Even before the news of the Omicron variant of COVID-19 emerged, Carnival Corporation (NYSE:CCL) was having a very difficult year. But the news sent the shares of the Miami-based leisure travel company which operates cruise ships under various brand names, even lower. The stock is now down almost 18% over the past 12 months.

The shares closed above $31 as recently as the start of June and remarkably the market now assesses that CCL’s value is lower than it was one year ago, when the CDC was urging Americans not to travel for the holidays and the first emergency use applications for COVID-19 vaccines were being approved by the FDA.

Source: Investing.com

At the start of this year the outlook for an economic recovery was improving. But, figuring out when, or even if, cruise lines might get back to a semblance of normalcy was almost impossible. Cruises may, in fact, be the industry that most depends on a return to something close to pre-COVID attitudes on travel.

In mid February, Carnival Corp's CEO Arnold Donald predicted “certainly by the end of this year, most, if not all, of our fleet, I’m optimistic, will be in action.”

At that time, the consensus among Wall Street analysts was far less rosy, with a consensus 12-month price target that was about 28% below the share price at that time.

On Feb. 23, 2021, CCL shares had gained 19.9% for the then YTD, suggesting an improving outlook in the equity market. The prices of options trading on CCL at that time told a very different story, however. By analyzing the prices of options on a stock, it is possible to calculate a probabilistic price forecast that is consistent with the options. This is referred to as the market-implied outlook. Back on Feb. 23, the market-implied outlook for CCL to early 2022 was incredibly bearish.

The price of an option on a stock reflects the options market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. The market-implied outlook is calculated by analyzing the prices of put and call options at a range of strike prices and the same expiration date. In the market-implied outlook for CCL in February, the peak-probability outcome to Jan. 21, 2022 was a price return of -46% and the expected annualized volatility was 82%.

Needless to say, with a strongly bearish view from Wall Street analysts and an even more bearish view from the market-implied outlook, it was not a tough decision to assign a bearish rating to CCL. With more than 9 months since my last post on CCL, and with the share price having fallen more than 31% over this period, I am revisiting my analysis.

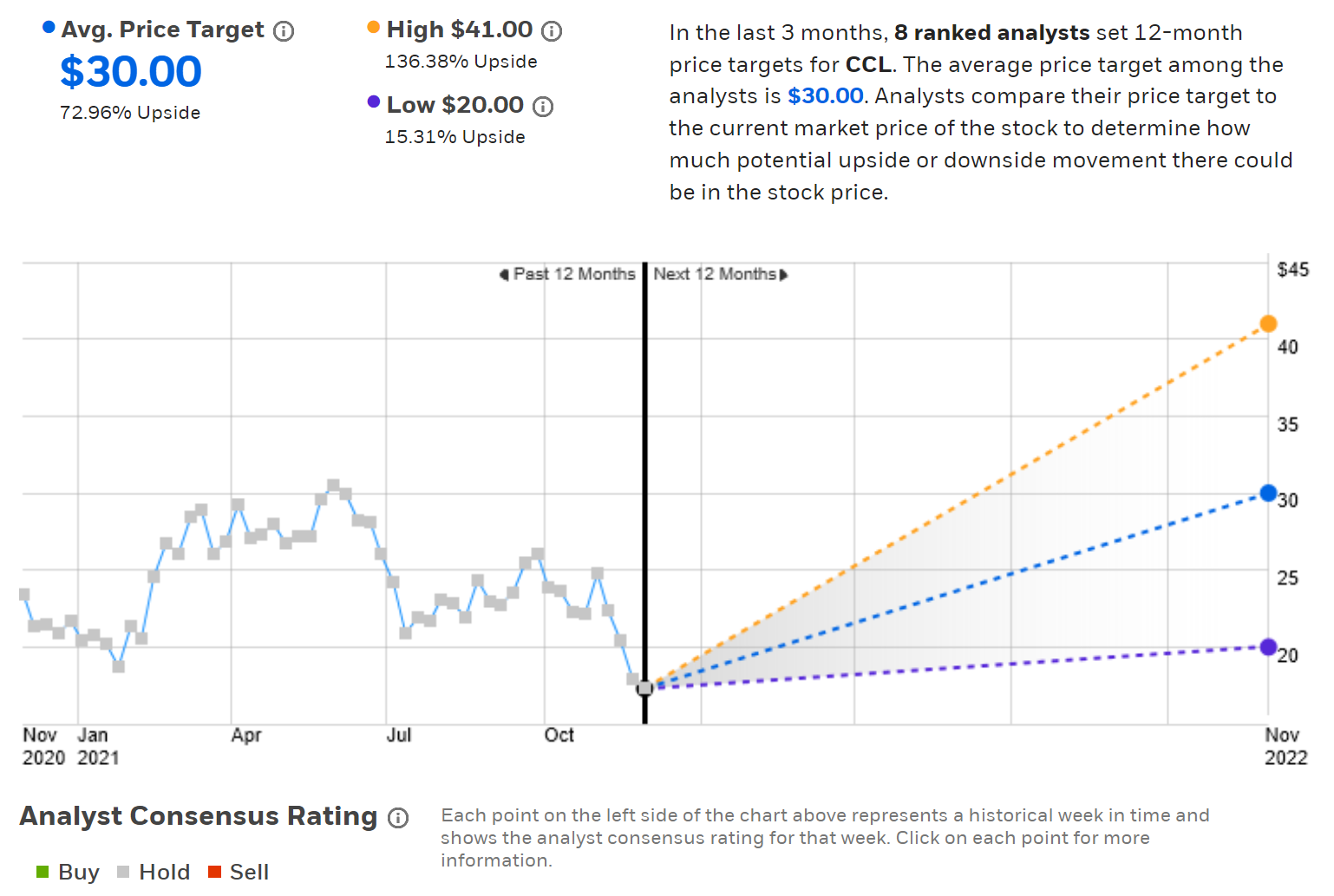

Wall Street Analyst Consensus Outlook for CCL

E-Trade calculates the Wall Street consensus outlook for CCL by combining the views of 8 ranked analysts who have published ratings and price targets over the past 90 days. At the time of writing on Dec. 1, the shares were trading at $17.30 and the consensus rating is neutral. The consensus price target is offering 72.96% upside while the lowest 12-month price target is offering 15.3%. Of the 8 analysts in E-Trade’s consensus cohort, 3 rate CCL as a buy, 4 as a hold, and only one has a sell rating.

Source: E-Trade

I find it somewhat concerning when the qualitative rating on a stock seems inconsistent with the 12-month price target and this is the case with CCL. A stock with an expected 12-month gain of 73% would seem like a good bet so I’d expect the consensus rating to be bullish. This apparent disconnect can be explained if the analysts feel that the risks are so high that even the high expected return does not justify a buy rating.

The Wall Street consensus price target tends to have predictive value as long as the dispersion among the individual price targets is not too high. In this case, the spread between the price targets is substantial. The highest price target is more than twice the lowest price target. As such, I don’t have much confidence in the consensus price target.

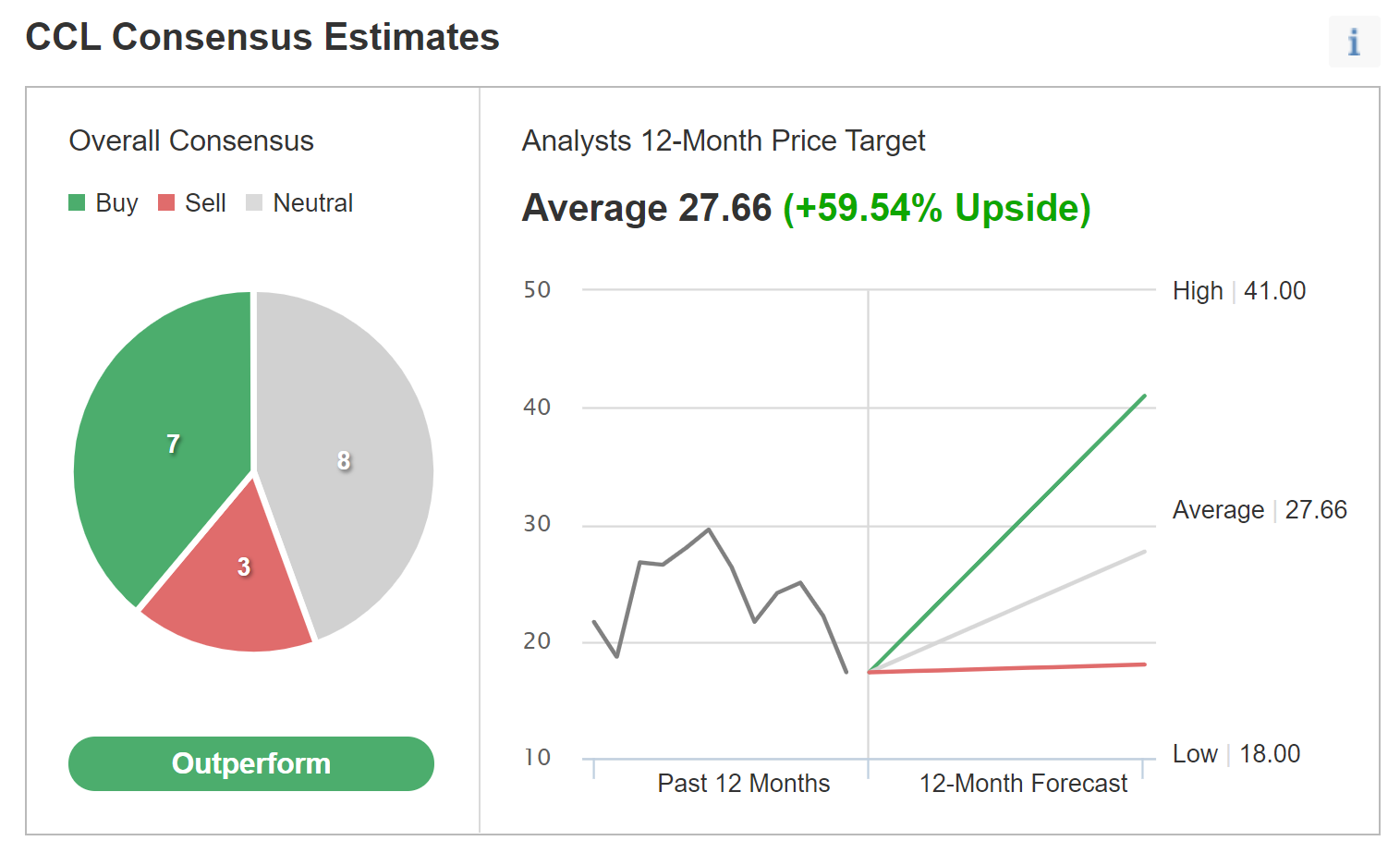

Investing.com’s version of the Wall Street consensus is based on ratings and price targets from 18 analysts. The consensus rating on CCL at a price of $17.30 is bullish and the consensus 12-month price target is 59.5% above the current share price.

Source: Investing.com

The Wall Street consensus outlook for CCL has improved dramatically since February. Back then, the consensus 12-month price target was about $19.50, as compared to $28.8 today (averaging the Investing.com and E-Trade values). CCL’s decline, in conjunction with the higher price targets, results in the massive 12-month expected returns in the current consensus outlooks.

One potential shortcoming in using the Wall Street consensus as guidance is that news may have emerged since an opinion was rendered and one or more analysts may not have had time to update their views.

In other words, the analyst opinions may be out of date. Certainly this is a concern with the recency of the Omicron variant’s emergence. In addition, the high dispersion among the individual analysts is important to consider.

Market-Implied Outlook for CCL

I have analyzed options on CCL expiring on Mar. 18, 2022 to calculate the 3.6-month market-implied outlook (from now until that expiration date). I have also calculated the 6.5-month market-implied outlook for the period from now until June 17, 2021.

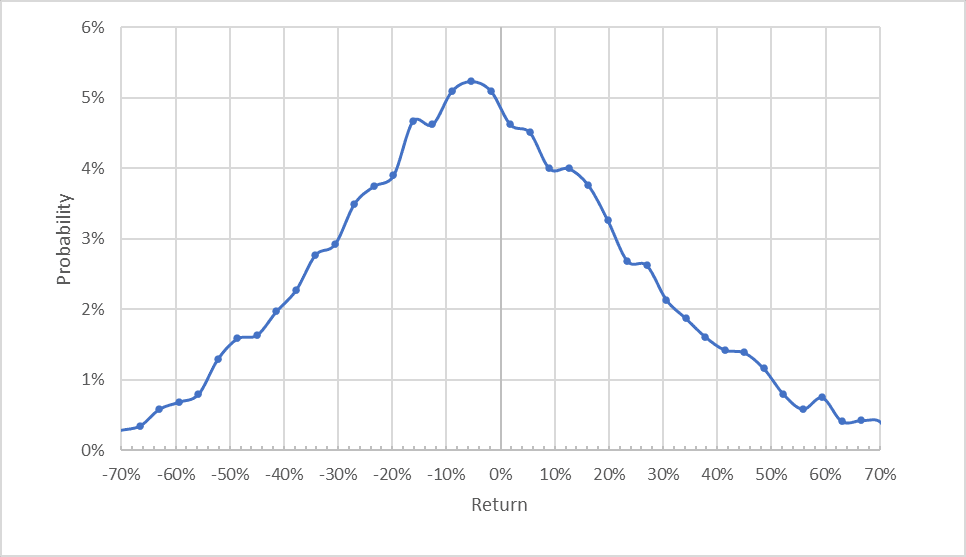

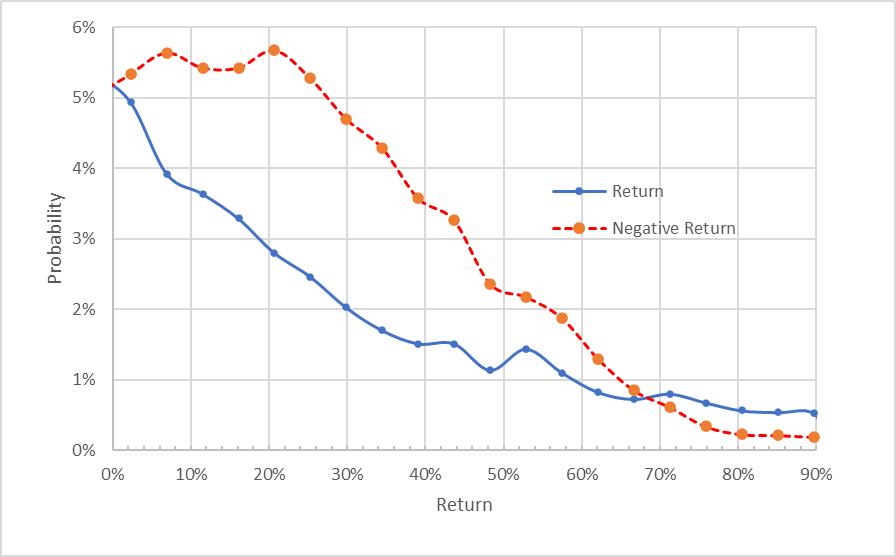

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied price return outlook for the next 3.6 months is fairly symmetric, but the peak probabilities are shifted to favor negative returns over this period. The maximum-probability outcome is a price return of -5.4% over this period. The annualized volatility calculated from this distribution is 67%. The estimated worst 1-in-5 outcomes over the next 3.6 months (the 20th percentile) is a loss of -27% or worse.

To make it easier to directly compare the probabilities of positive and negative return, I rotate the negative return side of the distribution about the vertical axis (see chart below).

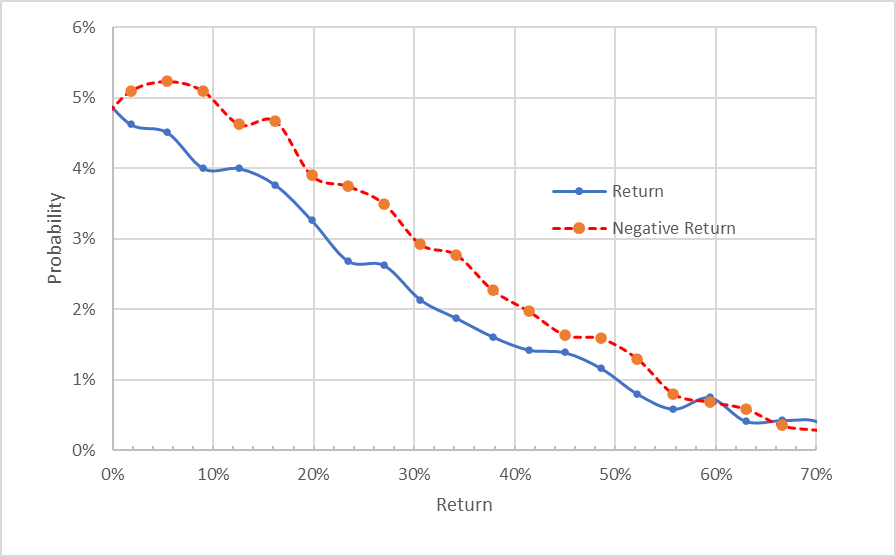

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

With this view, it is evident that the probabilities of negative returns are consistently higher than for positive returns of the same magnitude (the dashed red line is above the solid blue line over most of the chart). This is a slightly bearish outlook for CCL for the next 3.6 months.

Looking out to the middle of 2022, using prices of options that expire on June 17, 2022, the 6.5-month outlook is strongly bearish. The peak probability corresponds to a price return of -20.7% over this period and the probabilities of negative returns are substantially and consistently higher than for positive returns of the same magnitude. The annualized volatility calculated from this distribution is 60%.

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

Summary

Carnival Corp. faces continuing hardship and uncertainty as the world contemplates the potential impact of the Omicron COVID-19 variant. The Wall Street analyst consensus is neutral or bullish and the consensus 12-month price targets for CCL are in the range of 60%-70% above the current share price.

The Wall Street consensus suggests that the shares are substantially oversold, even in light of the difficult environment. The high dispersion among the individual analyst price targets leads me to discount the consensus for gains.

The market-implied outlook, which reflects the consensus views of buyers and sellers of options, is modestly bearish between now and the middle of March, becoming substantially more bearish by the middle of the year.

The expected volatility is quite high, as would be expected. Considering the enormous uncertainties in trying to predict CCL’s path forward, along with the disagreements between the Wall Street consensus outlook and the market-implied outlook, I am maintaining my bearish outlook on CCL.