Cyclical weakness in Carr’s Group’s Speciality Agriculture business has affected the company’s fortunes of late. However, the new management team, a strong net cash balance sheet and a record order book in the Engineering division offer optimism. Operational progress, particularly a reversal of fortunes in Speciality Agriculture, should rebuild confidence and a reduction in the current discount to our view of the underlying value.

FY23 results

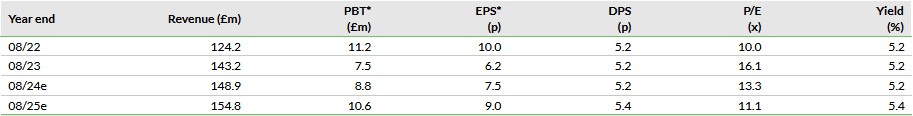

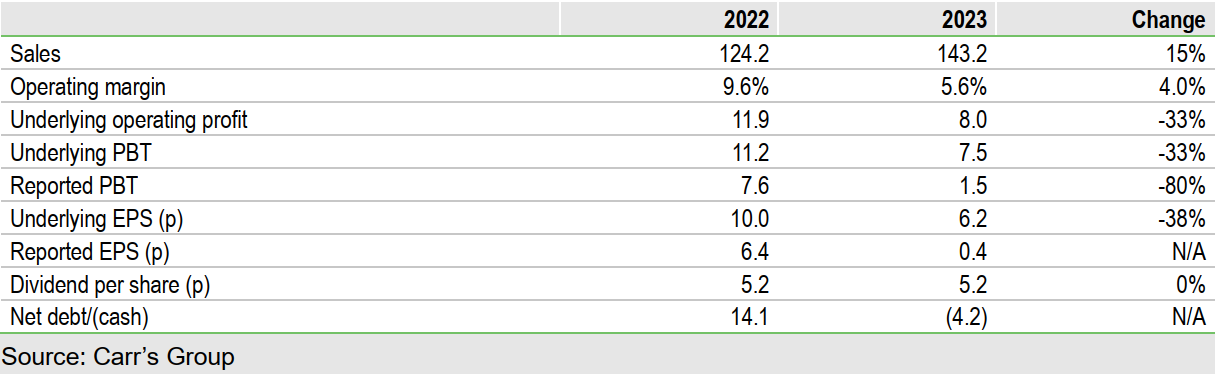

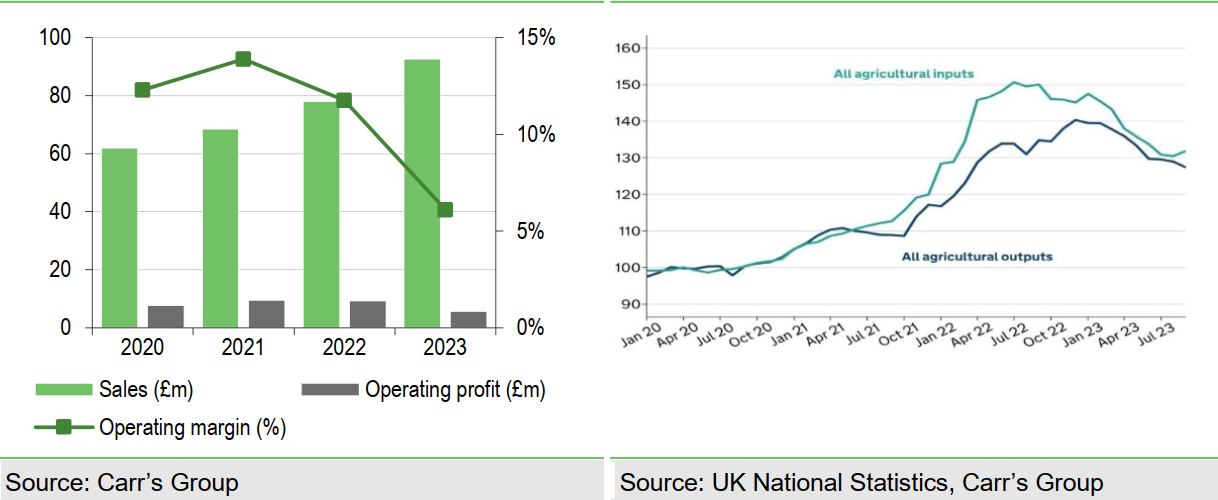

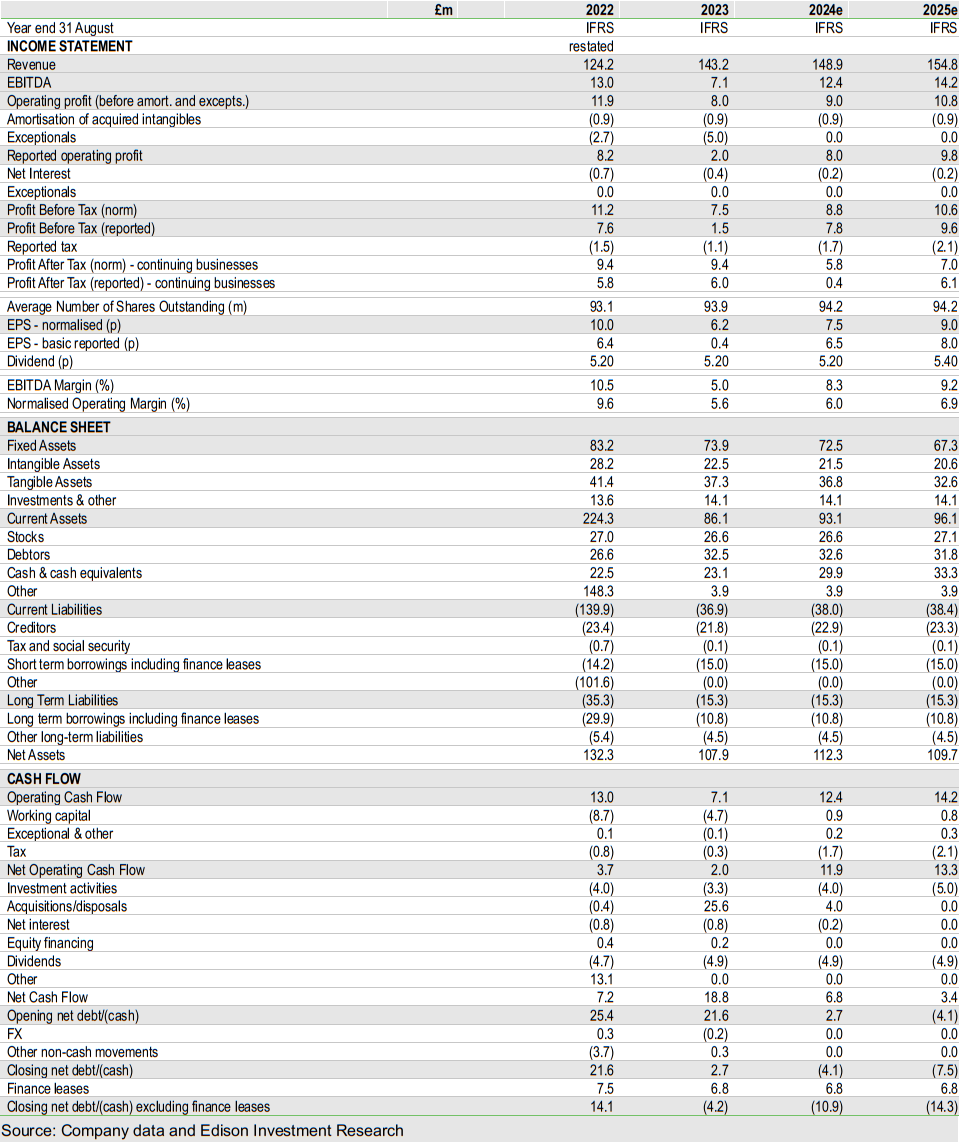

Sales increased 15% to £143m primarily due to strong positive pricing in the Speciality Agriculture division (sales +19%) although volumes were lower, while Engineering (sales +10%) benefited from a strong H2. Group operating margins declined 400bp to 5.6% primarily due to lower volumes in the Speciality Agriculture division, down 16%, and input price pressure, whereas Engineering profitability was broadly flat. Underlying PBT of £7.5m was 33% lower and underlying EPS of 6.2p declined 38%. The dividend was held at 5.2p. The balance sheet improved to net cash of £4.2m, primarily due to the disposal of the Agricultural Supplies division. A further £4m of deferred consideration has been received since the year end.

Outlook and forecasts

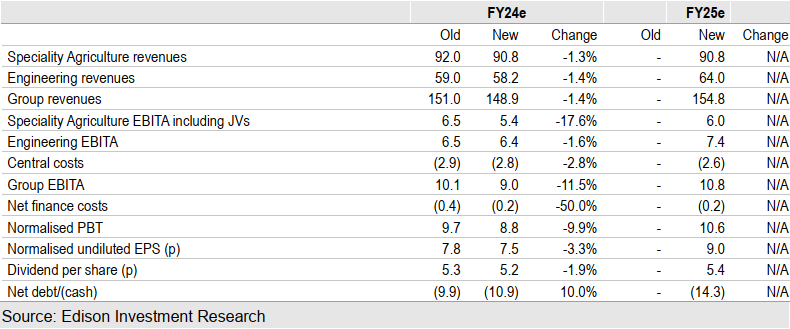

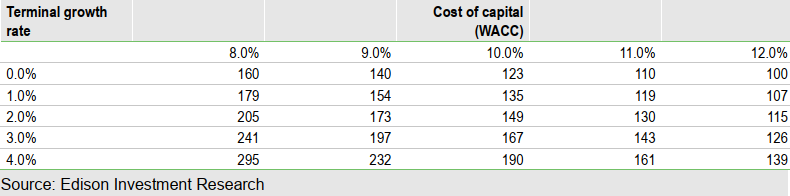

The Engineering division has a record order book (£60m) and c 85% cover for the current year, underpinning expectations of good progress. Speciality Agriculture had an improved first quarter of FY24 with UK volumes up 20%. However, cost pressures remain, which suggests a prudent view is needed. To reflect this, we have reduced our FY24 forecasts (PBT £9.7m to £8.8m -9.9%, EPS 7.8p to 7.5p 3.5%, DPS 5.3p to 5.2p -1.9%) and introduced estimates for FY25 (PBT £10.6m, EPS 9.0p, DPS 5.4p).

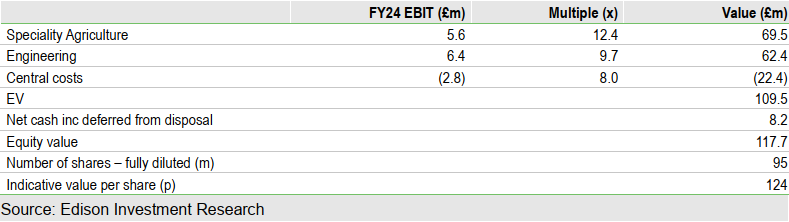

Valuation: Speciality Agriculture remains key

Our discounted cashflow valuation (DCF) is 149p per share, while our peer group derived sum-of-the-parts (SOTP) is lower at 124p. This reflects the current weakness in the Speciality Agriculture business and the short-term profitability metric used within our SOTP valuation. We believe our DCF valuation is more reflective of the true underlying value of Carr’s. This discrepancy also highlights what we see as the key catalyst to value appreciation, the performance of the Speciality Agriculture division, which was also a clear driver of the shares’ underperformance in 2023.

Full-year results

Overview

Sales increased 15% due to positive pricing in the Speciality Agriculture and a strong H2 in Engineering. Margins declined 400bp, primarily due to softness in volumes and cost pressures in the Speciality Agriculture division, leading to a 33% decline in underlying EBIT and PBT. Reported PBT included amortisation of intangibles of £0.9m, restructuring and cloud configuration/customisation costs of £1.2m and goodwill and intangible impairment of £3.8m. The full-year dividend was held at 5.2p. The balance sheet improved to a net cash position, due to receipt of the majority of the proceeds from the sale of the Agricultural Supplies division.

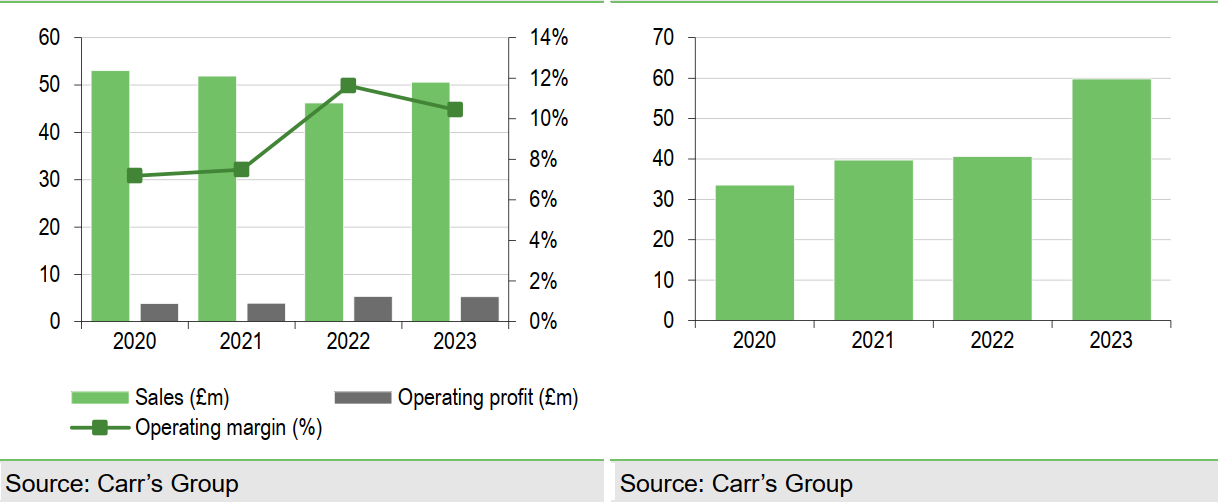

Engineering division

Sales increased 9.6% although profits declined 1.5% to £5.3m due primarily to the mix of business, with fabrication and precision engineering strong, up 16%, while robotics sales were weaker. The business had a particularly strong H2 when profits were 24% higher and the order intake increased to a record £59.8m, up 47%. While the order book includes multi-year contracts such as the £10m contract for the UK’s National Nuclear Laboratory, it provides a very healthy c 85% coverage for expected FY24 sales.

Speciality Agriculture division

Sales increased 19% due to strong pricing, with the average feed block pricing up 21%, while volumes declined 16%. In the UK, farmers reacted to wide-ranging cost inflation (in diesel, fertiliser etc) and used warmer weather to extend outdoor grazing to reduce the requirement for feed blocks, while the US business continued to suffer from a reduced calf headcount of up to 40% due to prolonged drought conditions. Margins declined by 570bp as a result of the lower volumes and input cost pressures. A new management team is largely in place, targeted to deliver improved performance. The first three months of FY24 have seen volumes in the UK up 20%. With agriculture costs and input prices appearing to have peaked, this provides a reason to be cautiously optimistic for FY24.

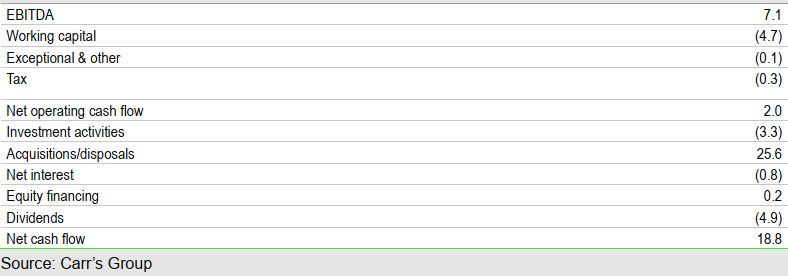

Cash flow

Operating cash inflow of £2.0m reflected lower profitability and £4.7m of working capital outflow due to increased inventories for the Speciality Agriculture division and increased receivables reflecting the strong second half in Engineering. Receipt of the disposal funds left the group with net cash of £4.2m, up from net debt of £14.1m at the end of FY22. The cash balance has been enhanced since the year end by receipt of a further £4m of deferred consideration.

Outlook

The new financial year has started positively. The strong order book in Engineering (£60m) provides 85% cover for the year, with margins expected to benefit from additional volume and mix towards the higher value-added robotics activities. Speciality Agriculture had an improved Q1 in the UK with volumes up 20%. With management expecting a more normal seasonal pattern, that is, no repeat of the losses in H2, and cost pressures in agriculture abating the fundamentals point to an improved performance. However, this starts from a low point given the difficult H2, which suggests there should be a degree of caution.

Forecasts

We have reduced our FY24 forecasts to reflect a shallower recovery profile in the Speciality Agriculture business, but we note the positive start to the current financial year. We have also introduced forecasts for FY25.

Strategy and management changes

Strategy

After the disposal of the Agricultural Supplies business, the focus is now on operational improvements and growth in the core Engineering and Speciality Agriculture divisions. In Engineering, this involves contract execution and addressing growth opportunities. In Speciality Agriculture, the focus is on returning to previous operating margins (FY21 operating margin ex JVs 12.4% versus FY23 4.5%) through both internal actions and leveraging the business’s strong brands in the market to promote volumes and pricing. These actions are supported by new management, including a new position of group transformation officer, and a new team in the UK Speciality Agriculture business. We expect to hear further details of the actions being undertaken in due course.

Management changes

The board and executive management have been refreshed since the strategic review and disposal of the Agricultural Supplies division. The key appointments over the last year have been:

- Non-executive chair. Tim Jones joined the board as chair in February 2023.

- Non-executive director and senior independent director. Gillian Watson joined as NED in October 2023, subsequently taking over the role of senior independent director.

- Chief executive. David White was appointed in November 2023, having joined the group as CFO in January 2023.

- Chief financial officer. Gavin Manson joined the group as CFO in November 2023 in a nonboard position.

- Executive director of transformation. Martin Rowland was appointed in November 2023 having been a non-executive director since March 2023.

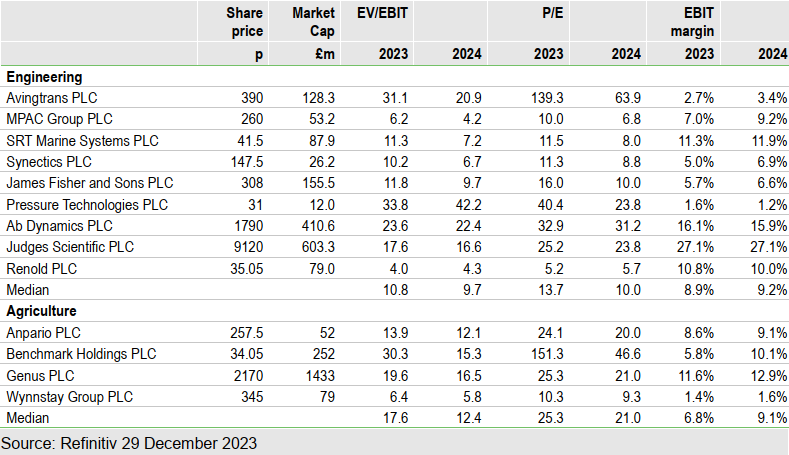

Valuation

The different operating profile of the two divisions provides an added complexity to valuing the group, particularly from a relative peer group perspective. Hence, we use an ‘activity agnostic’ discounted cashflow valuation alongside a peer group valuation that considers the two activities separately.

Discounted cashflow

Our DCF is based on a five-year forecast cash flow and terminal valuation. Exhibit 8 shows our DCF valuation per share relative to two key variables: the cost of capital (WACC) and terminal growth rate assumptions. Using a 10% WACC, relatively high due to the positive cash position, and a 2.0% terminal growth rate gives an indicative value of 149p per share.

Peer group comparison

Our peer group valuation considers the two divisions separately before combining them to generate an overall valuation for the group. The valuation is based on EV/EBIT multiples to ensure there is no impact from the financial structure of the peers.

Overall

Both methodologies suggest a valuation above the current share price. We also note that the DCF valuation is somewhat higher than the SOTP. This reflects the current weak performance in the Speciality Agriculture business. This hinders the SOTP valuation, which is based on short-term profitability, whereas the DCF longer-term valuation takes into account the expected recovery to historic levels of profitability. Hence, we see our DCF valuation as more reflective of the group’s inherent value.

—

General disclaimer and copyright

This report has been commissioned by Carr’s Group and prepared and issued by Edison, in consideration of a fee payable by Carr’s Group. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom