Defence spending is set to increase structurally worldwide amid a 'new normal' of heightened geopolitical tensions. The war in Ukraine and the prospect of a new Trump presidency have prompted European countries to increase their defence capability targets.

It also means increased revenue for companies that manufacture ammunition, F-35 fighter jets or air defence systems like Patriots. While this is a sector many investors have been reluctant to invest in the past, the greater focus on defence budgets might turn investors' attention back to this previously unpopular part of the market.

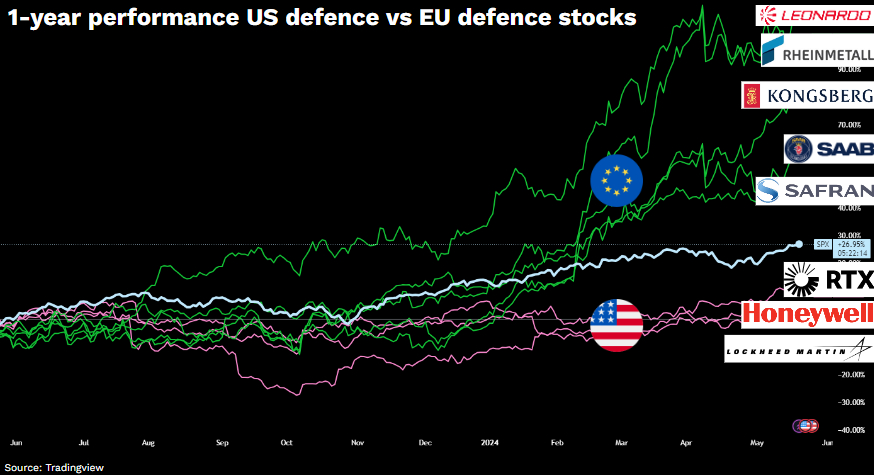

The largest and most defence stocks are in the US. US aerospace and defence conglomerate RTX leads the way with a market value of $140 billion, followed by Honeywell (NASDAQ:HON) and Lockheed Martin (NYSE:LMT).

However, the smaller European defence stocks have seen the biggest price increases. The US aerospace and defence ETF ITA has underperformed the S&P500 over the past year. Many of these companies are often part of larger aerospace and aviation conglomerates with less direct exposure to increased defence budgets. Meanwhile, Europe's smaller and more concentrated defence stocks have been on a roll. Italian Leonardo and German Rheinmetall have risen almost 100% over the past year. Norwegian Kongsberg (LON:0F08) (75%) and Swedish SAAB (LON:0GWL) (50%), with their well-known Gripen fighter jets, have also seen sharp price increases.

Europe is also set to see the biggest growth in defence budgets. The US spends 3.4% of GDP on defence, and at $900 billion, it is by far the largest budget in the world. While EU countries only spend 1.5% of GDP on average, the region is catching up. Large economies like the UK will lead the way by increasing spending to 2.5% of GDP by 2030, while smaller but more vulnerable countries like Poland have announced plans to increase their defence spending to as much as 4.0%. According to McKinsey, European NATO countries together have announced additional spending of between €700 and €800 billion by 2028.

Meanwhile, the European Commission has recently presented a strategy for Europe's defence sector, including a target to spend at least half of national defence spending within the EU by 2030, increasing to 60% by 2035. This could make smaller European defence stocks outperform the US defence giants, where the extra defence spending goes disproportionately further.

Jakob Westh Christensen, eToro Nordic Market Analyst

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Defence budgets on the rise: European equities in focus

Published 22/05/2024, 17:19

Defence budgets on the rise: European equities in focus

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.