In our last update, we found using our Elliot Wave Principle (EWP) count that Ethereum (ETHUSD) was most likely gearing up for a rally:

“…, we want to see a break above the grey W-i high, coinciding with a break back above the (green) 20d SMA. That can trigger a run to the red upper trend line. A break above that line, which equals a break back above the Ichimoku Cloud, is required to confirm the grey W-iii (green arrow). … The ideal target zone for the green W-5 is $4800-5400. But we can reassess that target zone once we get closer.”

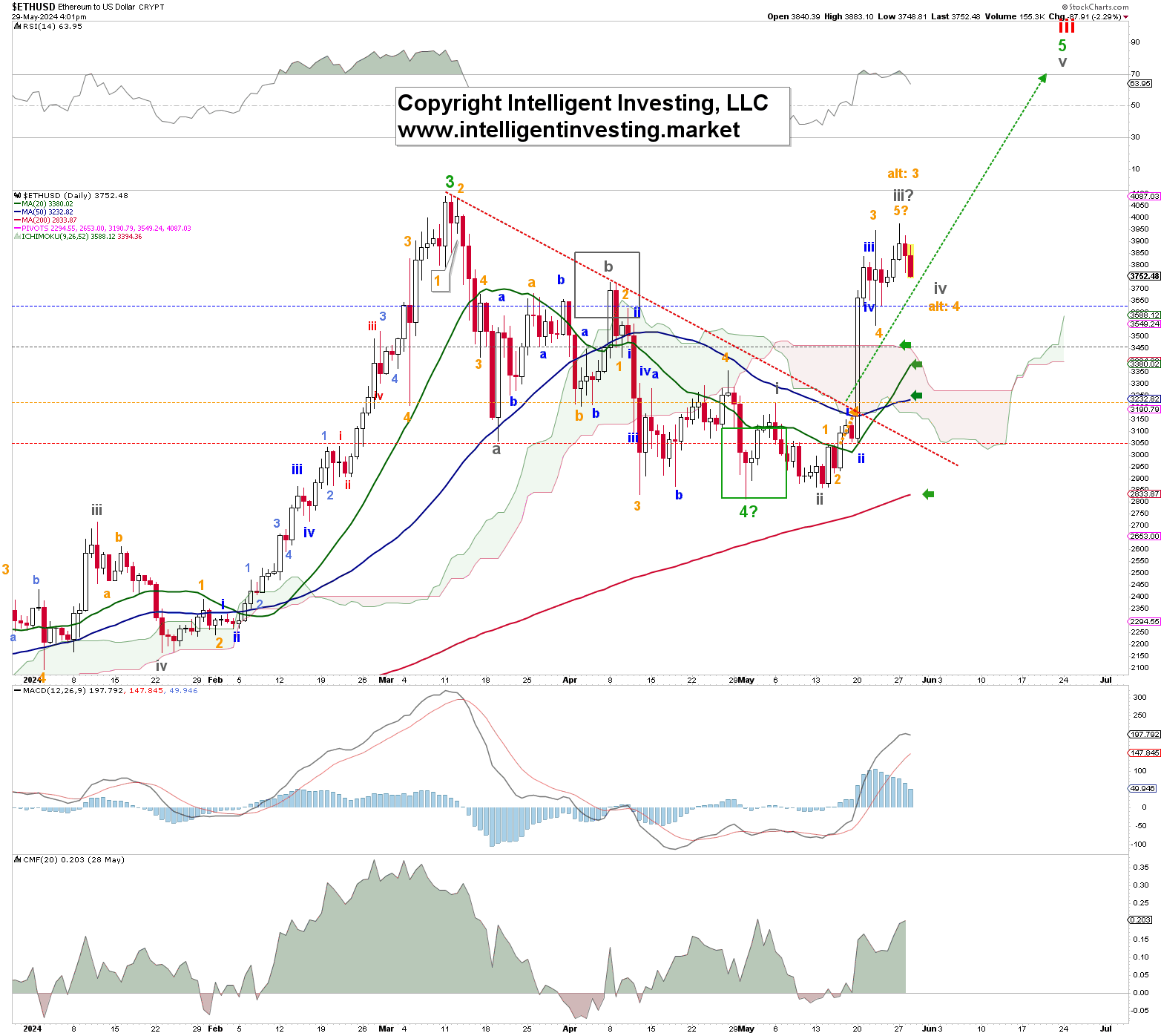

Fast-forward to Monday, May 20, when the second-largest cryptocurrency by market cap rallied strongly above these parameters (20d SMA, Trendline, Cloud) and reached as high as $3973 a week later. See Figure 1 below. This signaled it was now in the grey W-iii, contingent on holding above key price levels.

Figure 1. The daily resolution candlestick chart of ETH with several technical indicators

Thus, last month our assessment of the chart was correct, and if Ethereum can hold above at least $3450, the grey-colored warning level, we expect it to reach the ideal target zone for the green W-5 of $4800-5400. Given that ETHUSD’s chart has a 100% set up, i.e., price > rising 20d SMA, > rising 50d SMA > rising 200d SMA, and it is above the Ichimoku Cloud, we must also maintain a Bullish posture.

The last hurdle to take for the Bulls to fully confirm the green W-5 is a break above the green W-3 high at $4092 made on March 12. Hence, why we stated, “contingent on holding above key price levels,” because there are no certainties. Only probabilities.

But, in the bigger picture, once the green W-5 is completed, we should expect a sizeable pullback back to $3500-4000 but not much lower before the final wave of this Bull market that started in 2022 kicks in towards $10K+.