Chinese ‘Year of the Dragon’ may breathe fire back into commodity markets: Commodity outlook

Commodities had been under pressure in the past year, but we believe there are several reasons to be cautiously optimistic about the asset class in 2024 – the Chinese ‘Year of the Dragon’.

The key drivers of negative commodity performance in the past year were:

- Rising interest rates in many developed countries

- China’s economy stalling under the pressure of a real estate blow up

- Sentiment around the energy transition losing momentum

We believe all three will reverse course this year.

Interest rates to fall

Consensus strongly believes that we will see interest rate cuts this year. While we thought that markets were getting a little ahead themselves in terms of the timing and scale of the cuts at the beginning of the year, markets have recalibrated their views and are pricing in the first cuts for Federal Reserve and European Central Bank around the middle of the year.

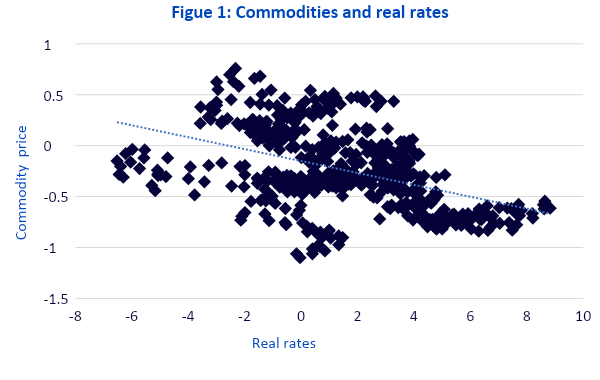

We believe that rate cuts will be positive for most cyclical asset classes, including commodities. Our observation is that lower real interest rates are price positive for commodities (Figure 1). The line of best fit indicates that the 1% decline in real rates would be consistent with a 6% increase in broad commodity prices.

Source: Bloomberg, WisdomTree. June 1976 to January 2024. Commodity price is the log of Bloomberg Commodity Index – log US Consumer Price Index. Real rates are the US two-year nominal Treasury yields – US CPI inflation. . Historical performance is not an indication of future performance and any investments may go down in value.

Chinese ‘Year of the Dragon’ may breathe fire back into commodity markets

Noting China’s disappointment in 2023, will the country step up a gear in 2024? China will announce its economic growth targets in March 2024. In its December 2023 Central Economic Work Conference, a mixed message of “pursue progress while ensuring stability, consolidate stability through progress and establish the new before abolishing the old”[i] was given. It’s hard to decipher a call to bold action from this.

China’s property slump has simply gone on too long for policy makers to continue with the 2023 piecemeal stimulus approach. Sentiment has already been damaged severely and the market needs support. In response to the broader sentiment slump, Chinese authorities have been relying on the so-called ‘national team’ – a group of state-run funds to buy equities in February 2024. That has certainly led to an upswing in equity markets since markets reopened after the Chinese New Year celebrations. To strike at the heart of the problem, policy makers could focus on the real estate sector itself.

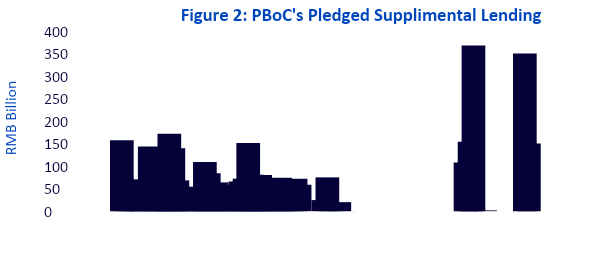

Policymakers have turned to ‘three major projects’: affordable housing, urban village renovation and emergency public facilities. A boost to funding for the People’s Bank of China (PBoC)’s Pledged Supplemental Lending (PSL)[ii] program seems to indicate spending on these projects will rise (Figure 2). Support via this channel does not involve a broad-based rate cut.

Source: Bloomberg, WisdomTree. June 2015 – January 2024. Monthly data. Historical performance is not an indication of future performance and any investments may go down in value.

