The financial markets were relatively quiet last week. US equities extended recent up trends with DJIA, S&P 500 making new record highs, but momentum were quiet unconvincing. Strength, however, was apparent in FTSE 100 which surged through 6900 handle on optimism from BoE easing. Another important development to note is the renewed buying in oil, with WTI back at 44.5. Gold on the other hand, continued to struggle to find direction and stayed range bound. In the currency market, Canadian dollar ended as the strongest major currency for the week as boosted by oil price and more could come ahead. Kiwi followed as the second strongest one in spite of a dovish RBNZ rate cut. Meanwhile, Sterling was the weakest major currency, followed by Dollar.

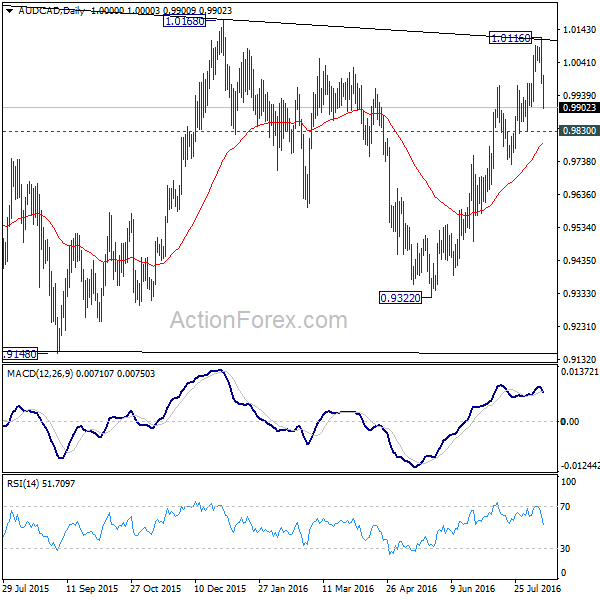

Strengths in stocks and oil are giving room for some more strength in commodity currencies in near term. And, the Canadian dollar might have an upper hand. The strong rejection from long term trend line resistance in AUD/CAD argues that a short term top could be in place at 1.0116. focus will turn back to 0.9830 support this week. Break there will indicate completion of the rise from 0.9322. As the cross is staying in the long term sideway pattern from 0.9169, in that case, AUD/CAD could head back to lower side of the range at 0.9148/0.9322.

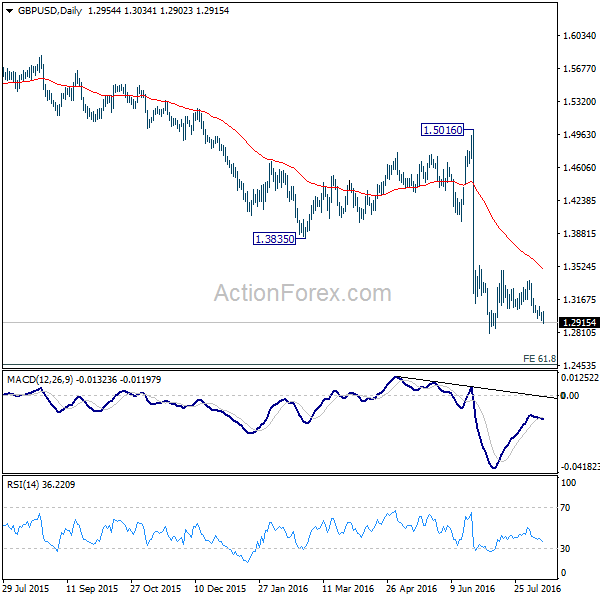

Meanwhile, Sterling's weakness will likely persist and there is prospect of downside acceleration. EUR/GBP took the leg by taking out 0.8626 resistance last week to resume the medium term rise from 0.6935. Downside momentum in GBP/USD and GBP/JPY are not too convincing for the momentum. But both pair will likely test recent low at 1.2794 and 128.66 soon. Break of these levels will trigger broad based selling in the pound to resume the post Brexit down trend.

Dollar, on the other hand, will look into FOMC minutes for direction this week. Even though Fed officials tried to maintain the chance of a Fed hike by the end of the year, markets are not buying these Fedspeaks yet. Fed fund futures are pricing in, most of the time, less than 50% chance of a hike by December. Markets will look into the minutes for Fed officials' views and discussion over the outlook of the economy. Overall assessment on labor markets and the economy could be upgraded. But the wouldn't be any change to inflation outlook. And baring any real hawkish surprise, dollar would possibly stay soft after the minutes.

Regarding trading strategy, we're staying short in our GBP/JPY, entered at 135.25. Stops will be lowered to 134.00 with first target at 128.66. After touching 128.66, we will tighten up the stop and lower it to 132.50 to lock in some more profits and see if there will be any breakout to resume the larger down trend from 195.86.