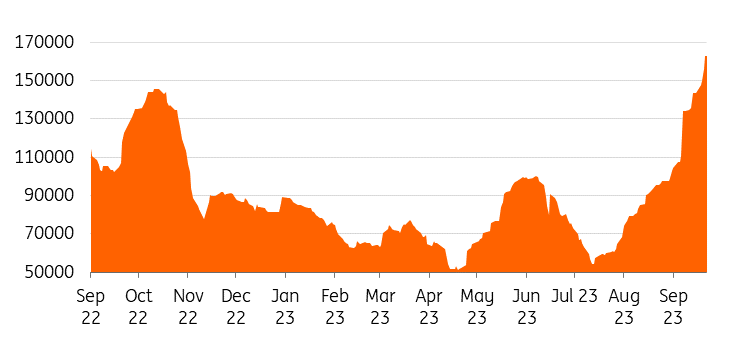

LME copper stocks double

Copper stocks held on the London Metal Exchange (LME) have more than doubled in the space of two months. This shows clear signals of weakening demand. Inventories of the red metal on the exchange now stand at 162,900 tonnes, according to the latest LME daily data, after 7,200 tonnes of the metal were delivered to LME warehouses in Hamburg, Rotterdam and New Orleans. So far in September, inventories are up by more than 50%, following a similar rise in August.

LME copper stocks have been rising since mid-July with more than 100,000 tonnes of the metal having been delivered into the exchange’s warehouses. They do, however, remain low by historical standards. We believe low inventories fuel the possibility for spot prices to rise rapidly if consumption picks up sooner than expected.

Meanwhile, loose nearby spreads indicate an ample supply of available material. The discount for near-term delivery versus the three-month contract continues to rise, which signals more deliveries might be on the way. It last stood at $64.25, compared to $4.50 on 5 September. This is the widest discount in data going back to 1994.

With rising LME inventories and loosening nearby spreads, more weakness may lie ahead for copper prices.

Rising LME stocks indicate weakening demand

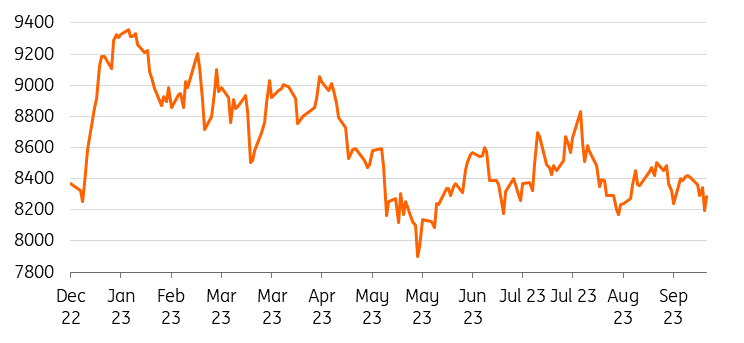

LME prices struggle for direction

Copper has been struggling for direction lately amid concerns over Federal Reserve policy and a disappointing Chinese economic recovery.

Copper prices fell to their lowest level in five weeks earlier this week, hitting $8,110.50/t, after the Fed indicated that its policy would remain restrictive for longer, which pushed the dollar to a six-month high. Further rate hikes could add more headwinds during a time of already weakening demand for copper.

Meanwhile, worries over China’s real estate sector continue to escalate after Moody’s Investors Service put two of the country’s strongest property developers – China Jinmao Holdings Group and China Vanke – on review for possible downgrades.

China's new home prices fell for a third month in August and at a slightly faster pace, according to the latest government data. New home prices in 70 cities, excluding state-subsidised housing, declined by 0.29% last month from July, when they fell 0.23%.

At the end of last month, Beijing rolled out a set of stimulus measures, reducing down-payment requirements for homebuyers and allowing lenders to lower rates on existing mortgages, resulting in a spurt of homebuying earlier in the month, however that is already losing momentum.

Still, there are some signs of economic activity picking up in August. Industrial production rose by 4.5% from a year earlier while retail sales jumped 4.6%, the latest data show.

However, China’s recovery is still uncertain, with anything related to real estate continuing to struggle. For copper, risks remain to the downside heading into the year's end on China’s uncertain outlook for the property sector. We believe commodity-intensive stimulus is needed to support short to medium-term demand growth. We maintain our price forecast of an average of $8,582/t in 2023.

Copper nears key support

First published on Think.ing.com.