Gold prices set for weekly gains on dovish Fed outlook; silver near record high

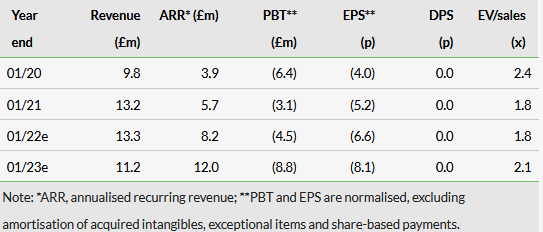

Checkit’s FY22 trading update confirmed it closed the year broadly in line with our revenue forecasts and, due to several contracts signed close to year end, beat our annualised recurring revenue (ARR) forecast with 44% y-o-y growth to £8.2m, versus our £7.6m forecast. We maintain our estimates for FY22 and FY23, noting the higher level of ARR at year-end supports our FY23 revenue growth forecast.

Share price performance

Business description

Checkit optimises the performance of people, processes and physical assets with its intelligent operations software. It is headquartered in Cambridge, UK, and has operations centres in Fleet, UK, and Tampa, US.

Revised reporting reflects shift to SaaS business

FY22 revenue of £13.3m (+1% y-o-y) was marginally ahead of our £13.2m forecast. Recurring revenue grew 33% y-o-y and non-recurring revenue declined 20%. As previously flagged, the company is transitioning to a pure SaaS model and in H222 significantly reduced the project work carried out by the BEMS division. Consequently, Checkit will no longer report across the Connect and BEMS divisions, instead disclosing revenue split by recurring/non-recurring. Recurring revenue made up 51% of FY22 revenue, rising to 75% of Q422 revenue. End FY22 cash stood at £24.2m, marginally ahead of our £24.1m forecast.

ARR growth accelerates in Q422

Checkit reported ARR of £8.2m at the end of FY22 (+44% y-o-y, +24% h-o-h), ahead of our £7.6m forecast, as it benefited from several contract wins at the end of Q4. These had a minimal impact on FY22 recurring revenue but should support recurring revenue growth in FY23. We note the majority of the Grifols deal announced earlier this month will add to ARR in FY23. With detail on profitability due with FY22 results on 28 April, our forecasts are substantially unchanged.

Valuation: Recurring revenue growth the trigger

On an EV/sales multiple of 1.8x for FY22e and 2.1x for FY23e, Checkit trades at a significant discount to the UK software sector (4.9x current year sales, 4.0x next year sales) and US SaaS peers (12.7x current year, 9.8x next year sales). We note the multiple for the UK software sector is down c 10% and for US SaaS peers down c 20% since we wrote in December, reflecting the market shift from growth to value. If Checkit were to trade on the UK average for FY23e, it would be worth 63.5p per share, and moving to trade in line with US SaaS peers would imply a valuation of c 154p. Key triggers to help Checkit attract a multiple more in line with SaaS peers include evidence that customers are signing up to use its software, existing customers are expanding their usage and non-recurring revenues are being converted to subscription services. The company has already made a good start on all three of these metrics.

Click on the PDF below to read the full report: