Cardano (ADA): A scientifically based approach and sustainable blockchain

Cardano is a blockchain platform based on a scientific approach and developed by Charles Hoskinson, a co-founder of Ethereum. The platform relies on the innovative Ouroboros mechanism, a proof-of-stake (PoS) protocol that is energy-efficient and environmentally friendly. Cardano stands out for the following reasons:

- Scientific methodology: the blockchain is based on rigorous research and peer review, making it particularly robust and secure.

- Whales and institutional interest: major investors (‘whales’) and institutions are currently considering ADA and accumulating holdings. This indicates a high level of confidence in the long-term relevance and value enhancement of the platform.

- Scalability and environmental friendliness: PoS makes Cardano perceived as sustainable, which appeals to institutional investors who are looking for environmentally friendly technologies.

- Long-term vision: Cardano aims to provide global financial solutions and promote decentralised applications while maintaining a focus on scalability and interoperability.

Solana (SOL): Maximum scalability and innovative technology

Solana was founded in 2017 by Anatoly Yakovenko and relies on groundbreaking technical innovations to provide fast and cost-effective blockchain infrastructure. At the core of Solana is Proof of History (PoH), a technology that documents the sequence of transactions more efficiently. Key features of Solana are:

- Proof of History: PoH organises transactions efficiently, enabling Solana to perform at up to 50,000 transactions per second – significantly more than most other blockchains.

- Cost efficiency: With average transaction fees of just $0.00025 and block times of less than a second, Solana offers an unbeatable combination of speed and low costs.

- Scalability without sharding: Thanks to its architecture, Solana does not need layer-2 solutions or shards, which simplifies integration and development on the network.

- Developer-friendly: Programming is possible in common languages such as C, C++ and Rust, making the platform attractive for developers.

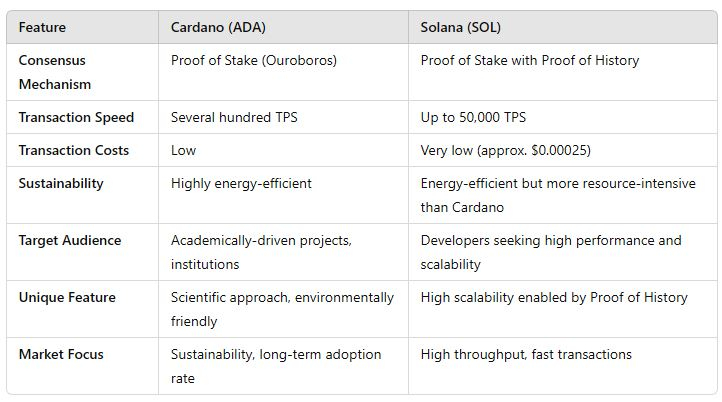

Comparison: Cardano vs. Solana

Conclusion

Cardano focuses on sustainability, scientific innovation and a long-term approach. It is particularly valued by investors who are looking for stability and environmentally friendly technologies.

Solana impresses with its speed, low costs and developer-friendliness, which makes it ideal for highly scalable applications.

Both platforms are leaders in their respective niches and aim to advance blockchain technology in unique ways. Which project will prevail depends heavily on the specific requirements of users and investors.

And which token has the greater potential?

Both cryptocurrencies look extremely bullish in the chart. However, they differ considerably in some details. If you want to invest in both coins, you should now know exactly what to expect in the short term, because the right timing is crucial for success.

In the following two charts, we compare the two tokens.

As we can see from the charts, Cardano has the higher potential because this coin entered the bull market significantly later. But both are extremely bullish overall.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.