Summary:

- Exxon shares have surged almost 50% this year, rebounding from a deep slump in 2020.

- Despite this rally, the majority of analysts don’t see much value in holding XOM stock over the long run.

- An improving energy consumption outlook, however, could help the giant cover its hefty dividend bill.

Shares of energy giant Exxon Mobil (NYSE:XOM) are coming out of a deep slump triggered by the global health crisis. The stock is up almost 50% this year, massively outperforming the benchmark S&P 500.

This upsurge, after the devastating blow that oil companies faced during the pandemic, leaves many investors wondering whether Exxon is a good long-term investment.

The largest U.S. oil producer’s track record during the past ten years doesn’t support a bullish stance on its shares. A decade ago, Exxon was the most valuable company on Earth. Since then, its shares have gone nowhere, lagging the S&P 500 by about 300 percentage points.

Exxon lost $20 billion last year, compared with a record-setting profit of $46 billion in 2008, when it was the most profitable American corporation. The company’s removal from the Dow Jones Industrial Average in August last year, after nearly a century on the 30-component index, marked a milestone in its decline.

At the heart of this spectacular fall from grace is Exxon’s bet on hydrocarbons, even as its rivals began to pivot to renewable energy. The result: disgruntled investors, lower valuations, and a massive pile of debt.

Between 2009 and 2019, Exxon spent $261 billion on capital expenditures, while its oil and gas production remained flat. In addition, it added $45 billion in debt, according to investment bank Evercore ISI. Its return on capital employed in 2009 was 16%. Last year that figure shrank to 4%.

Better Value Elsewhere

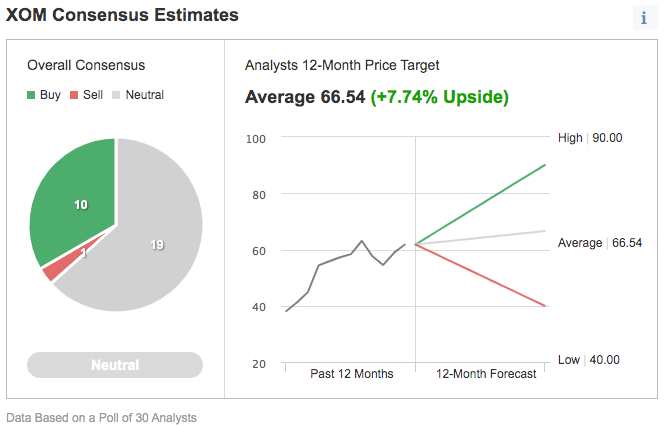

This financial situation doesn’t help make a compelling case for holding XOM shares over the long run. That’s the reason the majority of Wall Street analysts don’t see much upside, even after Exxon share rally this year.

Of 30 analysts polled by Investing.com, 19 gave it a neutral rating, suggesting that XOM isn’t generating much excitement despite a surge in oil demand after the pandemic slump.

Chart: Investing.com

The Royal Bank of Canada, in its recent note to clients, maintained its “underperform” rating on the stock, saying it sees “structural challenges” for the company and “better value elsewhere.”

Its note stated:

“The last few months have seen a lot of change at XOM. Following pressure from activist investors, three new board members have been elected, while XOM has also hired an external Chief Financial Officer from Diageo...We continue to see better value elsewhere in the sector, and maintain our underperform rating.”

In May, Exxon lost a major proxy battle when fledgling investment firm Engine No. 1 won a boardroom fight, securing three seats on the oil and gas giant’s board after purchasing only about $40 million of its stock. The shareholder vote was heralded as a major victory for so-called ESG investing, which focuses on improving corporate environmental, social and governance metrics.

Major Belt-Tightening

Despite the long-term uncertainty about Exxon and for the hydrocarbon industry in general, there is some evidence that the company could benefit from the turnaround in oil and gas demand globally after the pandemic-driven compression.

Exxon told investors in a regulatory filing last week that rising oil and natural gas prices will lift its third-quarter earnings by $700 million to $1.5 billion. In a Securities and Exchange Commission filing, Exxon said oil will likely give a $200-million to $600-million fillip, while gas will likely offer a $500-million to $900-million boost.

U.S. oil prices have soared 54% year-to-date, recently trading at $74.54. Natural gas prices have more than doubled this year. Exxon said refining margins will also likely lift third-quarter earnings by $500 million to hit $700 million.

That improving financial outlook is also encouraging for income investors who hold XOM stock because of its attractive 6% dividend yield. The company this year is in a much better position to cover its dividend payments through its own cash-generation rather than borrowing from the market.

But this short-term turnaround, in our view, doesn’t mean investors are going to get hefty payout hikes in the coming quarters. The company remains in a major belt-tightening phase, cutting its expenses and retreating from its major expansion plans.

For growth, analysts are favoring smaller and leaner energy players, like ConocoPhillips (NYSE:COP) and exploration and production company Diamondback Energy (NASDAQ:FANG). ConocoPhillips and Diamondback have received buy ratings from 80% of analysts covering those stocks.

Last month, Diamondback announced it plans to return 50% of its free cash flow to stockholders beginning in the fourth quarter, instead of in 2022 as previously announced. In addition, it's aiming to buy back $2 billion worth of its shares.

“We believe the accelerated return program, complemented by the share repurchase program, highlights Diamondback’s strong operational and financial performance and commitment to capital discipline and shareholder returns,” according to a note by Stifel carried by CNBC.com.

Bottom Line

Exxon is in a much better financial position than it was during the height of the pandemic when energy demand collapsed. That turnaround, however, doesn’t make a compelling case for owning XOM shares over the long term.

During the past decade, the industrial giant missed the shale boom, overspent on projects, and saw its debt rise to $50 billion. These missteps have weakened its appeal as a stable, income-generating stock.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI