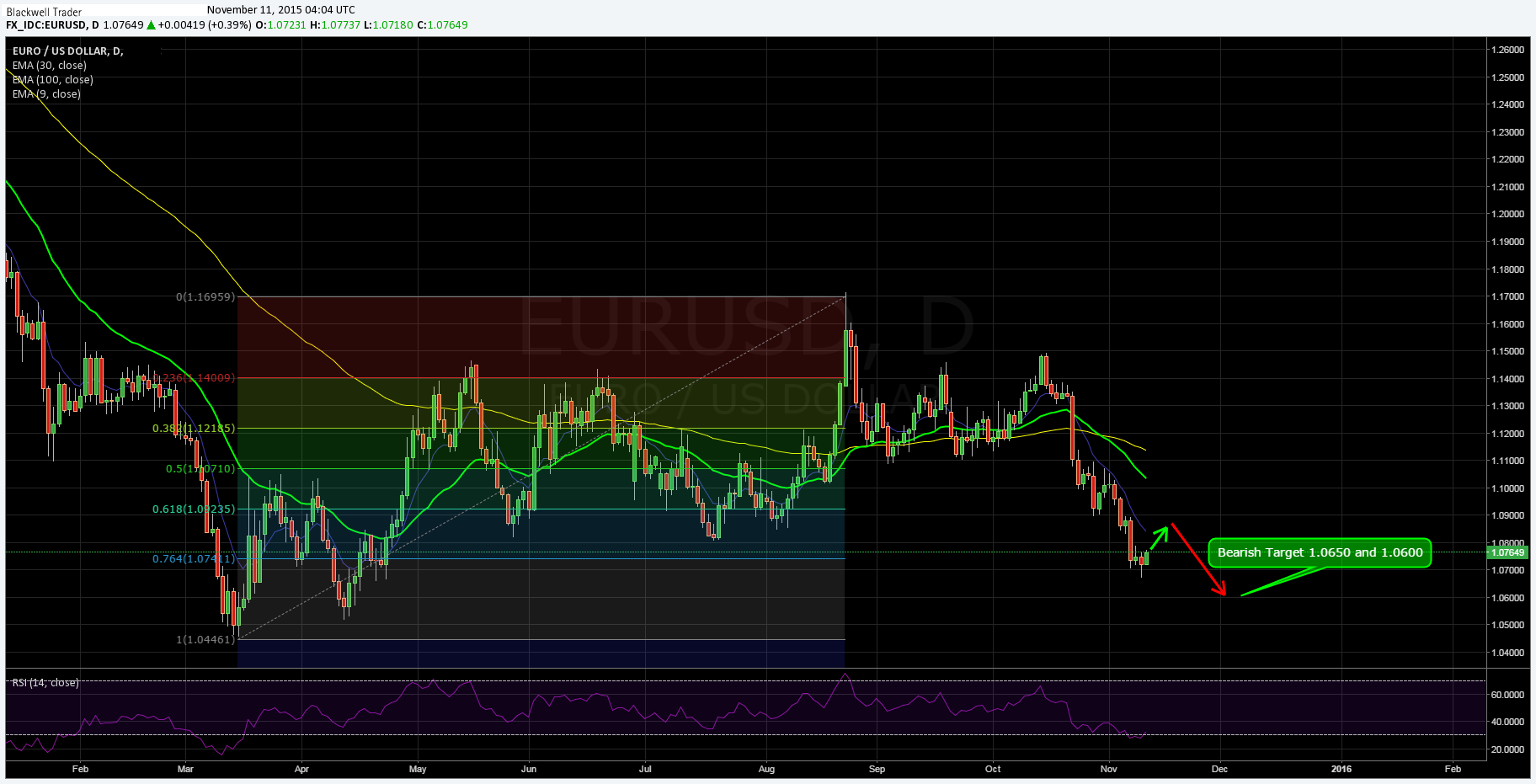

Technical analysis is depicting a negative sentiment for the pair as the 55, 30, and 20 EMAs are all declining and signalling further falls to come. However, RSI has trended strongly lower and now remains firmly entrenched within oversold territory.

Subsequently, expect to see a small retracement to relieve the pressure on the indicator, prior to further bearish falls. In addition, the current pricing level coincides with the 76.4% Fibonacci retracement level and a downward breach of this level could invalidate the ranging trend from March.

Therefore, look for short opportunities around the 1.0740 level with downside targets towards 1.0650 and 1.0600. However, be mindful of the risk of volatility as the US Unemployment Claims figures fall due, as the market looks for hints as to future policy from the Federal Reserve. Any surprises within the US economic data that detract from the Fed’s case could provide added buoyancy to the pair.

Prepare your euro positions for a bear week, the potential exists for the venerable pair to touch lows not seen since the early part of March.