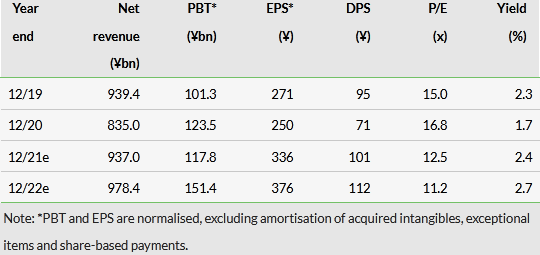

Dentsu's (T:4324) interim results show a strong recovery in Q221 for both Dentsu Japan (DJN) and Dentsu International (DI), with organic revenue less cost of sales (LCoS) up 15.0% in Q221, giving an increase of 5.4% for H121. The pick-up in operating margins is well ahead of expectations and the targets for FY22e (20% for DJN and 15% for DI) may even be achieved in FY21 as the transformation plan kicks in. Management has issued new guidance for FY21, including a good uplift in the planned dividend.

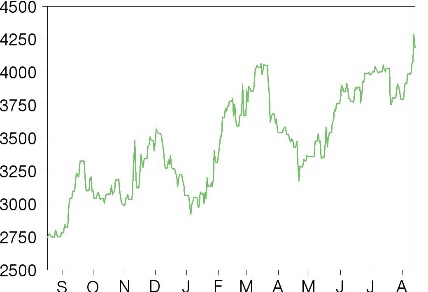

Share Price Performance

Step up in operating margins

The statement describes the group as having ‘line of sight’ to achieving the FY22 target operating margins a year ahead of plan. This reflects three factors; the first benefits of the accelerated transformation programme helping with cost reduction; operational leverage from greater throughput; and further shifts in the mix towards the customer transformation and technology (CT&T), which accounted for 29.4% of first half revenue LCoS. The business transformation is well underway, with around 20 of the DJN operating companies moving into the Shiodome Head Office building and increasing centralisation of corporate functions. For DI, management estimates that around one third of the plan is implemented. 160 brands are already down to 100 and there has been a reduction of around 300 legal entities. The costs of implementation have been lower than anticipated, as greater attrition has reduced the severance bill. With a payback of around 11 months, some benefit falls into FY21, with the balance driving further margin improvement in FY22.

Balance sheet robust

Negotiations for the sale (and leaseback) of the Shiodome building are not yet complete but must be well advanced given that the financial benefit is built into management’s full year guidance. The acquisition of LiveArea, announced in July, and the share buyback, which has now started, will absorb cash in H221, with the end June net debt figure ¥71bn benefiting from the sale of two smaller properties in Japan. Net debt is clearly well within the mid-term target of 1.5x EBITDA.

Valuation: Discount narrowed but still unjustified

The share price has recovered well from a dip during Q2, when news flow was relatively thin news and is now 35% off those lows and up 53% over the last twelve months as the outlook has clarified. This has narrowed the valuation gap to a 14% discount on EV/EBITDA and 10% on P/E, from 21% and 29% respectively at the time of our last note. Given the anticipated margin expansion, we still retain the view that this differential as overstated.

Progress on revenues and margins

The group had a particularly good Q2, in common with the other global marketing holding companies, with 15.0% organic growth and an increase of 370 bps in operating margin to 12.2%. Overall Q2 revenue LCoS was ¥218bn.

The simplification of both parts of the group should results in greater efficiency and lower costs. The real future potential gains, though, are to be achieved in greater up and cross-sell through offering an increased number of service lines to individual clients and driving up average revenues.

DJN (43% H1 revenue LCoS) - integration evolving

Organic growth for DJN overall was 4.5% in H121, although the agencies had divergent performances dependent on the nature of their activities. The largest, DENTSU Inc, posted organic growth of 3.1%, benefiting from its exposure to better performing economic sectors such as technology and food and beverage.

Click on the PDF below to read the full report: