Adjusted operating profit up c 20% to record levels

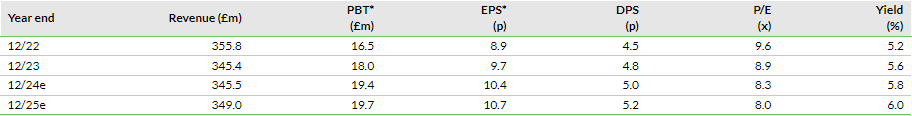

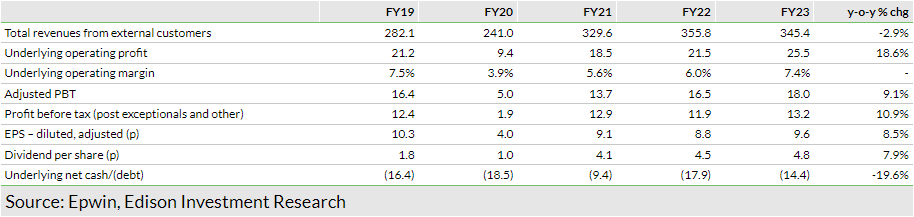

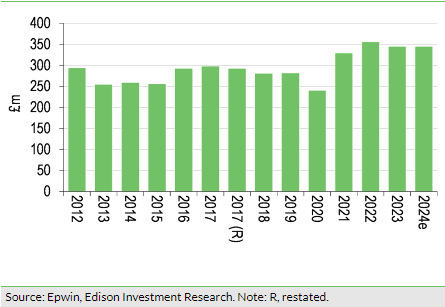

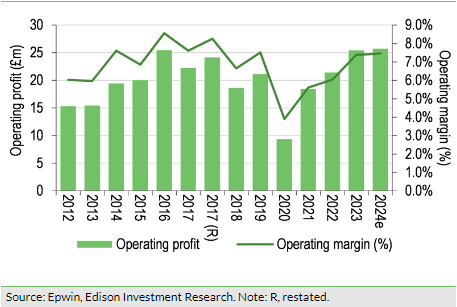

Despite the fall in underlying volumes, FY23 revenue declined by only 2.9% to £345.4m as lower raw material surcharges were offset by a full year inclusion of previous M&A. Despite the fall in underlying volumes, Epwin (LON:EPWN) grew underlying operating profit by 18.6% to £25.5m as material pricing fell by more than the volume impact and the increase in other costs. Therefore, the operating margin rose 140bp to 7.4%, within a whisker of the pre-COVID-19 level of 7.5%. Adjusted PBT increased 9.1% to £18.0m and EPS rose by a similar amount to 9.7p. The dividend was increased 7.9% to 4.8p, implying 2x dividend cover. Net debt declined c 20% to £14.4m, ahead of management expectations.

Unchanged and consistent long-term growth drivers

Epwin has for many years followed a set of strategic targets that drive the development of the business and improve profitability and its sustainability credentials. In 2024 and beyond, we believe Epwin will continue to evolve these strategic targets, which include product and materials development, operational leverage and efficiency, cross-selling and business development, the pursuit of value-enhancing acquisitions and sustainability developments.

