This article was written exclusively for Investing.com

The reflation trade continues to remain the dominant theme in the markets. Investors have repeatedly shrugged off inflation and valuation concerns, as they keep buying the dips in stocks and other risk assets and sell the dollar dips. This has kept the EUR/USD on the front-foot ever since everything bottomed out in March 2020.

Although rates have threatened to break down here and there, the bulls have remained largely in control. The sellers have had many opportunities to exert real downward pressure on the EUR/USD in the past. Their inability or refusal to do so makes it very likely we could see a new 2021 high in the days ahead for this popular currency pair.

From a technical viewpoint, there is no doubt about the EUR/USD’s longer-term bullish trend.

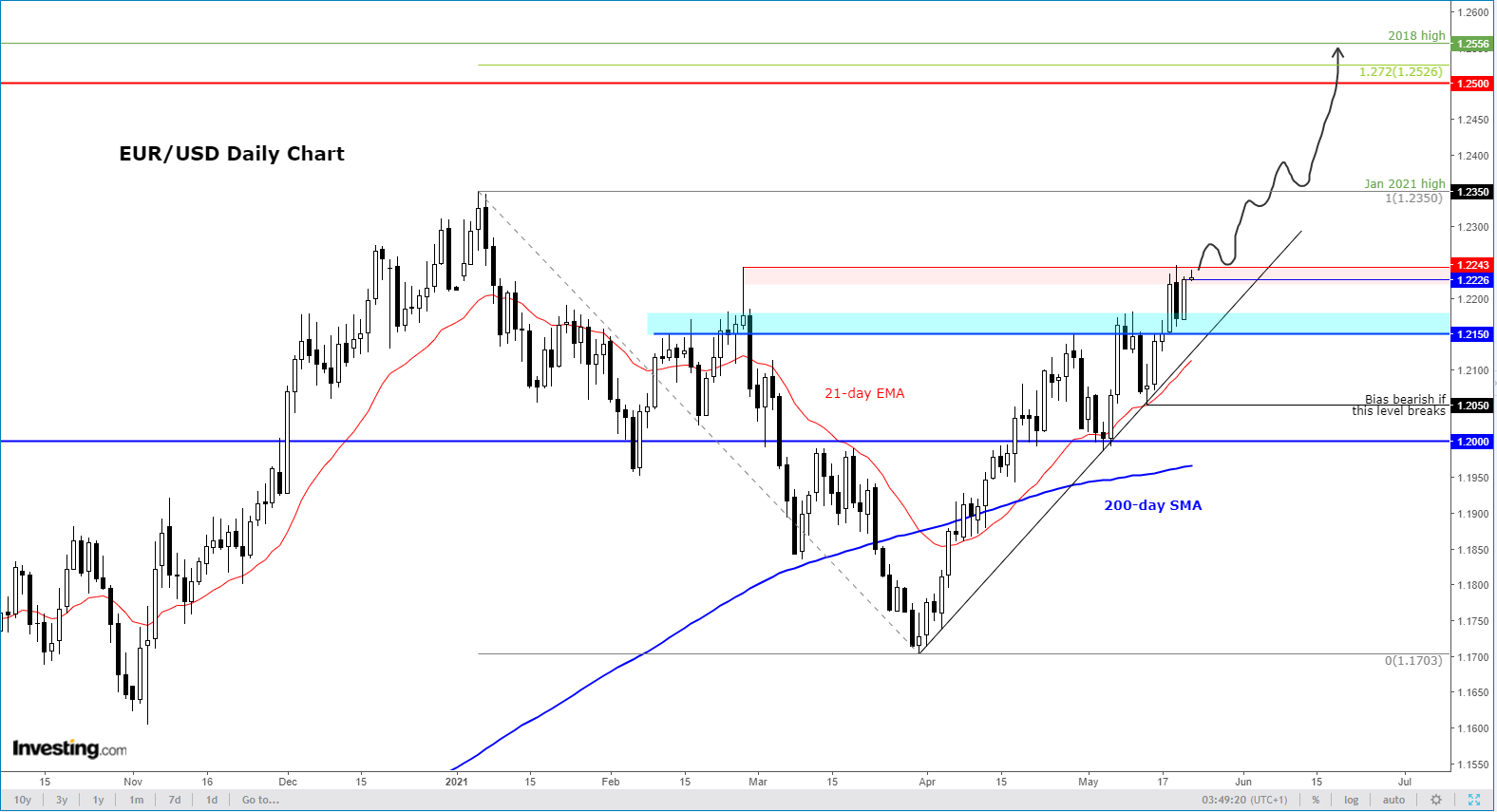

After it bottomed out in March 2020, the EUR/USD has been rising alongside other risk assets. But the rally has come to several halts, each time providing false hope for the bears. The lack of any real downside follow-through suggests the EUR/USD is gearing up for a breakout above this year’s earlier high at 1.2350 and possibly the peak of 1.2556 hit in 2018.

On the daily time frame, the EUR/USD has printed several higher highs and higher lows, in what has so far been a frustratingly-slow grind. The slow and steady progress has no doubt frustrated the sellers, alike. After printing bearish-looking price action on several occasions, the buyers have been quick to step in and push rates to a new incremental high, thus trapping the sellers.

The ongoing bullish resilience means the EUR/USD could be about to spike higher as more and more sellers are forced to abandon their bets, while the bulls grow in confidence. Already, the EUR/USD has taken out several key resistance levels, which have subsequently turned into support. The 1.2243 level could be next and if there is acceptance above this level then we may see price stage a quicker rally to take out the January high at 1.2350 next.

Conservative traders may wish to take advantage of the potential breakout by waiting for rates to take out 1.2243 cleanly and then look to buy any dips back towards that level, with the liquidity above 1.2350 being among the main objectives. Alternatively, traders who are happy to take a bit of risk may consider picking the EUR/USD before that potential breakout takes place. Meanwhile, the bears have very little reason to short the EUR/USD until such a time the structure of higher highs and higher lows break down.