In the ever-volatile energy sector, a shift in sentiment appears to be underway. As the new week commenced, Brent crude prices dipped, touching the 91.30 USD per barrel mark.

Investors, returning from their weekend hiatus, were greeted with no exacerbation in the Middle East conflict. While the unresolved issue and potential spillover into other nations continue to keep the market on edge, the current situation remains relatively stable.

This fleeting moment of diplomatic reprieve has trimmed the risk premium, a development which is subsequently mirrored in the downward adjustment of oil prices.

Latest figures released by Baker Hughes indicate a slight uptick in oil-drilling activity in the US. Over the past week, the count of active oil rigs inched up by a single unit, bringing the total to 502 rigs.

Technical Analysis:Brent Crude

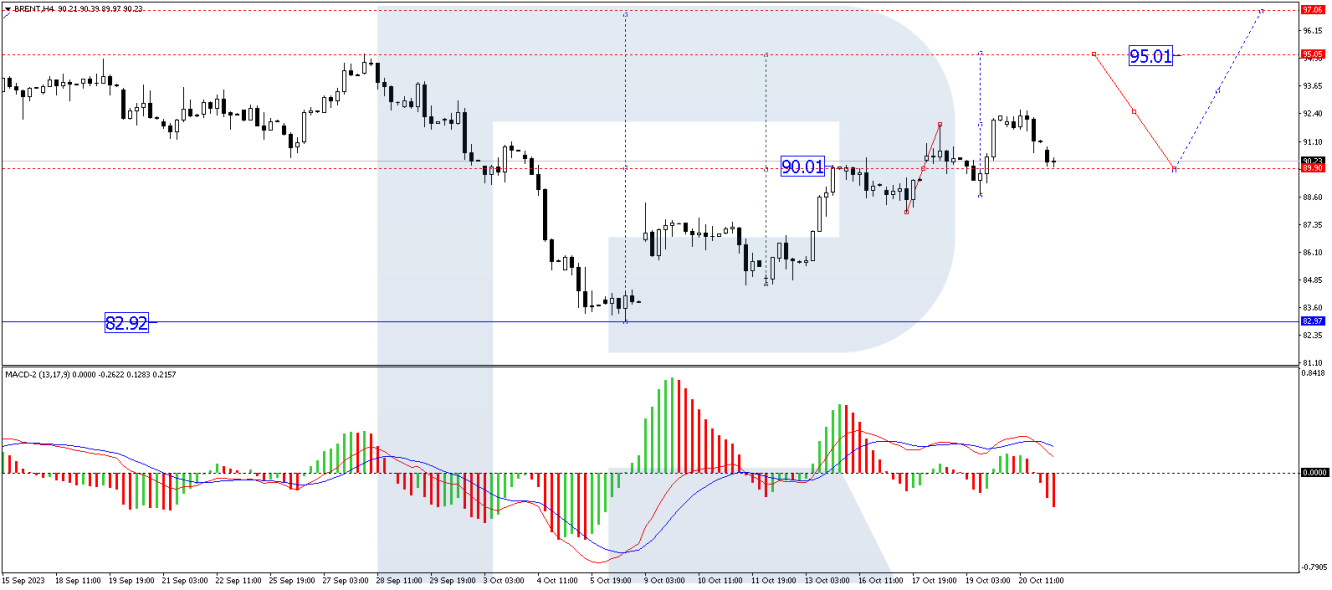

The Brent H4 chart showcases a bullish trajectory to the 90.00 mark. Currently, a consolidation phase is apparent around this level. The market managed to find support at the 88.70 level, propelling a bullish move towards 92.55. The commodity is currently undergoing a correction towards the 89.90 level. Post-correction, market dynamics hint at a potential bullish wave targeting 95.00. This serves as an immediate target. Subsequently, a bearish pullback to 89.90 (with a test from above) followed by another bullish push towards 97.00 might ensue. The Moving Average Convergence Divergence (MACD) offers technical corroboration for this prognosis. Its signal line, comfortably above the zero threshold, suggests a looming push to fresh highs.