The PBoC additionally cut key mortgage interest rates by the most since 2019 in February 2024. Reluctance to cut interest rates in a broader fashion stems from fears of currency depreciation. But as other countries cut their interest rates (see section above), then China will feel less restraint.

We should also note that China’s demand for commodities has not been dented severely. Commodity price weakness seems to stem from perception that a weak economy will drive commodity demand lower.

For example, we believe that China had been increasing its grid spending during a period of relatively low copper prices, as it aims to opportunistically accelerate its transition to a lower carbon economy. Copper is essential for renewable technologies and the grid infrastructure improvements needed to accommodate an increasing number of electric vehicles on the road.

Xin san yang

Apparently, a new buzz word is circulating among Chinese officials and state media – Xin san yang – the “new three”, referring to solar cells, lithium-ion batteries and electric vehicles (EVs). China is a leader in the production and exports of these goods. While the “old three” – household appliances, furniture, and clothing – had a negative contribution to export growth in 2023, the new three were positive.

Solar cells, lithium-ion batteries and electric vehicles are metal-intensive industries and a widening international market for them could go some way to replace the slowing metal demand from the domestic real estate sector. Moreover, while property is more steel/iron ore intensive, the new three are more base metal intensive.

Energy transition

Our long-term outlook for commodities is conditioned on an energy transition taking place: the migration away from fossil fuels and greater reliance on renewables in an effort to reduce green-house gases.

After strong momentum behind the energy transition in 2021 and 2022, investor interest began to fray in 2023. 2022 marked a high-water mark given the sheer scale of the US Inflation Reduction Act (IRA) that was signed into law (despite its name, the act was a piece of legislation designed to spur investment in green technology). However, in 2023 the European Union adopted its Fit for 55 legislation (aimed to reduce greenhouse gas emissions by 55% by 2030 relative to 1990 levels). It is also on the cusp of signing Critical Raw Materials Act (CRMA) into law. The CRMA is similar to the US IRA – providing tax credits to those on-shoring the supply chain of electric vehicles, wind turbines and other green goods (but on a smaller scale).

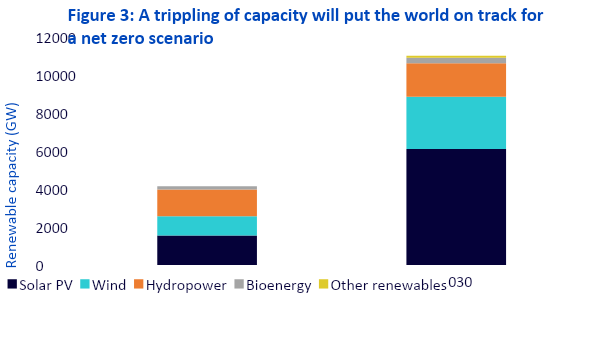

The COP28 in December 2023 concluded with a roadmap for “transitioning away from fossil fuels” – a first for a UN climate conference. That could potentially galvanise the energy transition once again. Although the extended discussions failed to agree on a “phase out”, the avoidance of stalemate allows planning and resources to be devoted to the “phase down” strategy. At the COP28 more than 130 national governments, including the European Union, agreed to work together to triple the world’s installed renewable energy capacity to at least 11 000 GW by 2030. That would be in line with the International Energy Agency’s Net Zero Emissions by 2050 scenario (if coupled with the doubling of the annual rate of energy efficiency improvements every year to 2030), see Figure 3.

Source: WisdomTree, International Energy Agency Renewables 2023, January 2024. 2030 forecasts refer to a Net Zero Scenario, which are higher than its base case forecasts. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

Conclusions

After a challenging 2023, commodities appear poised for a breakout as rate cuts come to the fore. The late December 2023 rally provides a glimpse of what could happen when the cuts are delivered.

