Wall Street went down yesterday

Tuesday has been a negative day for the US stock market.

All three major US indexes closed in a loss.

The S&P 500 finished at -0.47%, the Nasdaq closed at -0.16% and the Dow Jones closed the trading session with a loss of 0.72%.

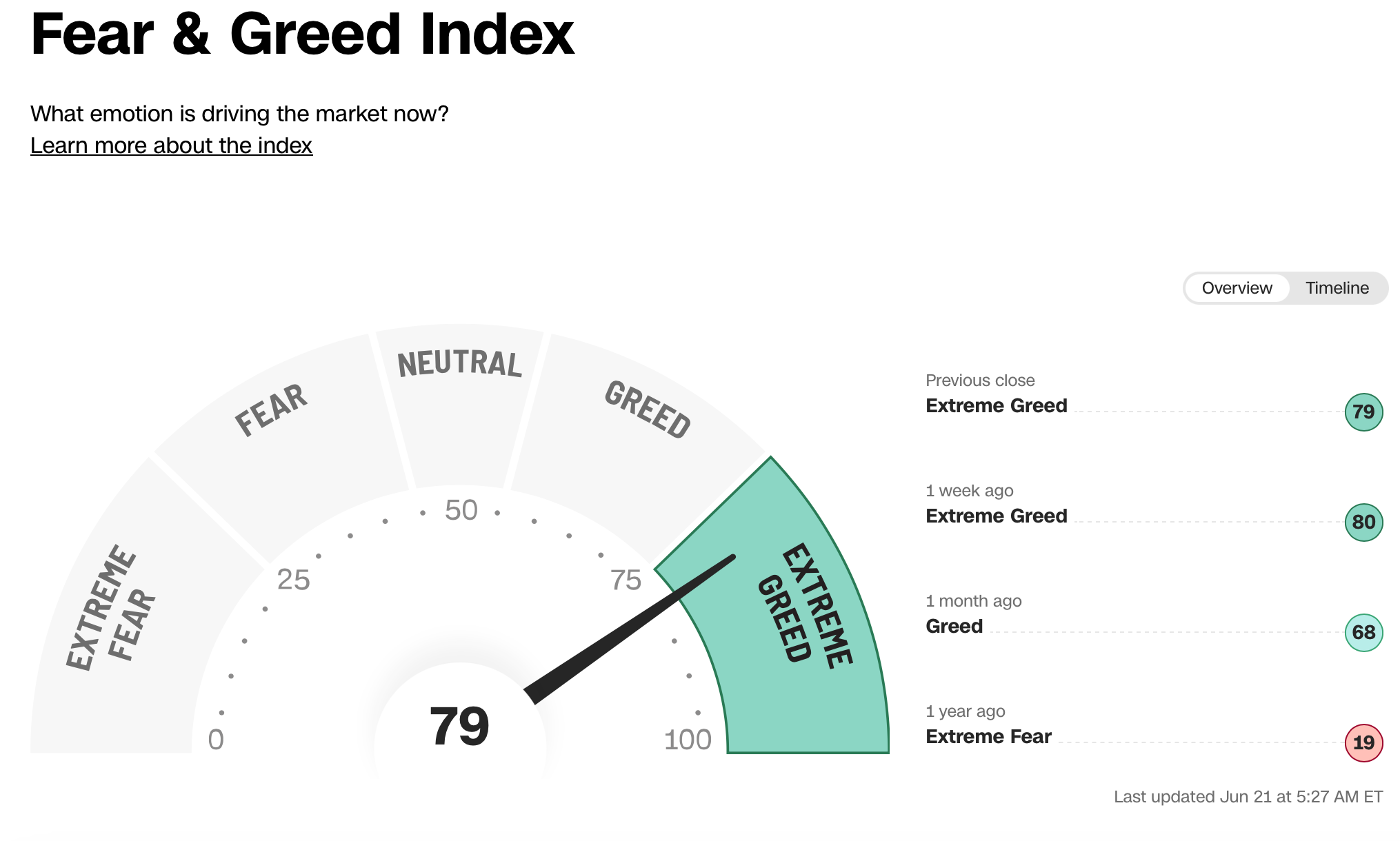

The investors' sentiment remains in Extreme Greed, as indicated in the graph below:

Sentiment indicator - Fear & Greed Index

The market sentiment is 79, in “Extreme Greed” mode, the same level as yesterday's reading.

Bullish sentiment

Investors are bullish and, thanks to their buying, the financial markets are rallying.

FOMO is partially responsible for the recent rally, but the main reason why investors are continuing to buy stocks is the enthusiasm around Artificial Intelligence.

Companies like Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Tesla, Meta and Nvidia are traders' favourites because of their effort to invest in AI, which is believed to change our lives in the near future.

As a contrarian signal, however, such a high level of positive sentiment is the prelude to a market decline.

US economic data are strong: the report regarding the housing market released yesterday has shown a better-than-expected number, despite the Federal Reserve's effort to cool down inflation (and the economy) by raising interest rates.

What to watch today

All eyes are on Jerome Powell, the Federal Reserve President, who will visit Capitol Hill today.

He will deliver his statement regarding the economic outlook and the recent monetary policy actions to the House Financial Services Committee and the Senate Banking Committee.

Financial markets could be volatile today.

Follow me

If you find my analysis useful, and you want to receive updates when I publish them in real-time, click on the FOLLOW button on my profile!

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bullish sentiment and FOMO are driving the markets

Published 21/06/2023, 11:51

Bullish sentiment and FOMO are driving the markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.