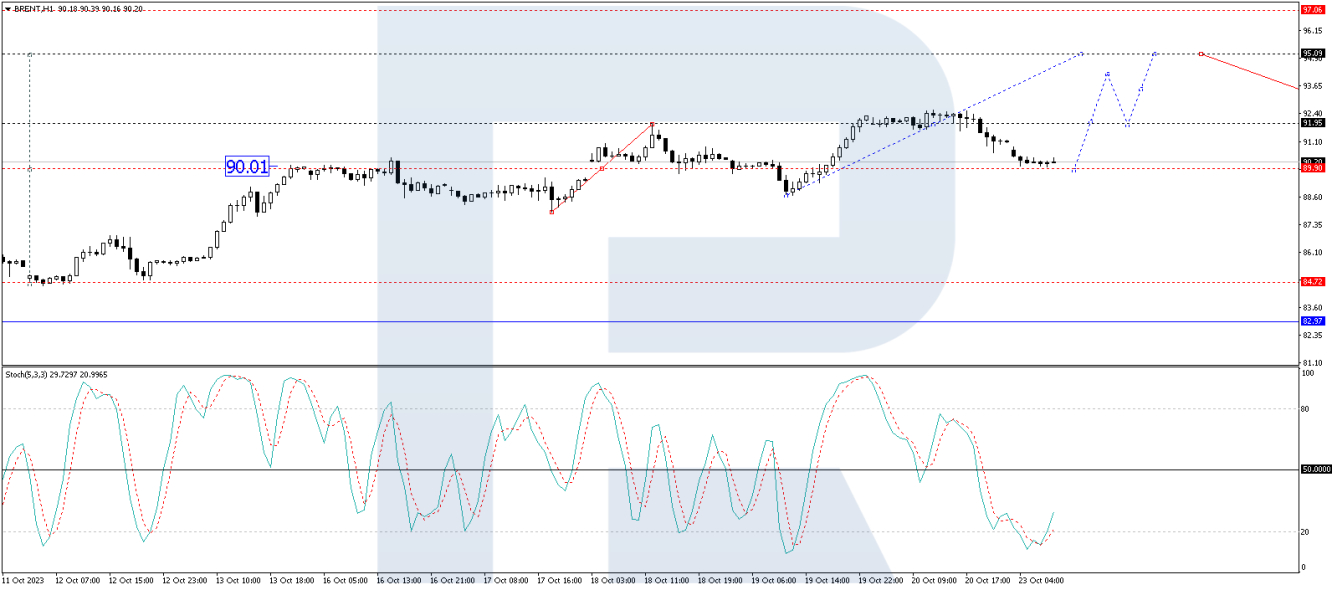

The H1 timeframe for Brent captures the completion of a bullish wave peaking at 92.55. In today's trading, a correction pulled the quotes to the 90.00 level. A minor bearish move towards the 89.90 level might be in the cards. This could potentially be followed by a bullish wave aiming for the 94.10 level, with momentum possibly propelling it further to the 95.00 level. The Stochastic oscillator backs this sentiment. Its signal line, currently positioned below the 20 mark, points definitively upwards. A climb to the 80 mark seems plausible.

Conclusion

Brent oil's pricing dynamics reflect the cautious optimism stemming from the lack of escalation in Middle East tensions. Although geopolitical stability has momentarily tempered oil prices, technical indicators suggest potential bullish moves in the near term. Market participants would be prudent to keep an eye on geopolitical developments and closely monitor technical patterns to inform their trading decisions.

By RoboForex Analytical Department

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Brent Oil Experiences Downward Pressure Amid Easing Middle East Tensions

Published 23/10/2023, 14:52

Brent Oil Experiences Downward Pressure Amid Easing Middle East Tensions

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.