Strong demand for care-based social housing underpins continuing positive accounting returns for Civitas Social Housing. The investment-grade credit rating has been reconfirmed and, alongside accretive share repurchases by the company, ‘insider’ share purchases demonstrate the confidence of the board and key members of the investment adviser team. This is not reflected in the share price, which offers an attractive 6.3% yield and c 19% discount to NAV.

Share price performance

Business description

Civitas Social Housing invests across the UK in care-based community housing and healthcare facilities, particularly specialised supported housing, for the benefit of working age adults with long-term care needs. Its investment objective is to provide an attractive level of income, with the potential for capital growth.

Positive returns but delayed capital deployment

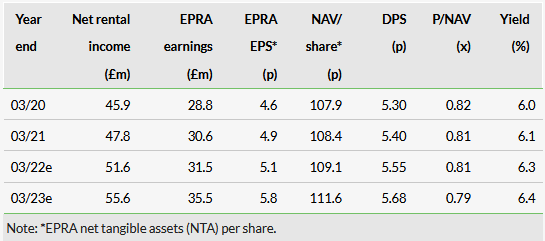

Civitas’s shares are yet to recover the weakness that followed the publication of open letters by a short seller in September 2021, and the valuation suggests significant potential. In August 2021, the shares traded at a c 10% premium to NAV, and the company was considering capital-raising measures to support further accretive growth. Civitas’s track record of consistently positive accounting returns has continued through Q322 and it is on track to meet its FY22 DPS target of 5.55p. Including the deployment of existing available capital into a strong pipeline of opportunities, DPS is fully covered (c 101% vs 87% reported in H122). Recent acquisition activity has been slow, but we expect this to pick up. Our FY22e EPRA earnings is reduced by 8% (FY23e by c 3%) but our DPS forecasts are unchanged.

Positive outcomes driving demand

In our July Outlook note we provided a detailed overview of Civitas’s strategy and the specialised social housing (SSH) market. The shortage of homes is forecast to increase yet compared with the alternatives of residential care or hospitals, SSH improves lives in a cost-effective manner. This explains government policy to offer supported housing to more people and private capital is crucial in meeting this need. For those individuals receiving SSH, rents are funded by central government and paid, via the commissioning local authorities, directly to the approved providers (APs), which lease the properties from Civitas and manage them. In some cases, APs have struggled to keep pace with the rapid growth of the sector, attracting regulatory scrutiny. We believe this is aimed at delivering sector sustainability and improved AP governance, operational performance and financial strength should also benefit the security of contracted rents and the long-term growth of the sector.

Valuation: Further strong potential

Dividends are backed by stable income, uncorrelated with the wider economy, with good inflation-linked growth prospects. Civitas targets aggregate FY22 DPS of 5.55p, which represents an attractive 6.3% yield. Meanwhile, the shares trade at a c 19% discount to Q322 NAV (average discount since IPO 4%).

Click on the PDF below to read the full report: