The Pound Sterling has skyrocketed against the USD recently. Early in a new summer month, GBP/USD is trading at 1.2180; investors have a positive attitude.

This week, the Bank of England is scheduled to have another meeting, which is expected to attract a lot of attention. Current market expectations imply a 50-point rate hike. It’s very interesting to find out what the regulator decides on selling bonds, but the decision may well not have been made yet.

If everything turns out to be just the way it is expected, investors are highly likely to continue buying the Pound. The rate hike really seems quite moderate, so there shouldn’t be any risks here. However, it is worth mentioning that the British currency is now facing huge pressure from the “greenback” and may experience significant fluctuations depending on the movement of the American currency.

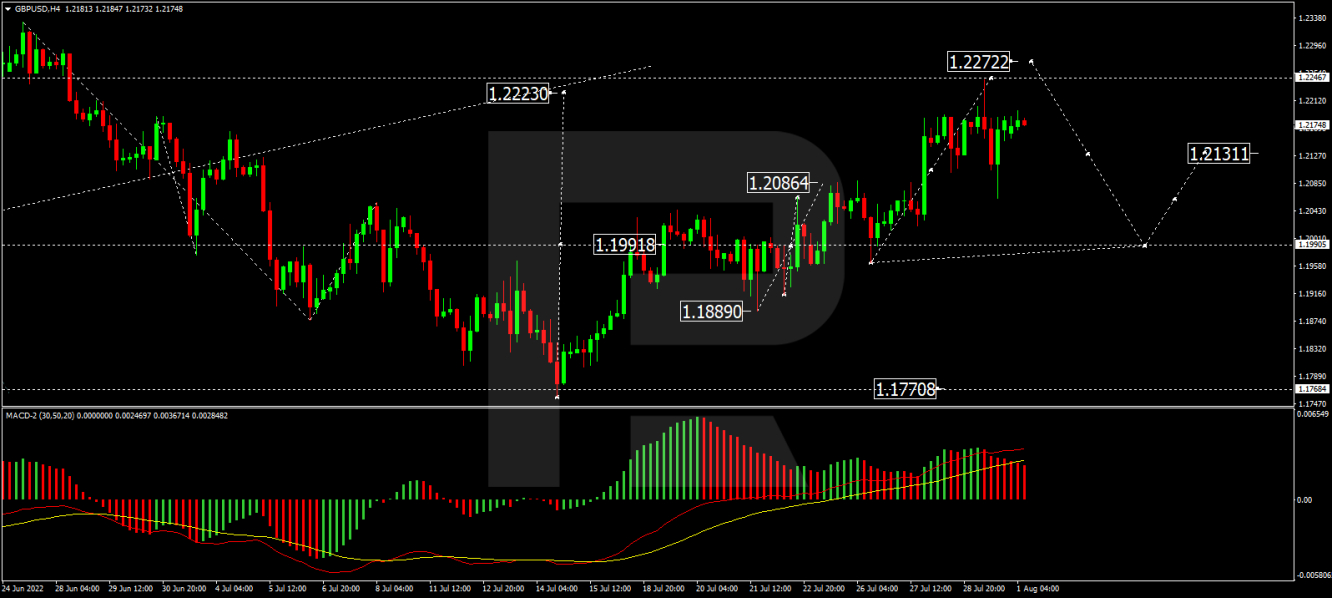

As we can see in the H4 chart, after finishing the ascending impulse with the target at 1.2222, GBP/USD is expected to correct down to 1.1990, thus forming a new consolidation range between these two levels. If later the price breaks the range to the upside, the market may resume trading upwards to reach 1.2500; if to the downside – start a new wave within the downtrend towards 1.1500. From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is moving close to the highs and may resume falling to reach 0 soon.

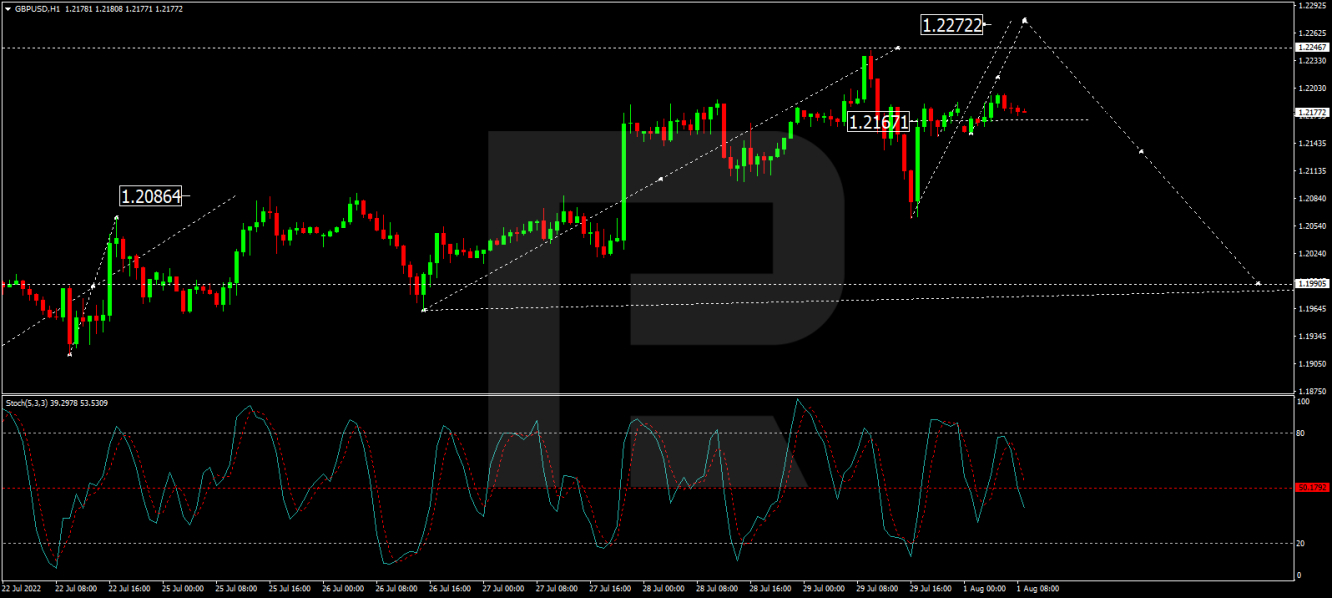

In the H1 chart, having completed the ascending wave at 1.2233 along with the descending impulse towards 1.2066, GBP/USD has finished the correction up to 1.2166; right now, it is forming a new consolidation range around the latter level. Possibly, the pair may expand the range up to 1.2272 and then form a new descending structure with the target at 1.1990. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: after breaking 80, its signal line is falling to break and may later continue moving to reach 20.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.