While the largest consumer of commodities – China – remains in a tough spot in terms of its economy, we recognise that its demand for commodities remains resilient as it modifies it ‘business model’. That may mean that some commodities will do better than others though. We believe China will continue to stimulate and its ability to do so may improve as other countries around the world loosen monetary policy (as the country is worried about currency depreciation).

While investor attention to the energy transition could be fading, policy makers are intensifying their resolve. Breakthrough agreements at COP28 are a case in point. Our long-term outlook for commodities is conditioned on the energy transition and we believe that the potential for medium-long term supply deficits in metals will generate a commodity Supercycle.

________________________________________

[i] https://english.www.gov.cn/news/202312/12/content_WS657860aec6d0868f4e8e21c2.html

[ii] The PSL programme, initiated in 2014, was originally designed to help support any property downturn by funding urban redevelopment, pushing up property prices in the process. China relied heavily on PSL loans to support its shanty-town renovation during 2015-2018.

________________________________________

Investing in broad commodity strategies

WisdomTree has a comprehensive range of broad commodity UCITS Exchange-Traded Funds (ETFs) that can help diversify a traditional portfolio and cater for different investor needs and objectives. We believe the diversified nature of our broad baskets will be beneficial in a soft landing scenario as defensive commodities like gold are mixed with cyclical commodities like oil.

WisdomTree Broad Commodities UCITS ETF

The WisdomTree Broad Commodities UCITS ETF closely tracks the benchmark Bloomberg Commodity Index (BCOM) but, unlike other BCOM-trackers, it uses an innovative replication method that includes direct exposure to spot prices for the precious metals portion of the index rather than synthetic. The direct exposure to physical precious metals allows the ETF to reduce roll cost on the precious metals portion of the BCOM index, potentially improving performance versus full swap-based replication, while maintaining a low tracking error versus the benchmark.

USD Accumulating: WisdomTree Broad Commodities UCITS ETF - USD Acc (IE00BKY4W127)

WisdomTree Enhanced Commodity UCITS ETF

The WisdomTree Enhanced Commodity UCITS ETF is a core commodity alternative to the Bloomberg Commodity Index (BCOM). It invests in the same commodities and rebalances yearly to the same weights as the BCOM, but seeks to systematically enhance the risk return profile by using the shape of individual commodity futures curves to optimise returns. The algorithm in the methodology finds the point on the futures curve where the roll yield (the yield from transitioning from a shorter dated contract to a longer dated one) is maximised. This can be a substantial source of return. The strategy also tends to have a much lower level of volatility compared to the benchmark, BCOM. A soft landing (as opposed to a continued recovery) may entail more volatility in a front-month contract-following commodity strategy, when softening demand may drive more commodity futures curves into a state of contango. The enhanced strategy we believe could mitigate some of that volatility.

- USD Accumulating: WisdomTree Enhanced Commodity UCITS ETF - USD Acc (IE00BYMLZY74)

- USD Distributing: WisdomTree Enhanced Commodity UCITS ETF - USD (IE00BZ1GHD37)

- EUR Hedged Accumulating: WisdomTree Enhanced Commodity UCITS ETF - EUR Hedged Acc (IE00BG88WG77)

- GBP Hedged Accumulating: WisdomTree Enhanced Commodity UCITS ETF - GBP Hedged Acc (IE00BG88WH84)

- CHF Hedged Accumulating: WisdomTree Enhanced Commodity UCITS ETF - CHF Hedged Acc (IE00BG88WL21)

WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF

The WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF provides broad commodity ex-agriculture and livestock exposure, while also aiming to systematically enhance the risk-return profile by selecting optimal maturities along the futures curves to improve carry and broaden the commodity set by including platinum and palladium. The strategy is designed for investors who don’t want to have exposure to the agricultural markets.

- USD Accumulating: WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF - USD Acc (IE00BDVPNS35)

- EUR Hedged Accumulating: WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF - EUR Hedged Acc (IE00BDVPNV63)

_______________________________________

IMPORTANT INFORMATION

Marketing communications issued in the European Economic Area (“EEA”): This document has been issued and approved by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Marketing communications issued in jurisdictions outside of the EEA: This document has been issued and approved by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

WisdomTree Ireland Limited and WisdomTree UK Limited are each referred to as “WisdomTree” (as applicable). Our Conflicts of Interest Policy and Inventory are available on request.

