Brent crude oil prices have rebounded to $81.05 per barrel this Monday, stabilizing after recent selling pressure. The market's focus now turns to the outcomes of the OPEC+ meeting held over the weekend, where members agreed to extend collective production cuts until the end of 2024.

The agreed plan includes a voluntary reduction of 3.66 million barrels per day, set to expire at the end of 2024. Additionally, OPEC+ committed to a 2.2 million barrels per day cut for the third quarter of this year. Furthermore, eight OPEC+ countries announced plans to gradually implement additional cuts totalling 2.2 million barrels per day from October 2024 to September 2025.

Despite these cuts, oil prices dropped nearly 6% in May, driven by uncertainties regarding demand and concerns over potential high interest rates maintained by the US Federal Reserve. These rates could slow economic growth and dampen commodity interest, impacting the energy sector.

Technical analysis of Brent crude oil

On the H4 chart, Brent is currently forming a consolidation range around the $81.50 level. There is potential for this range to extend downward to $79.79. If this level is reached, a rebound to $81.10 (testing from below) might follow, with possibilities of further downward movement. The correction could extend to $78.00 before a new growth wave towards $85.00 might begin. This scenario is technically supported by the MACD indicator, with its signal line above zero but directed downwards.

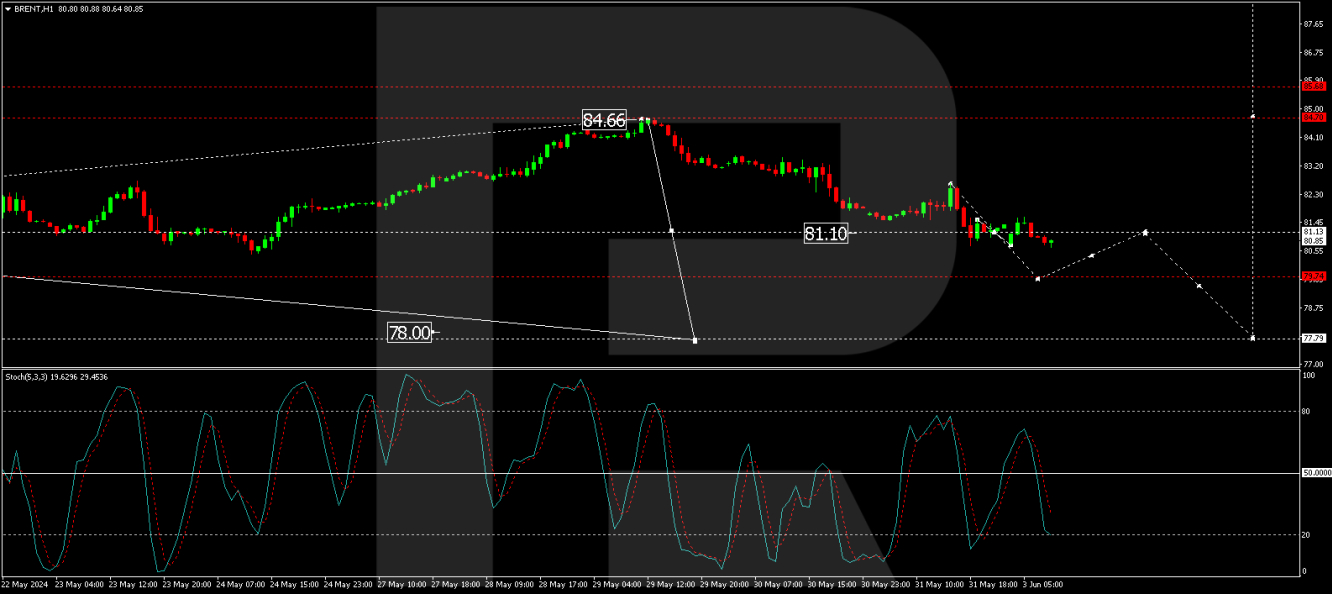

On the H1 chart, Brent has completed a downward structure to $81.10, with a consolidation range forming around this level. A downward breakout could lead to a decline to $79.79. Following this, a corrective move to $81.10 could occur. Conversely, an upward exit from the range might trigger a rise to $82.50. This setup is technically confirmed by the Stochastic oscillator, with its signal line at 50 and trending down towards 20.

Market outlook

As Brent crude navigates through the effects of OPEC+ production cuts and global economic uncertainties, investors should closely monitor further developments in commodity demand and central bank policies. The technical setup suggests volatility with potential downward and upward movements, making it crucial for traders to watch for breakouts from established consolidation ranges.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Brent crude oil rebounds to $81.05 amid OPEC+ agreements

Published 03/06/2024, 10:07

Brent crude oil rebounds to $81.05 amid OPEC+ agreements

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.