Last week, the European Central Bank (ECB) decided to cut rates for the second time this year, following its initial cut in June. The Deposit Facility Rate, which determines the interest banks earn on deposits at the ECB, was lowered by 25 basis points to 3.50%.

The Main Refinancing Rate, used for short-term loans to commercial banks, was cut to 3.65%. Despite these rate reductions, the ECB plans to proceed with caution in normalizing its monetary policy stance as domestic inflation remains above target, and wage growth is still elevated.

Regarding the macroeconomic projections, GDP growth has been slightly revised downward for this year and the following two. Inflation is expected to gradually decelerate towards the 2% target by 2026, with core inflation projections revised slightly higher for this year.

The bottom line is that the rate cut was widely anticipated, and markets continue to expect another reduction in December.

However, the chances of a further rate cut in October have diminished, as inflation remains stubbornly high and growth forecasts have only seen slight revisions.

Source: Bloomberg

Meanwhile, A Complicated Decision Ahead for the Fed Amid August CPI and PPI

Ahead of the next Federal Reserve policy meeting, the Unites States Department of Labor reported that inflation in August fell to its lowest level since February 2021.

While this indicates a softening of inflationary pressures, a key measure came in higher than anticipated, introducing additional complexity to the Federal Reserve's upcoming decision on interest rates.

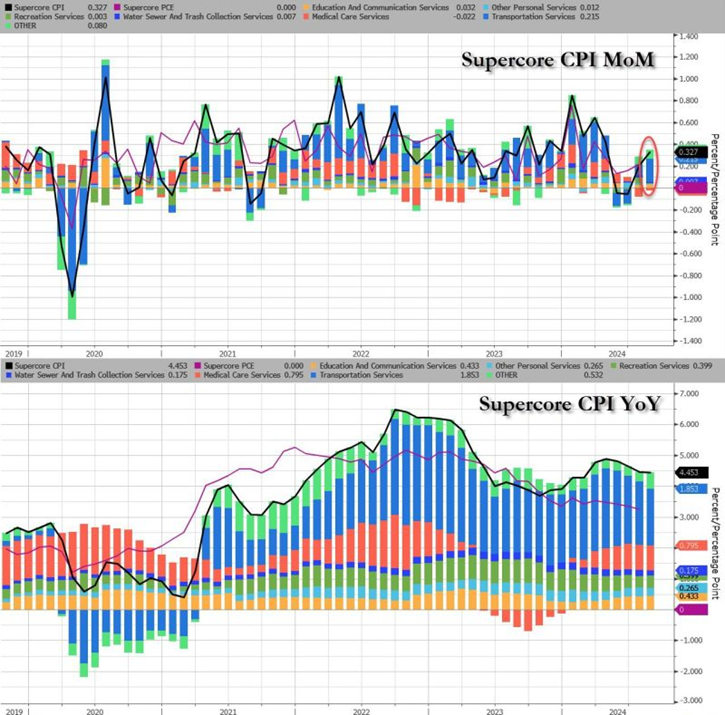

Source: ZeroHedge, Bloomberg

The headline Consumer Price Index (CPI) rose by 0.2% month-over-month (MoM), matching expectations, while core CPI, which excludes the more volatile food and energy sectors, increased by 0.3%, slightly exceeding estimates.

Additionally, the Producer Price Index (PPI) for August fell below expectations to 1.7%, indicating some easing of inflation. However, "supercore" CPI, which measures services inflation, surged by 0.33% MoM, its largest increase since April, driven by higher transportation costs.

This uptick in core inflation is likely to keep the Federal Reserve cautious, lowering the chances of a more aggressive rate hike at the upcoming policy meeting.

Key figures:

- CPI (MoM): +0.2%, in line with expectations.

- Core CPI (MoM): +0.3%, higher than expected.

- CPI (YoY): +2.5%, in line with expectations.

- Core CPI (YoY): +3.2%, in line with expectations.

- Supercore CPI (MoM): +0.33%, higher than expected.

- PPI (MoM): +1.7%, below expectations.

- Core PPI (YoY): +2.4%, below expectations.

U.S. Banks Stuck in the Red With $512.9 Billion in Unrealised Losses

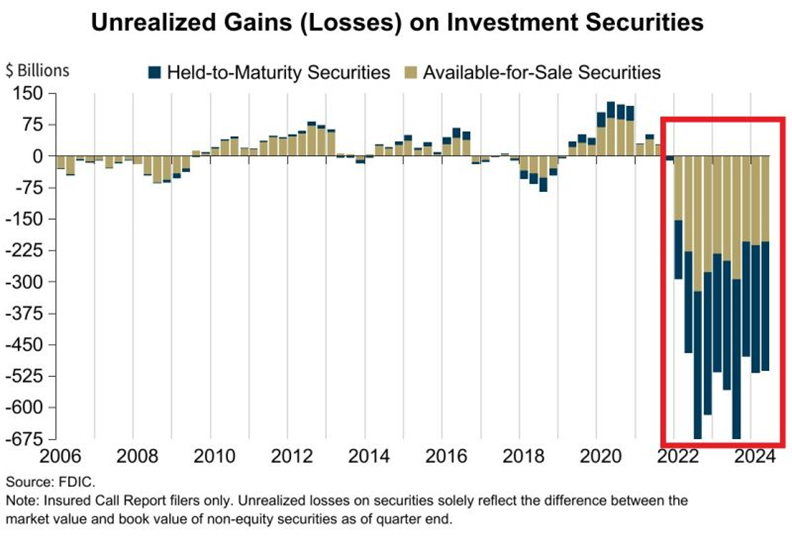

In Q2 2024, U.S. banks reported unrealised losses on investment securities (bonds) totaling $512.9 billion. This marks the 11th consecutive quarter of losses, an unprecedented streak in banking history.

Additionally, the number of banks on the FDIC's Problem Bank List, which tracks institutions undergoing significant financial pressure, rose to 66, representing 1.5% of all U.S. banks.

Source: LSEG Datastream, Global Markets Investor

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.