For professional clients only. Past performance is not a reliable indicator of future performance. Any historical performance included in this document may be based on back testing. Back testing is the process of evaluating an investment strategy by applying it to historical data to simulate what the performance of such strategy would have been. Back tested performance is purely hypothetical and is provided in this document solely for informational purposes. Back tested data does not represent actual performance and should not be interpreted as an indication of actual or future performance. The value of any investment may be affected by exchange rate movements. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice. These products may not be available in your market or suitable for you. The content of this document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment.

An investment in exchange-traded products (“ETPs”) is dependent on the performance of the underlying index, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including among others, general market risks relating to the relevant underlying index, credit risks on the provider of index swaps utilised in the ETP, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

The information contained in this document is not, and under no circumstances is to be construed as, an advertisement or any other step in furtherance of a public offering of shares in the United States or any province or territory thereof, where none of the issuers or their products are authorised or registered for distribution and where no prospectus of any of the issuers has been filed with any securities commission or regulatory authority. No document or information in this document should be taken, transmitted or distributed (directly or indirectly) into the United States. None of the issuers, nor any securities issued by them, have been or will be registered under the United States Securities Act of 1933 or the Investment Company Act of 1940 or qualified under any applicable state securities statutes.

This document may contain independent market commentary prepared by WisdomTree based on publicly available information. Although WisdomTree endeavours to ensure the accuracy of the content in this document, WisdomTree does not warrant or guarantee its accuracy or correctness. Any third party data providers used to source the information in this document make no warranties or representation of any kind relating to such data. Where WisdomTree has expressed its own opinions related to product or market activity, these views may change. Neither WisdomTree, nor any affiliate, nor any of their respective officers, directors, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this document or its contents.

This document may contain forward looking statements including statements regarding our belief or current expectations with regards to the performance of certain assets classes and/or sectors. Forward looking statements are subject to certain risks, uncertainties and assumptions. There can be no assurance that such statements will be accurate and actual results could differ materially from those anticipated in such statements. WisdomTree strongly recommends that you do not place undue reliance on these forward-looking statements.

WisdomTree Issuer ICAV

The products discussed in this document are issued by WisdomTree Issuer ICAV (“WT Issuer”). WT Issuer is an umbrella investment company with variable capital having segregated liability between its funds organised under the laws of Ireland as an Irish Collective Asset-management Vehicle and authorised by the Central Bank of Ireland (“CBI”). WT Issuer is organised as an Undertaking for Collective Investment in Transferable Securities (“UCITS”) under the laws of Ireland and shall issue a separate class of shares ("Shares”) representing each fund. Investors should read the prospectus of WT Issuer (“WT Prospectus”) before investing and should refer to the section of the WT Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in the Shares.

WisdomTree Broad Commodities UCITS ETF

“Bloomberg®” and the Bloomberg Commodity Index(es)SM referenced herein are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the indices (collectively, “Bloomberg”) and have been licensed for use for certain purposes by WisdomTree UK Limited and its permitted affiliates including WisdomTree Management Limited and WisdomTree Issuer ICAV (together, WisdomTree). Bloomberg is not affiliated with WisdomTree, and Bloomberg does not approve, endorse, review, or recommend the WisdomTree Broad Commodities UCITS ETF. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the index(es).

WisdomTree Enhanced Commodity UCITS ETF

The methodology of and rules governing the index (the "Index Methodology" and the "Index") are proprietary and shall not be reproduced or disseminated without the prior written consent of the “Index Sponsor” (as defined in the “Index Rules” available on http://www.wisdomtree.eu/home). None of the Index Sponsor, the index calculation agent (where such party is not also the Index Sponsor, the "Index Calculation Agent") nor, where applicable, the index Investment Advisor (the "Index Investment Advisor") guarantee that there will be no errors or omissions in computing or disseminating the Index. The Index Methodology is based on certain assumptions, certain pricing models and calculation methods adopted by the Index Sponsor, the Index Calculation Agent and, where applicable, the Index Investment Advisor, and may have certain inherent limitations. Information prepared on the basis of different models, calculation methods or assumptions may yield different results. You have no authority to use or reproduce the Index Methodology in any way, and neither the Index Sponsor nor any of its affiliates shall be liable for any loss whatsoever, whether arising directly or indirectly from the use of the Index or Index Methodology or otherwise in connection therewith. The Index Sponsor reserves the right to amend or adjust the Index Methodology from time to time in accordance with the rules governing the Index and accepts no liability for any such amendment or adjustment. Neither the Index Sponsor nor the Index Calculation Agent are under any obligation to continue the calculation, publication or dissemination of the Index and accept no liability for any suspension or interruption in the calculation thereof which is made in accordance with the rules governing the Index. None of the Index Sponsor, the Index Calculation Agent nor, where applicable, the Index Investment Advisor accept any liability in connection with the publication or use of the level of the Index at any given time. The Index Methodology embeds certain costs in the strategy which cover amongst other things, friction, replication and repo costs in running the Index. The levels of such costs (if any) may vary over time in accordance with market conditions as determined by the Index Sponsor acting in a commercially reasonable manner. The Index Sponsor and its affiliates may enter into derivative transactions or issue financial instruments (together, the "Products") linked to the Index. The Products are not in any way sponsored, endorsed, sold or promoted by the sponsor of any index component (or part thereof) which may comprise the Index (each a "Reference Index") that is not affiliated with BNP Paribas (EPA:BNPP) (each such sponsor, a "Reference Index Sponsor"). The Reference Index Sponsors make no representation whatsoever, whether express or implied, either as to the results to be obtained from the use of the relevant Reference Index and/or the levels at which the relevant Reference Index stands at any particular time on any particular date or otherwise.

No Reference Index Sponsor shall be liable (whether in negligence or otherwise) to any person for any error in the relevant Reference Index and the relevant Reference Index Sponsor is under no obligation to advise any person of any error therein. None of the Reference Index Sponsors makes any representation whatsoever, whether express or implied, as to the advisability of purchasing or assuming any risk in connection with the Products. The Index Sponsor and its affiliates have no rights against or recourse to any Reference Index Sponsor should any Reference Index not be published or for any errors in the calculation thereof or on any other basis whatsoever in relation to any Reference Index, its production, or the level or constituents thereof. The Index Sponsor and its affiliates shall have no liability to any party for any act or failure to act by any Reference Index Sponsor in connection with the calculation, adjustment or maintenance of the relevant Reference Index and have no affiliation with or control over any Reference Index or the relevant Reference Index Sponsor or the computation, composition or dissemination of any Reference Index. Although the Index Calculation Agent will obtain information concerning each Reference Index from publicly available sources that it believes reliable, it will not independently verify this information. Accordingly, no representation, warranty or undertaking (express or implied) is made and no responsibility is accepted by the Index Sponsor or any of its affiliates nor the Index Calculation Agent as to the accuracy, completeness and timeliness of information concerning any Reference Index. The Index Sponsor and/or its affiliates may act in a number of different capacities in relation to the Index and/or products linked to the Index, which may include, but not be limited to, acting as market-maker, hedging counterparty, issuer of components of the Index, Index Sponsor and/or Index Calculation Agent. Such activities could result in potential conflicts of interest that could influence the price or value of a Product.

WisdomTree Enhanced Commodity ex-Agriculture UCITS ETF

The Morgan Stanley (NYSE:MS) RADAR ex Agriculture & Livestock Commodity Index℠ (the “Index”) is the exclusive property of Morgan Stanley Capital Group Inc. and/or its affiliates (collectively, “Morgan Stanley”), which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) (“S&P Dow Jones Indices”) to maintain and calculate the Index. The Index Components comprising the Index are the property of S&P Dow Jones Indices, its affiliates and/or their third party licensors and has been licensed by S&P Dow Jones Indices for use by Morgan Stanley in connection with the Index. S&P Dow Jones Indices, its affiliates and their third party licensors shall have no liability for any errors or omissions in calculating the Index.

The Index is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices, its affiliates or their third party licensors and neither S&P Dow Jones Indices, its affiliates nor their its third party licensors make any representation regarding the advisability of investing in the Index. Morgan Stanley and the Index names are service mark(s) of Morgan Stanley and have been licensed for use for certain purposes by WisdomTree. The Fund referred to herein is not sponsored, endorsed, or promoted by Morgan Stanley. Neither Morgan Stanley nor any other party (including without limitation any calculation agents or data providers) make any express or implied warranties, and hereby expressly disclaim all warranties of merchantability or fitness for a particular purpose, with respect to the Index or any Index related data. Without limiting any of the foregoing, in no event shall Morgan Stanley or any other party (including without limitation any calculation agents or data providers) have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) with respect to the Index, Index related data, the Fund, or any shares or investment units, even if notified of the possibility of such damages.

The assessment of UCITS compliance is made solely by WisdomTree and not made in reliance on any representations, warranties, undertakings or statements by Morgan Stanley or any of its affiliates.

Notice to Investors in Switzerland – Qualified Investors

This document constitutes an advertisement of the financial product(s) mentioned herein.

The prospectus and the key investor information documents (KIID) are available from WisdomTree’s website: https://www.wisdomtree.eu/en-ch/resource-library/prospectus-and-regulatory-reports

Some of the sub-funds referred to in this document may not have not been registered with the Swiss Financial Market Supervisory Authority (“FINMA”). In Switzerland, such sub-funds that have not been registered with FINMA shall be distributed exclusively to qualified investors, as defined in the Swiss Federal Act on Collective Investment Schemes or its implementing ordinance (each, as amended from time to time). The representative and paying agent of the sub-funds in Switzerland is Société Générale Paris, Zurich Branch, Talacker 50, PO Box 5070, 8021 Zurich, Switzerland. The prospectus, the key investor information documents (KIID), the articles of association and the annual and semi-annual reports of the sub-funds are available free of charge from the representative and paying agent. As regards distribution in Switzerland, the place of jurisdiction and performance is at the registered seat of the representative and paying agent.

For Investors in France

The information in this document is intended exclusively for professional investors (as defined under the MiFID) investing for their own account and this material may not in any way be distributed to the public. The distribution of the Prospectus and the offering, sale and delivery of Shares in other jurisdictions may be restricted by law. WT Issuer is a UCITS governed by Irish legislation, and approved by the Financial Regulatory as UCITS compliant with European regulations although may not have to comply with the same rules as those applicable to a similar product approved in France. The Fund has been registered for marketing in France by the Financial Markets Authority (Autorité des Marchés Financiers) and may be distributed to investors in France. Copies of all documents (i.e. the Prospectus, the Key Investor Information Document, any supplements or addenda thereto, the latest annual reports and the memorandum of incorporation and articles of association) are available in France, free of charge at the French centralizing agent, Societe Generale (EPA:SOGN) at 29, Boulevard Haussmann, 75009, Paris, France. Any subscription for Shares of the Fund will be made on the basis of the terms of the prospectus and any supplements or addenda thereto.

For Investors in Malta

This document does not constitute or form part of any offer or invitation to the public to subscribe for or purchase shares in the Fund and shall not be construed as such and no person other than the person to whom this document has been addressed or delivered shall be eligible to subscribe for or purchase shares in the Fund. Shares in the Fund will not in any event be marketed to the public in Malta without the prior authorisation of the Maltese Financial Services Authority.

For Investors in Monaco

This communication is only intended for duly registered banks and/or licensed portfolio management companies in Monaco. This communication must not be sent to the public in Monaco.