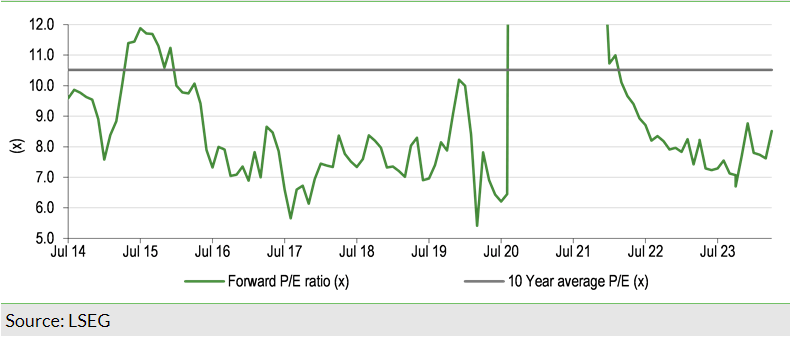

Valuation: Material discount to average P/E remains

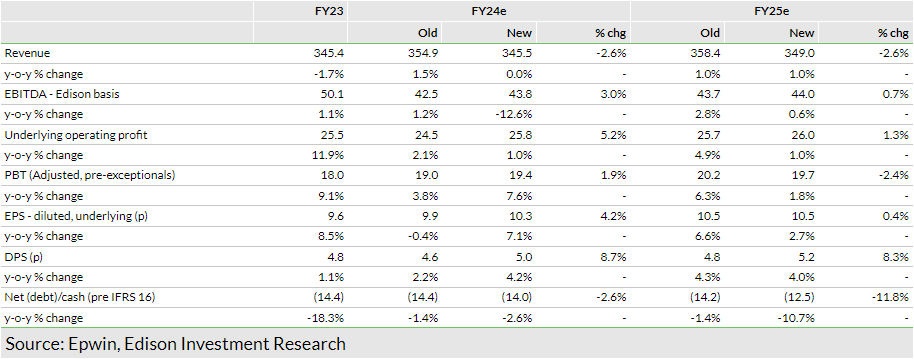

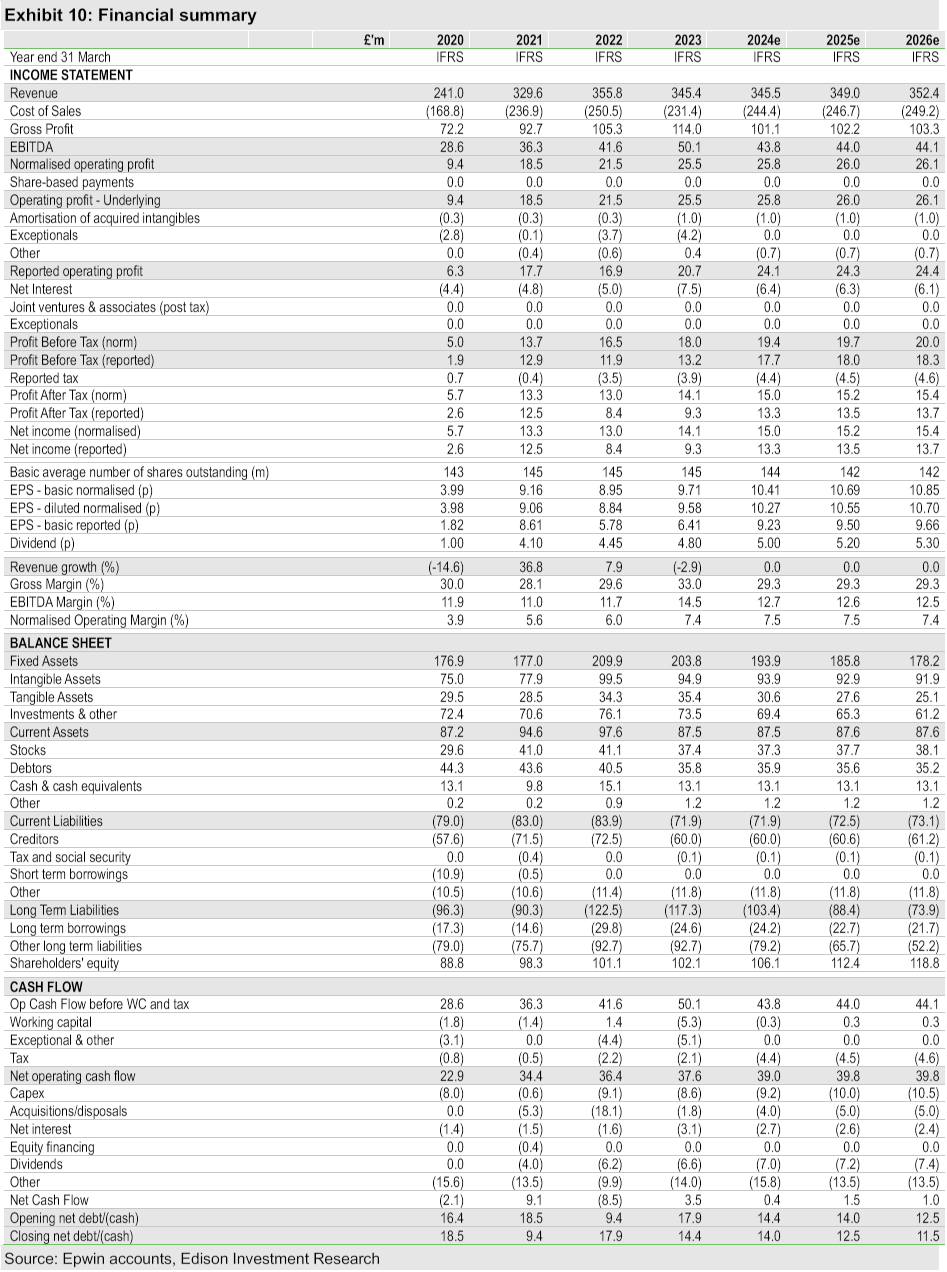

We have raised estimates for the second time this year following the robust FY23 results. This time we have lifted FY24e and FY25e underlying EBIT from £24.5m and £25.7m to £25.8m and £26.0m, respectively. Our revised forecasts imply normalised EPS of 10.4p and 10.7p, which in turn gives an FY24e P/E ratio of 8.3x, a material discount to its long-term average of 10.5x. The company is cash generative and remains acquisitive. We note that the shares offer an attractive 5.8% prospective yield from a twice-covered dividend.

FY23 results exceed and new share buyback announced

FY23 results reflected both weaker market conditions and the effect of management action to improve profitability. Revenues declined modestly as input-cost surcharges and volumes both reduced, but profits increased by nearly 20%, reflecting effective management action. Profit for the year was comfortably ahead of FY19, the last year before the pandemic, and net debt was c £2m lower despite returning cash to shareholders via dividends and share buybacks, and M&A. The FY23 dividend is c 2.5x higher than in FY19, with modest growth expected in future periods.

FY23 results ahead of market expectations

FY23 revenue declined by 2.9% to £345.4m due to a combination of modestly lower raw material surcharges and a decline in volume, offset by a full year inclusion of Poly-Pure and, to a lesser extent, Hampton Decking, both acquired in the second half of 2022. This compared well to an 11% decline in repair, maintain, improve (RMI) demand and a 19% fall in private new build, according to data from the Construction Products Association (CPA). Despite the fall in underlying volumes, Epwin grew underlying operating profit by 18.6% to £25.5m as material pricing fell by more than the volume impact and the increase in staff and other costs combined. Therefore, the operating margin rose 140bp to 7.4%, within a whisker of the pre-pandemic level of 7.5%.

The 9.1% increase in adjusted PBT to £18.0m was less pronounced due to higher interest costs related to higher average debt levels and higher interest rates. EPS rose by a similar amount to 9.6p and the dividend increased 7.9% to 4.8p, implying 2x dividend cover. Net debt declined nearly 20% to £14.4m, ahead of management expectations.

Non-underlying items rose from £4.6m to £4.8m, primarily due to a £4.2m goodwill charge to write down all of the remaining goodwill carried in relation to the Ecodek post regulatory changes relating to the Grenfell Tower disaster. Despite the decline in revenue year-on-year, underlying operating profit for FY23 was nearly 20% ahead of FY19, the last period before the COVID-19 disruption.

