STEALTH: The stealth commodities rebound has broadened, after a terrible 2023. With oil breaking $90/bbl.. New gold highs. ‘Dr. Copper’ surging. Alongside soaring niches like cocoa. Demand has been under-estimated. Supply is structurally tight. And technicals disproportionately important. With investor sentiment depressed, demand for inflation hedges, and geopolitical risks rising. Its a better but not great outlook. With US dollar resilient, US bond yields high, and China demand half-hearted. And major natgas and cereals markets deeply over-supplied. Caveat emptor that commodities has the worst long-term record of all assets and ‘solution to high prices is high prices’.

FUNDAMENTAL: Commodities is seeing a slow-burn supply-demand squeeze. 5.5% OPEC+ oil supply cuts and weather-driven disruptions are coming against a backdrop of 15-years of supply under-investment driven by low prices and ESG headwinds. Whilst demand growth is being under-estimated, with US ‘exceptionalism’ and China manufacturing signs of life. Most recently by the US Energy Information Agency raising its oil demand outlook and correcting past under-estimates. Yet the asset class is far from firing on all cylinders. Natgas and cereals are over-supplied. The robust dollar is dampening overseas demand. And higher oil will start to fray OPEC unity.

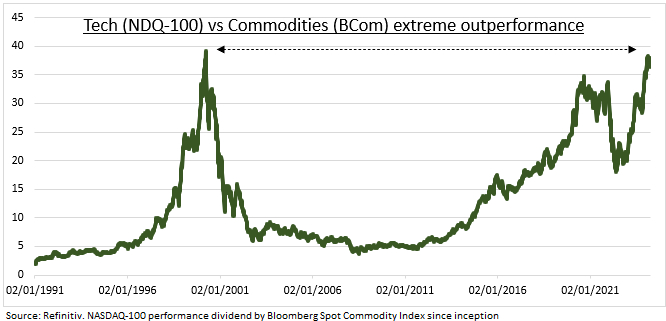

TECHNICAL: We see these drivers as significant. 1) A geopolitical risk premium has reemerged in oil and been a driver of safer-haven gold. 2) Stalling US inflation progress has driven investor demand for traditional inflation-hedges like commodities. 3) Whilst low investor commodity allocations, its 2023 underperformance, and extreme longer term underperformance vs tech (see chart) are contrarian positives. Our global retail investor survey sends a mixed allocation message. With 8% highlighting commodities as the asset they are most likely to increase investments in. Its ranked behind crypto, stocks, cash as the most attractive. But ahead of local bonds, FX, alternatives.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Commodities come in from the cold

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.