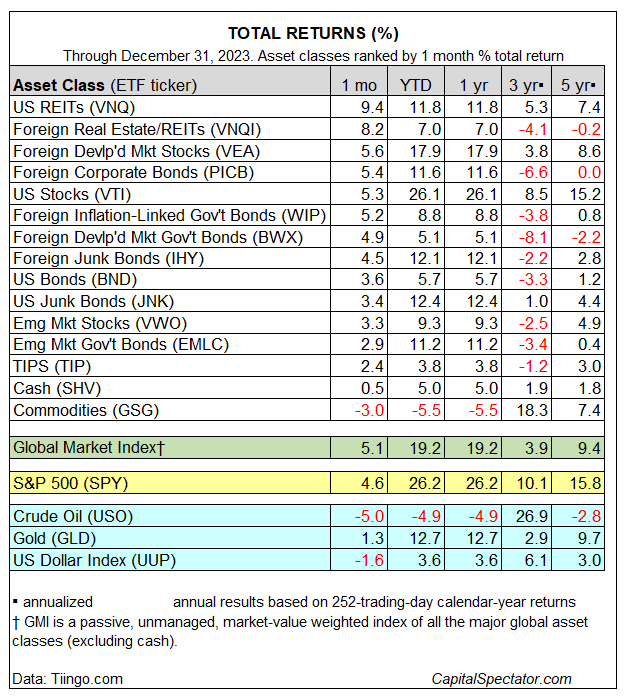

Real estate securities rebounded sharply in December, leading the broad-based gains for the major asset classes in the final month of 2023, based on a set of ETFs.

Commodities, by contrast, were the downside outlier, for December and for the calendar year that just ended.

Vanguard US Real Estate Index Fund (NYSE:VNQ) surged 9.4% in December, topping the long list of gainers for last month. The rise follows an even stronger advance in November for the asset class.

International property stocks ex-US were the second-best performers last month. Vanguard Global ex-U.S. Real Estate Index Fund ETF Shares (NASDAQ:VNQI) rallied 8.2%.

US stocks (VTI) and bonds (BND) also rose in December, as did cash (SHV). The only loser last month for the major asset classes: commodities GSG, which fell 3.0%, the third straight monthly decline.

Widespread gains marked results for 2023, except for commodities (GSG), which lost 5.5% for the year. Last year’s top winner: US stocks (VTI), which surged 26.1%, the strongest performance by far in 2023 for the major asset classes.

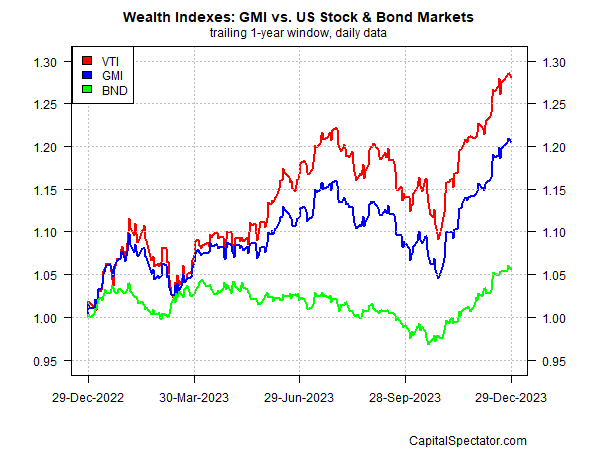

The Global Market Index (GMI) also enjoyed a strong year via a 19.2% surge in 2023. The gain marks a strong recovery after 2022’s hefty loss.

GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios.

GMI’s performance over the past year continues to benefit from the strong trend in US stocks (VTI). By comparison, the US bond market (BND), although rebounding from recent weakness, continues to trail by a wide margin over the past 12 months.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.