It has begun. Campaigning for the Brexit 'remain' or 'leave' vote has officially started and has opened up a huge door for fortunes to be made or lost. While the incumbent UK government has spent hardworking tax payers money on their nationwide 'remain' campaign (so much for democracy), Donald Trump's lookalike Mr Boris Johnson has thrown the race wide open backing the 'leave' campaign. Clearly politics are in play here and we'll let the supposed, elite Etonians, battle it on the school playground. In the mean time the rest of us hardworking folk need to get down to business and figure out how we're going to play the crazy volatility that's potentially in store for us in the coming months.

When Is The Referendum And What Will It Mean?

The referendum is set for 23 June and even though most of the FTSE 100 bosses believe Britain is better off in the EU, the overall market has been brushing it off rallying from a low of 5500 in Feb to a high of 6410 as I write, in April. Whilst the British Pound has crashed on the uncertainty investors are still trying to figure out what the ramifications will be for UK businesses. We're in very uncertain times and it really is a leap into the unknown!

Typically all global stock markets are quite highly correlated meaning they generally move up or down together (FTSE, DAX, DOW, etc) unless there is a significant event on the horizon -- which there is now. The word on the street from a few special brokers is that this correlation is about to break down -- a very rare occurrence. In fact the correlation has only broken four times in sixteen years -- the year 2000 dot-com burst, the foot and mouth crisis of 2001, the terrorist attacks in London in 2005 and the Scottish independence vote of 2014.

Why Is It Important?

Everything will be affected as Europe is the UK's largest trading partner, so a vote does pose many questions and problems. Trading barriers, immigration, visas, investments, tax, debts the list goes on and on. In fact, nearly 14% of the revenue from 300 of the UK's largest companies come from the EU. And while many believe that a vote to 'leave' would stop immigration, it is immigration that has helped contribute over 5% to UK GDP since 2004. I'm sure 'immigration' will be a hot topic for the 'leave' campaign as it's a sensitive issue for many Brits. In fact, expect many pain points to be attacked in the coming months.

How Should We Play This?

AFTER the event: Let's face it we don't know which way the vote will go or the market. However, the market will be moving in accordance with every new poll released so expect a volatile time ahead. We can also use the current market action to forecast the likely effect after the votes are counted. If the UK choose to stay in the EU it's probable the British pound and UK stocks will rally on the news, as uncertainty and fear will be lifted from investors' minds. If they choose to exit the EU then it's probably that the British Pound and UK stocks will fall hard on the news as uncertainty and the fear of the unknown remains. So that's a great play AFTER the event! How about before?

BEFORE The Event

Regardless of whether the UK leave the EU or not there are some companies whose fundamentals still remain positive and have zero exposure to the EU in terms of revenue. It's true that most stocks will get caught in all the volatility but some will recover quickly and stay resilient during all the turmoil up to June.

Seven Hot Markets That Have Potential For Explosive Moves

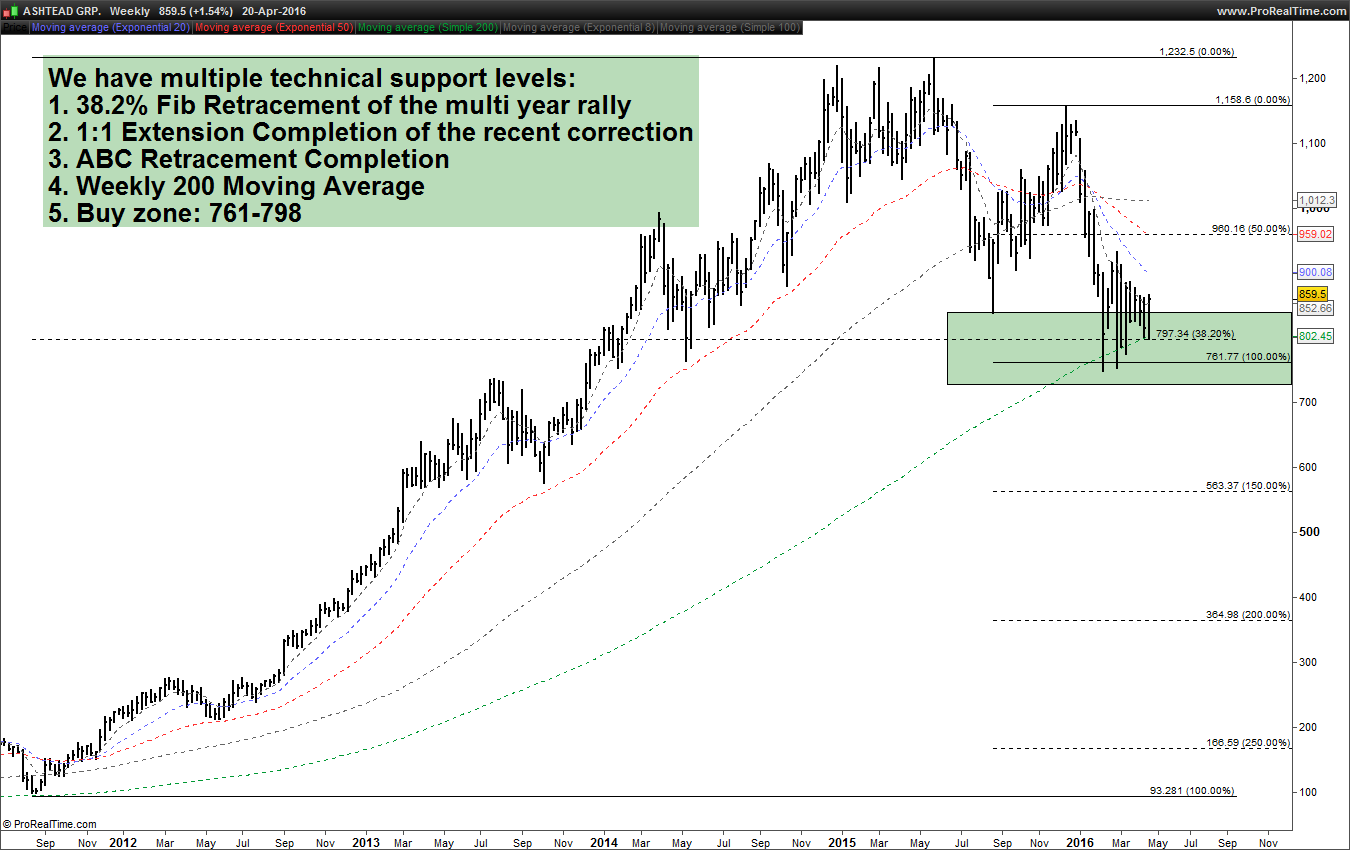

Hot Stock No1: Ashtead Group (LON:AHT.LSE)

Fundamentals: Ashtead group are an international equipment rental company with networks in the UK and US and build the stuff we need no matter what's happening in the economy! Founded in 1947 and with 2015 revenue coming in just over £2billion it makes our list as it has zero exposure to revenue in the EU. Analysts including JPMorgan (NYSE:JPM) and Barclays (LON:BARC) are bullish on the stock with 11 others issuing a Buy rating and an average price of £12.36, 4 analysts issued a Hold rating and 2 a Sell rating. All good so far, let's have a look at the technicals for more info:

Technicals

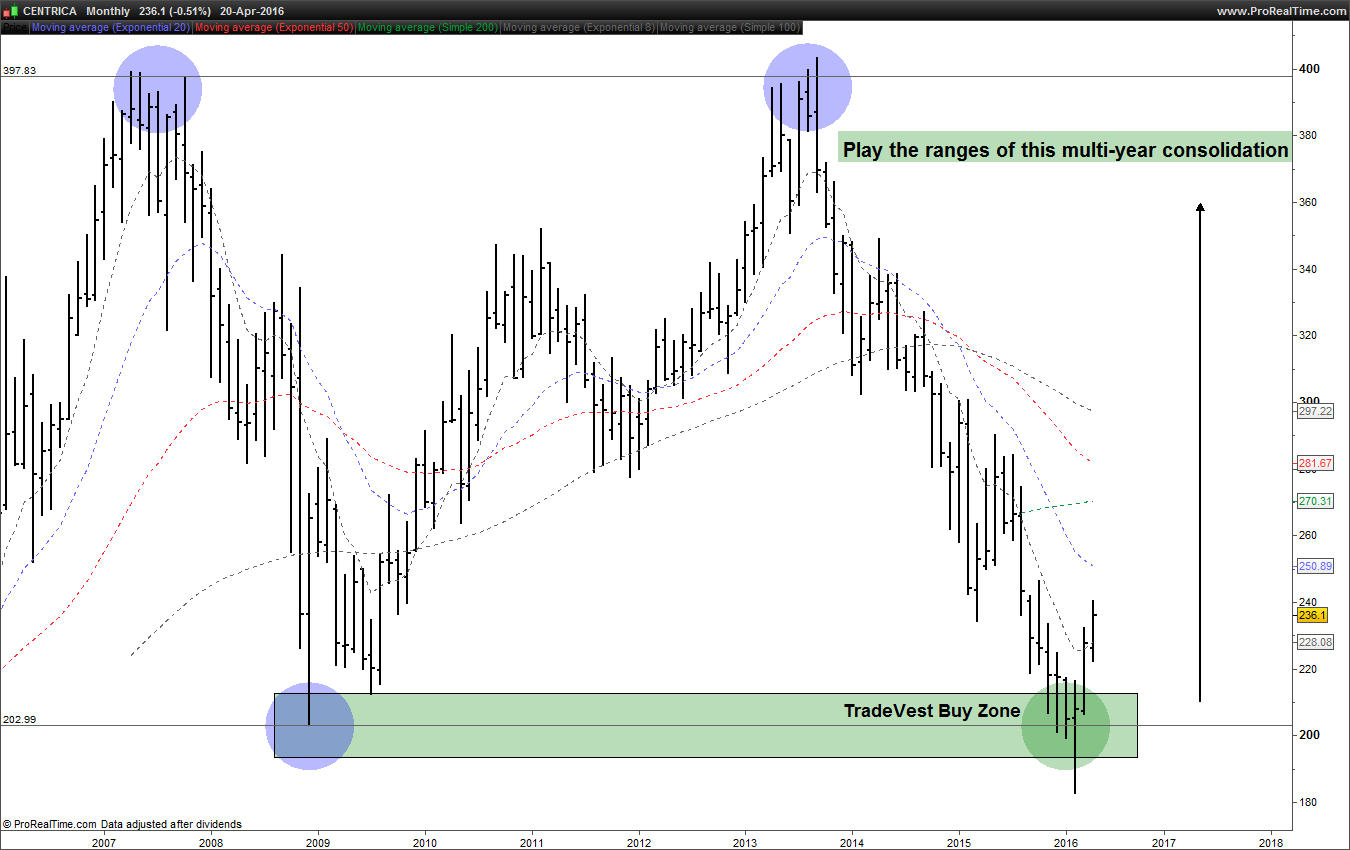

Hot Stock No2: Centrica (LON:CNA.LSE)

Fundamentals: Centrica is a huge energy and services company better known for their British Gas brand. With revenues in 2015 of over £27billion it makes our hot list due to the recent bottom in energy prices, the defensive nature of the stock if the economy crumbles and it's less than 1% exposure to EU revenues. It's also made interesting moves into renewable energy making it a strong long term prospect. Let's have a look at the technicals for more info:

Technicals

Hot Stock No3: EasyJet PLC (LON:EZJ)

Fundamentals: The nations loved, or hated, low cost airline operates over 700 routes in 32 countries. It's probably the share price will drift lower or sideways until June as nearly 41% of their revenue comes from the EU. A potential 'leave' vote could have some serious ramifications for Easyjet. However, if a 'remain' vote ensues it's probable the share price could rally aggressively as any fears or uncertainty would be lifted and would turn to the strong growth prospects of this budge airline. Let's have a look at the technicals for more info:

Technicals

You may agree or disagree but as long as you can sleep at night without thinking about your trades or investments then that's a job well done!

The above analysis combines a top down approach from the macro fundamental picture to the technical analysis of a price chart. In our combined twenty-five year experience we have found this to be a very powerful combination.

Happy trading!