The commodity market is on a bullish trend, with the price of a Brent crude barrel reaching an impressive $90.50 as of Monday. Market sentiment in the oil sector is distinctly optimistic, primarily driven by a supply shortage.

Current data suggests no immediate need to revise crude oil production forecasts. According to Baker Hughes, the number of oil rigs in the U.S. modestly increased by one, totaling 513, while the number of gas rigs decreased by one, bringing the count to 111.

This week is pivotal for oil investors, as key market reports are due to be released by OPEC, the U.S. Secretary of Energy, and the International Energy Agency. These reports will serve as vital indicators, potentially influencing investment decisions.

Technical Analysis of Brent

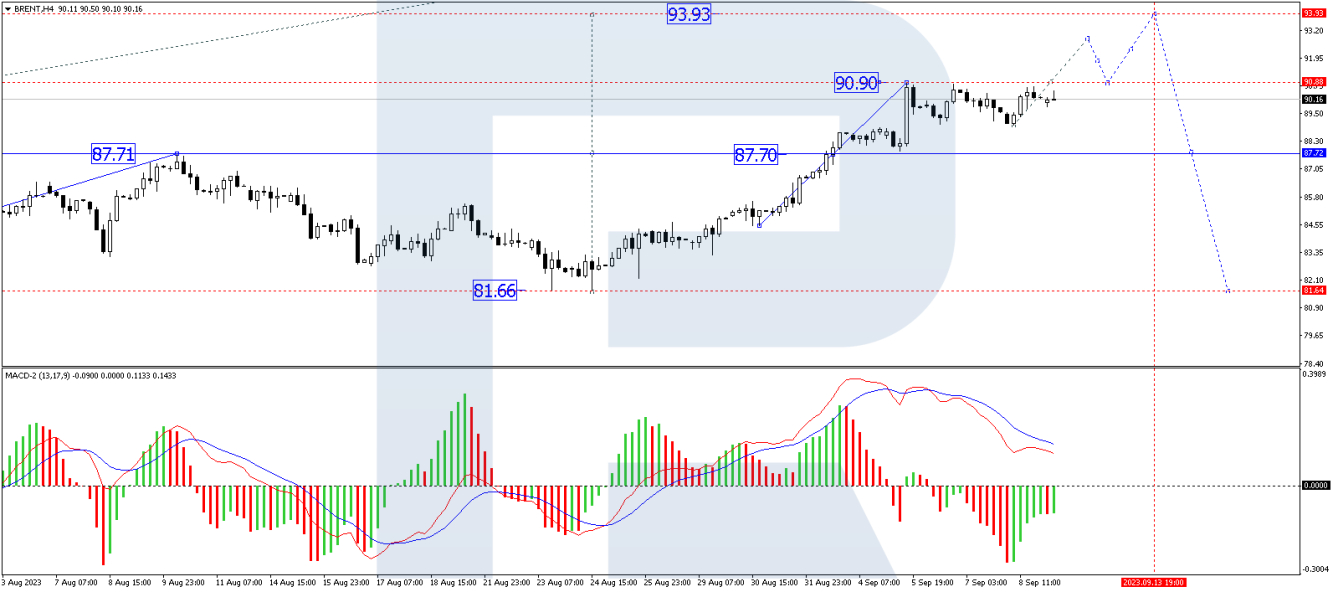

On the 4-hour chart, Brent broke past the critical $87.77 level and surged toward its growth target of $90.90. A corrective phase briefly occurred, pulling the market back to $88.98. However, the upward trend is expected to resume, possibly reaching $91.00. Should this level be surpassed, the potential for a further ascent to $93.93 becomes increasingly likely. The Moving Average Convergence Divergence (MACD) indicator supports this outlook, with its signal line above the zero mark and the histogram recording new highs.

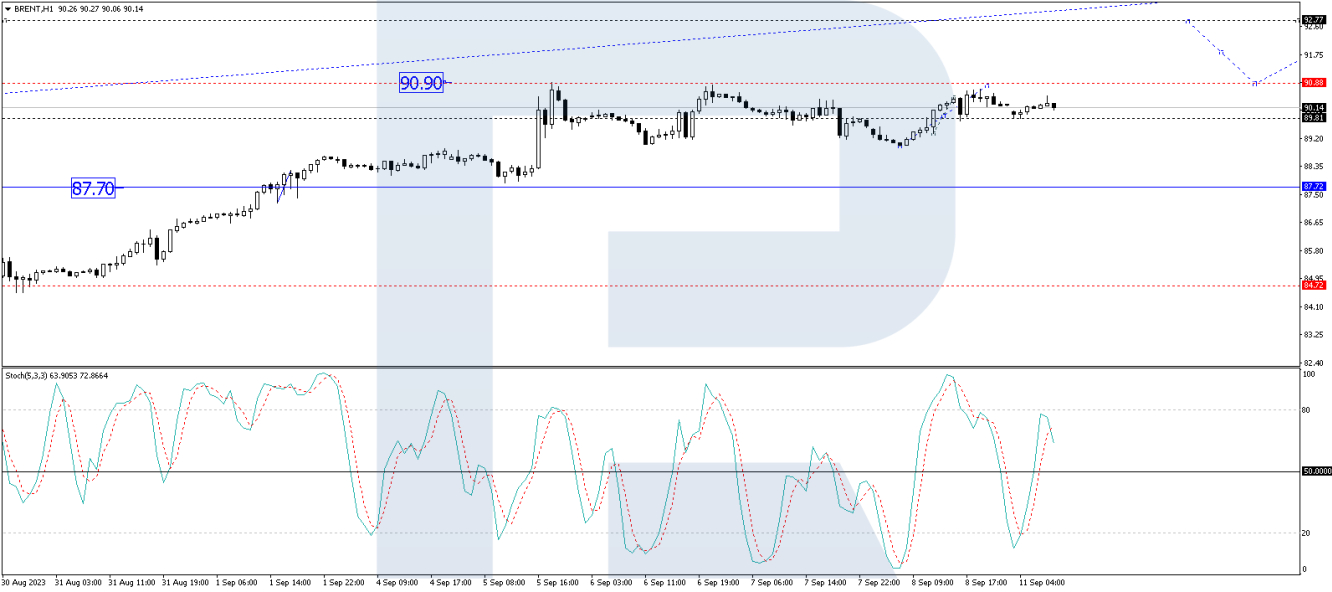

On the 1-hour chart, a consolidation phase has formed around the $89.80 level. Breaking free from this range, the price has continued its upward momentum towards $91.00. If this level is also breached, an extension of the wave to $92.77 may be on the horizon. Following that, a corrective movement back to $91.00 could take place (subject to testing from above), before another potential rally to $93.93. This scenario is technically corroborated by the Stochastic oscillator, which shows its signal line has crossed the 50-mark upward and is trending toward 80.

In summary, Brent crude oil is displaying strong bullish momentum, fortified by both supply dynamics and positive technical indicators. The week ahead is crucial, with forthcoming market reports likely to offer valuable insights that could either sustain or shift the current bullish trend.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.