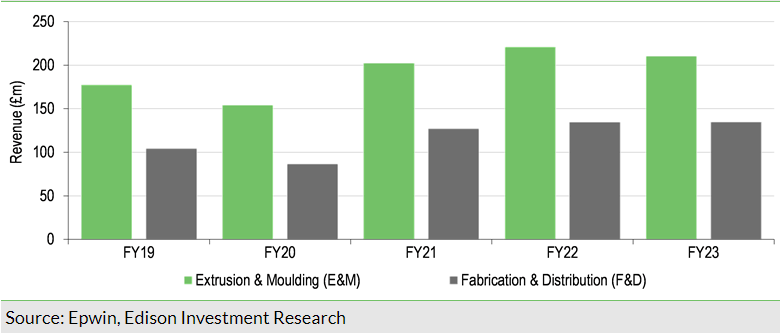

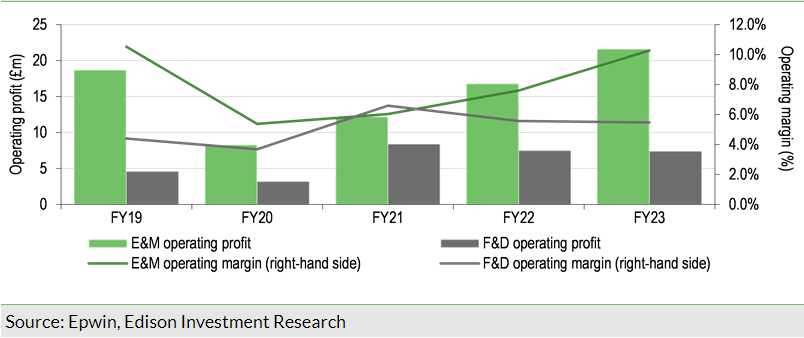

Epwin’s largest division, Extrusion and Moulding (E&M), reported revenue that was down 5% to £210.3m, affected by lower surcharges on PVC input costs as prices fell, offset by an increase in revenue from Poly-Pure, from £3.4m in 2022 to £7.2m in FY23. The increase in group operating profit was principally driven by the improvement in profit from the E&M division, which increased from £16.8m to £21.6m, as the division benefited from management action taken in FY22 and FY23 on pricing and operational efficiency, which resulted in underlying operating margins increasing from 7.6% to 10.3%, robustly moving up towards pre-pandemic levels.

In the year, Epwin made progress on a number of fronts in the division including the integration of Poly-Pure, a capital programme to expand materials re-processing capacity, which was completed in the period, and increasing the use of recycled materials within extruded products. It also completed the consolidation of decking manufacturing to a single site in H123, made progress on the transition of third-party production at Mayfield to group facilities, and extended the product range and market opportunities for reprocessed materials.

In Fabrication and Distribution, revenue increased modestly to £135.1m, the net effect of reduced volumes and softening RMI demand, particularly in the distribution network in H223, completely offset by revenue from the Mayfield acquisition, which added £4.8m of external revenue. Underlying operating profit declined by £0.1m to £7.4m, implying a slightly lower operating margin of 5.5%. The margin reflected the pricing action taken and consolidation activities, which is a creditable result considering the pre-COVID-19 margin of 4.4%.

Within the Fabrication and Distribution division, in Fabrication, which accounts for around a third of revenue, both the Trade and Social revenues outperformed the CPA estimate of market growth, implying that Epwin took market share. In Distribution, which accounts for roughly half the divisional revenue, revenue fell year-on-year as the end-user market came under pressure. The business made progress on integration and consolidation of the trade counter distribution business. The IT system consolidation continued and is expected to complete in H124, while additional cross-selling opportunities between the fabrication and distribution businesses have been realised.

Share buyback programme nearly complete and extended

In November 2023, Epwin announced its intention to repurchase up to 3m shares for cancellation. By the year end it had purchased 366,723 shares for a cost of £0.3m and by the end of Q224, it expected to complete the programme. We have updated our forecasts to reflect these events.

With the FY23 results, Epwin announced an intention to extend the programme by a further 3m shares, subject to approval at the forthcoming AGM. This extension is not currently reflected in our forecasts as it is yet to be approved.

Estimate uplift due to management improvements

FY23 revenue came in modestly lower than we anticipated due to lower input cost-related surcharges, and due to this adjusted starting point we have reduced revenue modestly in forecast years. However, underlying profit was higher for reasons discussed above and we anticipate that Epwin will be able to continue to report improved adjusted operating profit in FY24 and FY25, which also implies an improved margin. Our upgraded FY24 adjusted operating profit of £25.8m is a raise of 5.2% on our previous estimate. However, increased finance costs reduce the increase at the adjusted PBT line.

The other major change to forecasts is the increase in the DPS from 4.6p to 5.0p in FY24 as the company operates a twice-covered dividend policy. Our net debt estimates remain broadly unchanged despite the inclusion and completion of the first phase of the share buyback as FY23 net debt was better than expected. A proposed extension of up to a further 3m shares is as yet not approved and not reflected in our estimates. At the current share price, a full completion would add c £3m to FY24 net debt expectations.

Epwin shares trade at a P/E discount to long-term average

Epwin trades on a P/E ratio of 8.3x to December 2024, which is a visible discount to its long-term average of 10.5x, suggesting material upside. Furthermore, the company is acquisitive and has more than £60m of investment headroom on its borrowing facilities, which was discussed in our November 2022 results note. This offers considerable potential for value-enhancing M&A activity. Epwin is cash generative and we anticipate that debt will decline, albeit slowly in the periods to FY26 due to a c £5m pa earnout relating to Poly-Pure. We also note that despite the valuation discount the shares offer an attractive prospective 5.8% yield from a dividend that is twice covered.

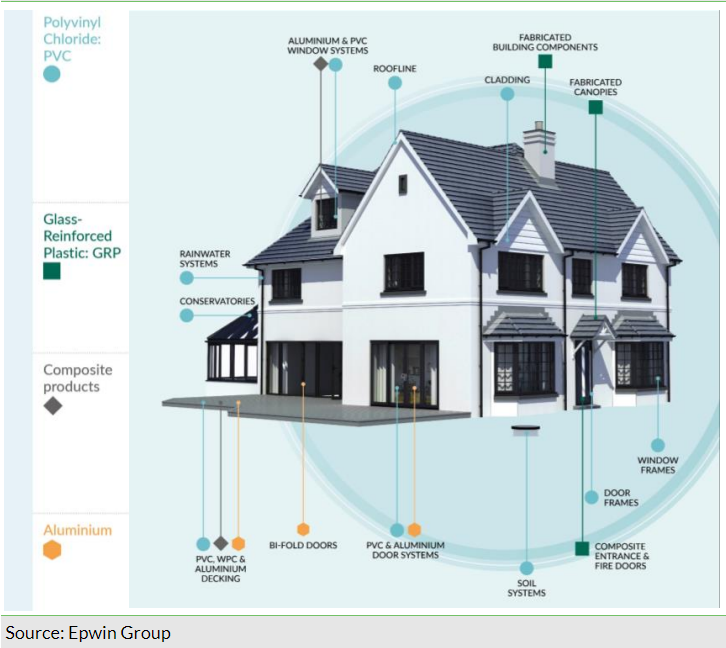

The Epwin investment case

Epwin has a near 50-year history since it began as the first PVC-U window fabrication business in 1976. It now sells a wide range of additional products, including doors and door frames, conservatories, cladding and rainwater systems, to name a few. It has developed a number of well-known brands in numerous product segments and fostered numerous routes to market that include selling direct to business customers such as the national housebuilders, social housing providers, builders merchants and general builders as well as specialist stockists, wholesalers and installers.

In support of Epwin’s robust market position, it continues to invest in innovation and new products and systems. Its Stellar window range and Dekboard are two examples of this. It also continues to focus on operational efficiencies that will drive medium-term margin improvements, potentially to levels in excess of the long-term average. Finally, its cash-generative characteristics and low levels of gearing allow it to participate in M&A when the right opportunities arise. Poly-Pure, the PVC reprocessor, and Hampton Decking, both acquired in H222, are examples of this.

Over the last 10 years, Epwin has maintained a robust revenue stream despite the multiple headwinds that have been thrown at the sector including Brexit, COVID-19 and more recently the implications of a high inflation environment. During most of this extended period, both profits and margins were on an upward trend until 2020. Recovery was seen in 2021 and has been a consistent feature since. Short-term trends are less clear, but longer-term trends are arguably more encouraging when one considers Epwin’s position in the market and other long-term drivers.

Firstly, Epwin is the largest UK manufacturer of PVC window profile systems, roofline and cladding products and glass reinforced plastic (GRP) mouldings used in housebuilding. It has around a 20% market share in the former, a c 40% share of the cellular roofline market and around a 40% share of the GRP market.

Secondly, the construction and RMI markets have positive long-term trends. For example, the UK has a growing population and an increasing tendency for people to live alone, so there is likely to be underlying demand for new homes to be built. An increasing and ageing stock of housing also points towards increased requirements for building materials to address RMI demand.

Furthermore, political impetus to improve the thermal efficiency of both new and existing housing, driven by newer thermally efficient products and carbon reduction targets, suggests that companies like Epwin that have value-adding products should be able to take market share from others.

Strategic initiatives continue to progress

Epwin has consistently made steady progress on its five strategic initiatives over the last few years. These include the introduction of new products and materials, a drive for greater operational efficiency and a drive to cross-sell products via a range of subsidiaries and channels. Furthermore, its active M&A pipeline has delivered success over the years since the flotation in 2014 and it has significantly contributed to the company’s drive to reduce emissions and address other ESG targets. The five core initiatives are discussed in more detail below.

Product and materials development

Epwin has a strategic aim to broaden its product portfolio, to widen its material and technical capabilities as well as to continuously improve its products and offerings. In 2023, Epwin invested in plant to expand recycling capacity and margins at Poly-Pure, invested in co-extrusion tooling to enable the increased use of recycled PVC thereby reducing the use of virgin materials and expanded the range of existing products, including decking.

In 2024, Epwin’s priorities are to realise the capacity and margin benefits of the Poly-Pure investments, increase the use of recycled products across the group and utilise product and materials knowledge to expand and develop the group’s offering.

Drive for operational leverage and efficiency

Epwin completed a major project to consolidate its Window Systems warehousing in 2022 and continues to target the utilisation of existing spare capacity and the delivery of site consolidations, as well as operational efficiencies. In 2023, it completed the consolidation of its decking manufacturing to a single site following the 2022 Hampton Decking acquisition and implemented a single IT system for its distribution network.

In 2024, Epwin is targeting the completion of the distribution IT project in H1 and increasing the utilisation of its production capacity by transferring in third-party production following acquisitions.

Cross-selling and business development drive

One of Epwin’s key strategic drives is a push to sell more existing and new products to its current customers via differing channels and markets. In 2023, it integrated the decking business acquired in 2022 into its own decking manufacturing facilities and realised further cross-selling opportunities between its fabrication business and customers and its distribution network.

In 2024, in plans to identify and extract all remaining cross-selling and synergy opportunities from the 2022 acquisitions and advance cross-group sales opportunities given the group’s increasingly broad product range.

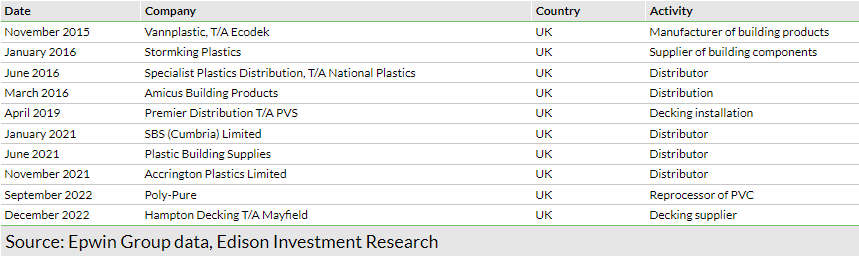

M&A to remain a feature of growth

Epwin’s growth strategy includes selective, value-enhancing M&A that have the potential to deliver on the three core strands outlined above and that are aligned to its sustainability agenda. Although no deals were announced in 2023, we believe Epwin will continue to develop relationships with potential targets. Very often, opportunities arise due to succession issues and Epwin maintains a robust balance sheet, which enables it to take advantage when an opportunity arises. Hampton Decking was last of a line of deals that have contributed to volume and revenue growth stretching back to 2015.

Epwin typically pays 3–6x EBITDA depending on the business and synergies. Often there is an earnout in the arrangements that is payable if profits hit or exceed targets, but again the resulting post-earnout multiple will fall between 3x and 6x EBITDA post synergies. Most senior managers will be retained in the business to maintain the status quo. Currently Epwin is trading on an EV/EBITDA of under 5x, versus a five-year average of c 6.5x.

We understand that Epwin maintains a good pipeline of potential M&A targets and that further deals are likely, although of course the timing and size of any deal is very unpredictable. Epwin currently has banking facilities totalling around £75m and we estimate that it will end FY24 with net debt of c £14m, implying a net bank debt to EBITDA ratio of 0.6x. This implies c £60m of potential M&A headroom.

Environmental, social and governance progress achieved

Epwin is making good progress on its ESG targets, which include promotion of the sustainability credentials of its products to customers, the creation of sustainable value and minimising its environmental impact. Furthermore, it prioritises the wellbeing of staff while maintaining high standards of governance and transparency for investors.

In 2023 the company renewed its banking facilities with a sustainability-linked loan, reduced its greenhouse gas emissions, retained its Fair Tax Mark and further developed its sustainability reporting, including Task Force on Climate-related Financial Disclosure requirements. In 2024, it is targeting the recognition of third-party certifications for core product ranges, and the formalisation of sustainability metrics and targets.

________________________________

General disclaimer and copyright

This report has been commissioned by Epwin Group and prepared and issued by Edison, in consideration of a fee payable by Epwin Group. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom