This article was written exclusively for Investing.com

- The “new oil” is critical for decarbonization

- Almost a decade to bring new production online; inventories are dropping

- Leading copper producers scouring the earth for reserves and production

- FCX: leading producer of copper, gold, molybdenum

- Levels to watch in FCX shares

Copper is an essential, nonferrous metal building block for infrastructure worldwide. China is the world’s leading copper consumer, but the US has just passed an infrastructure rebuilding package which will require lots of the red metal over the coming years.

Indeed, copper is more than a metal—it's a global barometer for economic expansion or contraction. Many market participants have nicknamed the commodity Dr. Copper, as the industrial metal diagnoses economic conditions. While inflationary pressures pushed copper’s price to a new record high at nearly $4.90 per pound in May, prospects remain strong for a substantial increase in demand over the coming years. Freeport-McMoran (NYSE:FCX) is a leading copper producer that should continue to trend higher alongside the red base metal.

The “new oil” is critical for decarbonization

While copper was on its way to new highs in May, Goldman Sachs called the red metal “the new oil.” The investment firm said that decarbonization does not occur without additional copper supplies.

The base metal is a crucial component in EVs, wind turbines, and other technological advances that decrease fossil fuel consumption and favor alternative and renewable energy.

Source: CQG

The quarterly chart, above, shows that COMEX copper futures rose to a high at $4.8985 per pound, surpassing the 2011 $4.6495 peak.

Source: Barchart

Three-month copper forwards on the London Metals Exchange rose to $10,747.50 per metric ton. Goldman forecast the price would increase to the $15,000 per ton level by 2025, with other analysts calling for even higher prices.

At $15,000 per ton, COMEX copper futures would be north of the $6.80 per pound level, leaving lots of upside room for the red metal.

Almost a decade to bring new production online; inventories are dropping

When commodity demand rises, producers increase output to meet the escalating requirements. At the same time, it's impossible to turn on new production overnight. New mines can take eight to ten years to yield the copper ore that becomes the metal.

Over the past months, China, the world’s leading copper buyer, attempted to temper the rally by selling their strategic stockpiles. While copper has not made a new high, the price has remained above the $4 per pound level.

The price action during four auctions where China sold copper, aluminum, and zinc, as well as other commodities, has been bullish. While copper’s price touched a new record, it hasn't declined under the weight of the sales either.

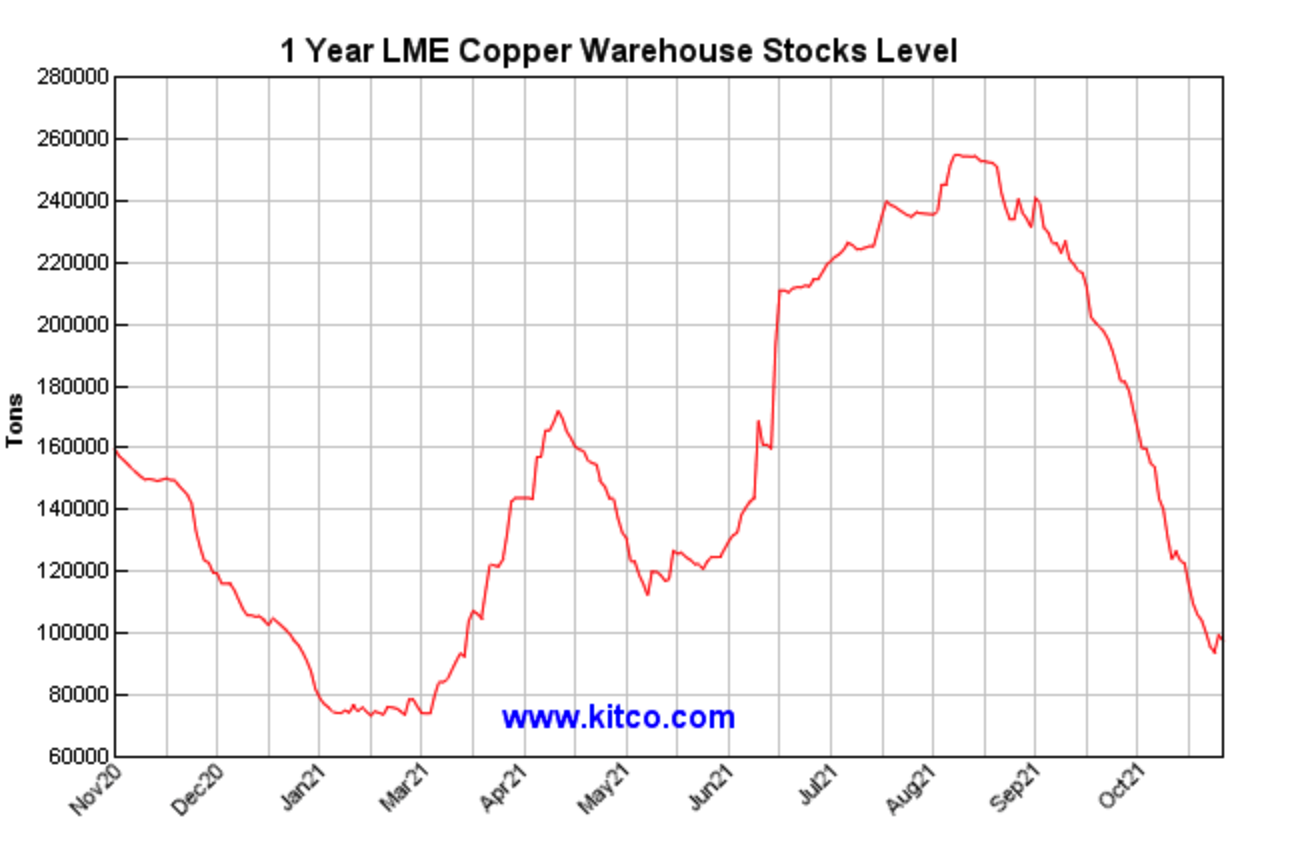

Meanwhile, copper inventories in London Metal Exchange warehouses worldwide have been falling.

Source: LME/Kitco

The chart shows that after reaching a high of over 255,000 metric tons in August 2021, copper stockpiles were at the 89,875-ton level at the end of last week. The decline is a sign of rising demand for the red metal.

Leading copper producers scouring the earth for reserves and production

The world’s leading copper producers are scrambling to identify new supplies. BHP Billiton (NYSE:BHP), a leading, global diversified producer, had 1.72 million tons of copper output in 2020, second only to Codelco, the Chilean mining giant that produced 1.73 million tons.

BHP is currently looking at copper projects in the Democratic Republic of Congo (DRC) to increase its output. The DRC is a challenging mining jurisdiction because of its long history of corruption. BHP’s move to even consider a DRC project signifies that producers are starving for more copper supplies.

The third leading global producer is Freeport-McMoRan, with 1.45 million tons of copper output in 2020.

FCX: leading producer of copper, gold, molybdenum

Aside from copper, FCX also produces molybdenum and gold and is the world’s leading molybdenum producer. FCX’s primary mining interests include the Grasberg copper-gold deposit in Indonesia, the world’s biggest gold mine.

FCX also operates the Morenci mine in Arizona in the US, one of the leading copper deposits in North America. Freeport also operates two copper-producing mines in South America, Cerro Verde in Peru and El Abra in Chile.

Levels to watch in FCX shares

At the $38 per share level at the end of last week, FCX had an over $56.2 billion market cap. The stock trades an average of over 18 million shares each day. The $0.30 dividend translates to a 0.79% yield.

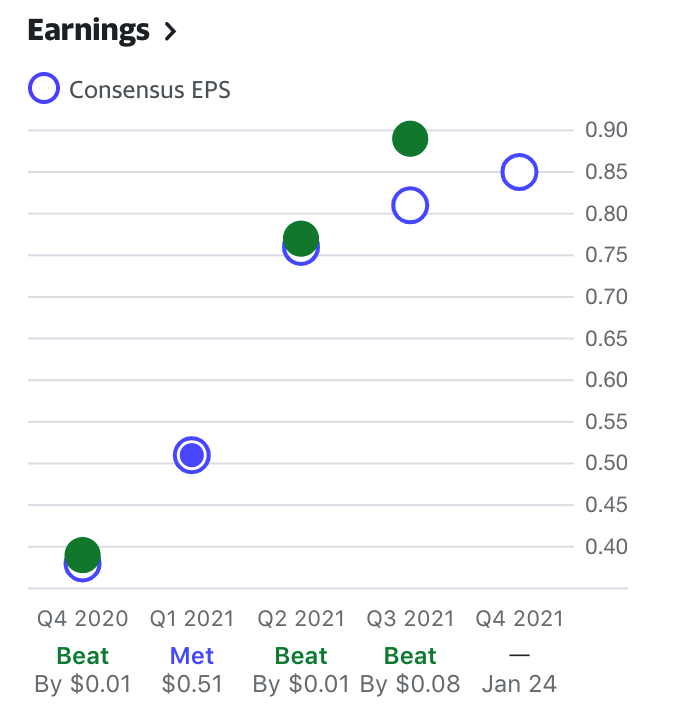

Source: Yahoo Finance

The chart shows the bullish trend in FCX’s earnings as it met or exceeded EPS forecasts over the past four consecutive quarters.

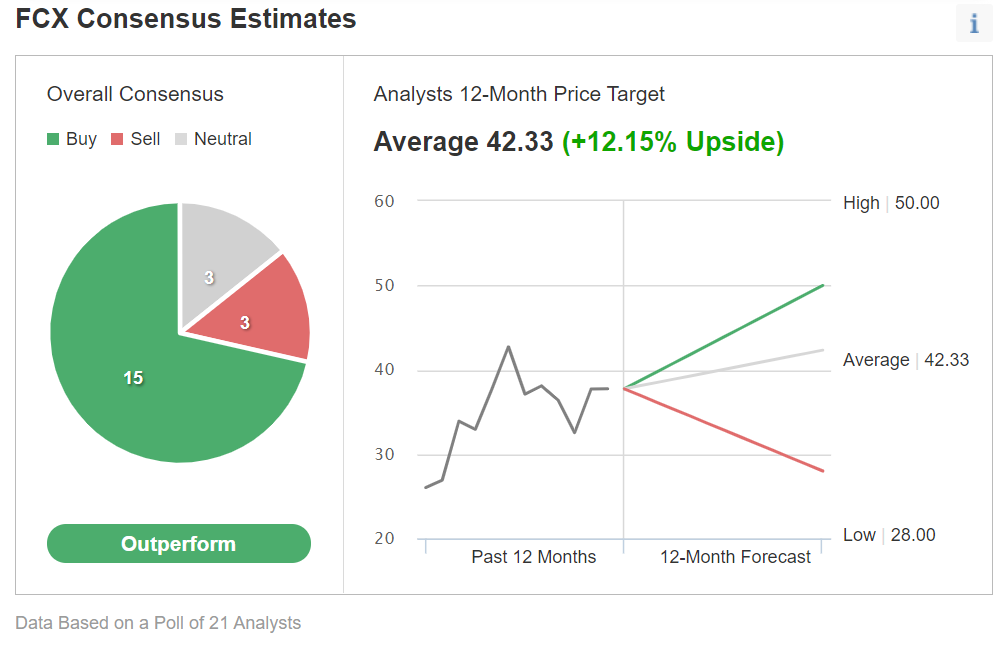

A survey of 21 analysts on Investing.com has an Outperform rating on the stock.

Chart: Investing.com

As well, among those polled there's an average price target of $42.33 for FCX shares for a 12.15% upside with projections ranging from $28 to $50 per share.

Source: Barchart

The chart above shows that FCX shares rose from lows of $4.82 in March 2020 during the height of the pandemic to the most recent high at $46.10 in May 2021, when copper reached its all-time peak.

If Goldman Sachs and other analysts are correct and copper is heading towards the $15,000 per ton level, FCX shares could challenge the 2011 and 2008 highs at $61.34 and $63.63 per share respectively. At below $40 currently, FCX correlates well with copper and could experience explosive growth over the coming years.

Bull markets rarely move in straight lines. Corrections can be brutal, shaking the faith of the most committed bulls.

However, in this case, I view corrections and price weakness as a buying opportunity for FCX, the third leading copper producer worldwide, which will continue to profit as the price of the red metal rises over the coming years.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI