First, a review: last month, August’s report missed higher. But the miss was mostly due to the quirky jump in Owners’ Equivalent Rent. Outside of that, CPI had been okay – not great, but moving in the right direction. The Fed eased 50bps anyway (at the time I said the miss in CPI wouldn’t deter that), setting up what will be the headlines for the next week now. Because of the strength in the Employment report, some people were already questioning whether the Federal Reserve made a policy error in starting to move rates back towards neutral so quickly. But as long as inflation was heading back to their target, neutral would still make sense even if the jobs market wasn’t weakening (as it still looks like it is, outside of government spending). The questions now get a little more pointed because today’s CPI miss higher was not due to a one-off.

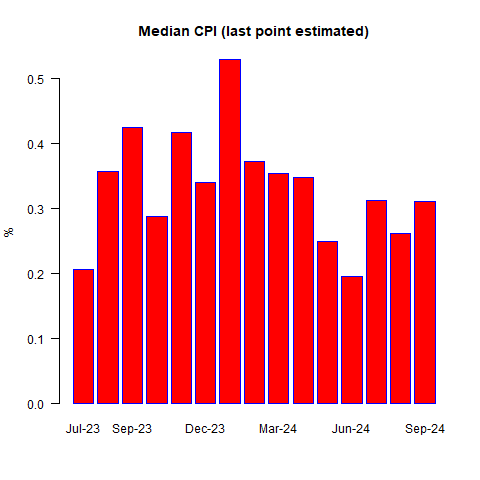

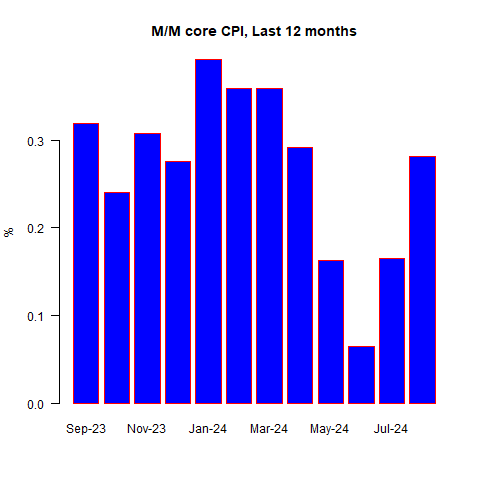

The consensus of economists coming into today was for a +0.10% rise in the seasonally-adjusted CPI. Now, energy this month was expected to be about a -0.17% drag on the number (it turned out to be 13bps rather than 17bps), so this low m/m print was scheduled to be mostly due to last month’s slide in energy prices. Still, decent optics especially with the last CPI we’ll see before the election. Economists saw +0.24% m/m on core. The actual figures were +0.18% m/m on headline CPI and +0.31% m/m on core CPI. This is unfortunate, because the y/y Core CPI number rose, instead of being flat, to +3.26% y/y. Moreover, the overall shape of the monthlies…well…see for yourself.

We have to be careful about the cognitive bias that makes us see stories and trends where there aren’t any, which is why it’s so very important to not focus on one month’s number. Or two. But if you look at this chart, it sure looks like the outlier might not be August and September, but May and June. Doesn’t it?

Ditto that for the Median CPI (last point estimated by me at +0.33% m/m).

Again, it could be a cognitive error but this sure looks like we’re pretty steady around 0.3%. If sustained, that would be in the ‘high 3s’, and it is time for my monthly reminder that I think median inflation will settle in the ‘high 3s, low 4s’ although it could dip into the low 3s first. (It’s looking more and more like the dip into the low 3s may not happen, as we get further along in the adjustment of rents.)

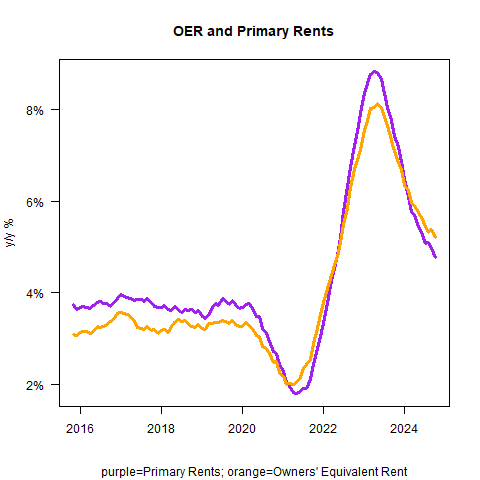

So where did this high miss come from? It wasn’t from OER and Primary Rents, which were back into their slowly-declining mode. OER was +0.33% m/m, and Primary Rents +0.28% m/m. Year over year, Primary Rents are down to +4.8% y/y. My model has them eventually ending up around 3.8%, after dipping lower. But they should be dipping right now, and they’re not. They may simply be converging on that 3.8%ish level.

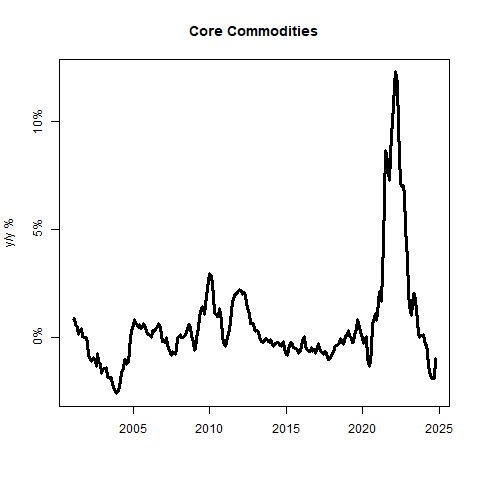

But here’s an interesting chart. Remember how I have been saying for a long time that a good part of the overall deceleration in inflation had come from Core Goods, which would not continue to plumb new deflationary depths? This month, Core Goods was only -1.0% y/y, versus -1.9% y/y the last time we got these numbers.

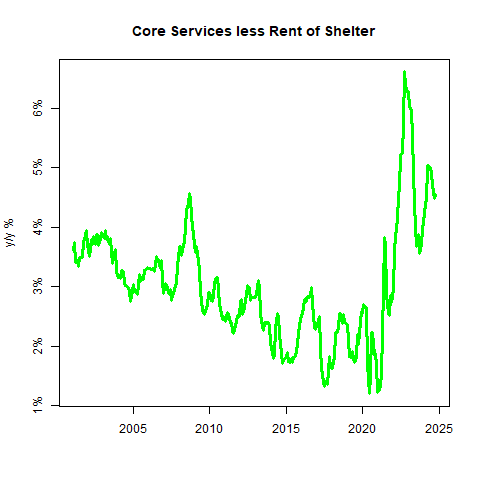

Now, that doesn’t look wildly inflationary but if core goods inflation goes merely back to flat, then core services needs to do a lot more heavy lifting. Core Services did drop to 4.7% y/y from 4.9% y/y. But flat on core goods and 4.5% on core services wouldn’t get us back to the Fed’s target. Not even close.

In the core goods category, there were rises in Used Cars (+0.3% m/m) and New Cars and Trucks (+0.15% m/m), but nothing terribly out-of-the ordinary. Similarly, in core services there wasn’t much out-of-the ordinary. The problem is, ‘ordinary’ looks like it’s not at the Fed’s target. Medical Care Services were higher, with Doctor’s Services +0.9% m/m and Hospital Services +0.57% m/m. Airfares rose +3.16% after +3.86% last month. Motor vehicle insurance continues to rise, +1% m/m, with the only good news being that the y/y figure on insurance is now down to ‘only’ +16%. But +1% per month still is a rate above 12% per year – not too exciting.

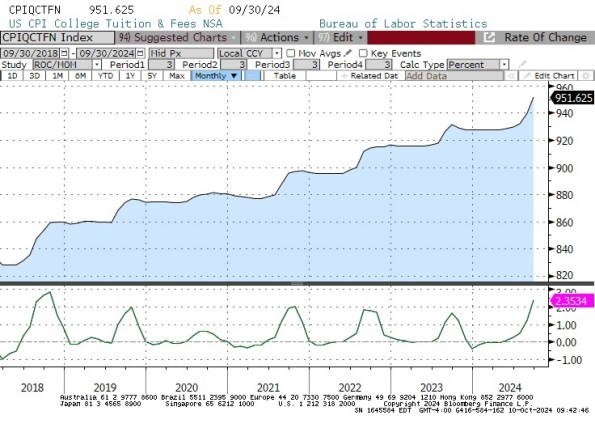

Car and truck rental was also +1.2% m/m. So, in transportation outside of the cost of energy itself, it was a rough month (but that’s what happens, I guess, when you try and force people to buy electric cars when they don’t want them). But it wasn’t just transportation goods and services, either. This is the time of year when the jump in college tuitions happens. And it looks like the jump in tuitions this year is the largest since 2018. The seasonally-adjusted numbers will smooth this out, but that means tuition is going to be adding a little more over the next 12 months than it added over the last 12 months.

This is also somewhat surprising. Normally, when asset markets are going gangbusters we tend to see smaller increases in tuition because endowments are doing well and the financial model for colleges is basically (exogenous cost increases we don’t really try to control, minus endowment contributions or federal support, divided by number of students). If markets are doing well and college tuitions are still accelerating, it implies an increase in costs. My guess is that insurance is part of that, but so will be teachers’ salaries. Provision of education is ‘labor intensive,’ and wages continue to refuse to slip back down to the old levels. This is also the reason that Food-Away-From-Home was +0.34% m/m and continues to hang out around +4% per year.

And, as a result of wages refusing to moderate, ‘supercore’ (core services ex-shelter) also continues to refuse to slip back to the old levels.

The bottom line is that this number is not high because of any weird one-offs. In the same way that last month’s number was generally okay in a balanced way, outside of rents, this month’s number is generally less pleasant, in a balanced way. I don’t think we are at the start of another spike higher in prices. But we continue to aim for ‘high 3s, low 4s.’

And this will be an unfortunate story for the Fed as they will be peppered with questions about a potential policy error. I will repeat here what I said last month:

“To be clear, I personally do not think the FOMC should stop quantitative tightening and there’s no hurry to cut rates. The fight against inflation is not only unfinished, it won’t be finished for quite a while…and an ease now will just make it harder later. But that’s what I would do. What I am saying is that the Fed is not likely to change course on the basis of this number.” As expected, the Fed did cut rates 50bps. I am not sure this is necessarily a terrible policy error, although starting with 50bps now looks like an obvious mistake. Getting rates back to neutral, around 4% or so, is not a bad idea as long as quantitative tightening continues. It isn’t the best idea, but it’s not a disaster. But this raises the stakes for the next FOMC meeting. If the Fed skips the meeting, it will be a tacit admission that the first move was a mistake. If the Fed piles on another 50bps, it will show they are terrified about growth or simply don’t care about inflation. I suspect 25bps is the only choice they can make which will make almost everybody equally unhappy. There’s more data to come before that meeting, but the FOMC’s path has narrowed considerably as inflation remains sticky.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI