Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

Daily FX Market Roundup Sept 17, 2019

For the second time this year, the Federal Reserve lowered interest rates by 25bp to a range of 1.75% to 2%. This widely anticipated move failed to hurt the dollar, which ended the NY session up against all major currencies. Today’s move by the Fed was a hawkish hike where two members voted against easing. To everyone’s disappointment, Fed Chairman Jerome Powell provided limited insight to future policy changes. According to the central bank, the labor market and household spending is strong, job gains are solid and economic growth is moderate. However exports weakened and there’s been additional weakness abroad but these exogenous risks were not enough for FOMC voters George and Rosengren to get on board with easing. According to the dot plot, Fed officials are divided on whether additional action is needed. Five members did not favor a cut today, five approved of the cut but see no more easing this year and seven see one more cut. This divisiveness is the main reason why Powell said the Fed is not on a preset course, is highly data dependent and will look at what’s needed carefully on a meeting-by-meeting basis. He said if the economy weakens further, “more extensive cuts may be needed,” but for the time being, more members favor steady policy for the rest of the year. In their small way, future traders agree, with rate-cut expectations dropping slightly to 65%.

Central-bank meetings will remain in focus for the next 24 hours with three additional monetary policy announcements on the calendar. No changes are expected from the Bank of Japan, Swiss National and the Bank of England. Recent stability in the financial markets will relieve some of the pressure on policymakers. The Bank of Japan is probably the closest to easing. Back in July, Governor Kuroda said they were “more positive” about adding stimulus and could consider taking interest rates deeper into negative territory to support the economy and prices. If his language hardens, we could see USD/JPY break 109.

Swiss interest rates are one of the lowest in the world and the European Central Bank’s latest actions increases the pressure on the Swiss National Bank to ease. To the SNB’s relief, however, safe-haven flows did not intensify after the ECB’s massive stimulus program, which should be all that they need to keep rates at a record low. Economic data hasn’t been terrible, inflationary pressures increased, manufacturing activity improved in August and Q2 GDP growth slowed less than expected. So while the SNB lowered their inflation and GDP forecast for 2019, unless there is a shock to the economy, they will not be inclined to act.

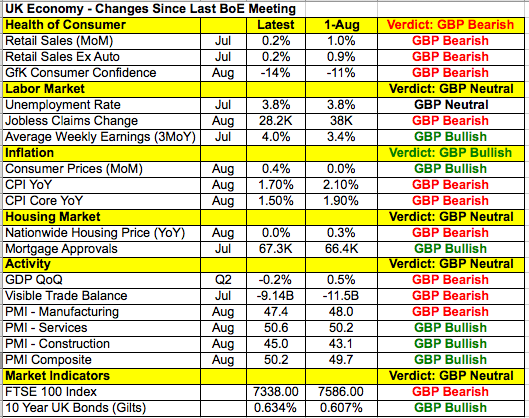

In many ways, the Bank of England will find themselves in a similar position – unless the Brexit outlook clears, they’ll keep policy unchanged. Unlike the BoJ and SNB, however, the BoE feels that if their projections are met, which includes an unruly exit from the European Union, the next move will be a rate hike. But as the clock ticks, the UK could be headed for a no-deal Brexit with EU President Juncker saying as recently as this morning that “There is very little time left…The risk of a no-deal is very real.”

Back in July, the BoE lowered their GDP forecast for 2019 and 2020 and raised their inflation forecasts. Their projections did not include the possibility of no-deal and is based on the central bank lowering interest rates 25bp by early 2020. According to the central bank, there’s a lot of uncertainty, which could lead to a wide range of paths but if their forecast is met and a smooth Brexit occurs, gradual rate hikes could be necessary. Governor Carney’s comments were not as upbeat – he acknowledged that the chance of a no-deal Brexit has risen, felt that financial conditions remain volatile and warned that trade tensions have a larger-than-expected impact on the UK economy. As a result, he felt that underlying growth is now below potential with investment likely to fall further in the third quarter. Since that meeting, we’ve seen a tinge more deterioration than improvement in the UK economy. Retail sales growth slowed, inflationary pressures eased and manufacturing activity contracted at a faster pace. With that said, wages, services and manufacturing activity are up. In all likelihood, the BoE rate decision could be a nonevent for the currency.

Wednesday night will also be a busy one for the commodity currencies with Australian employment and New Zealand GDP numbers scheduled for release. Labor-market conditions in the service and construction sectors improved according to Australian PMIs but weakness was reported in manufacturing. Despite the RBA’s optimism, we believe that Australian job growth slowed in the month of August because the labor market reported very strong numbers in July. New Zealand GDP growth is expected to slow as well as softer consumer demand weighs on economic activity. NZD/USD sold off 5 out of the last 6 trading days and it may be time for AUD/USD to catch up. USD/CAD on the other hand rallied for the sixth straight day despite a smaller than expected decline in consumer prices.