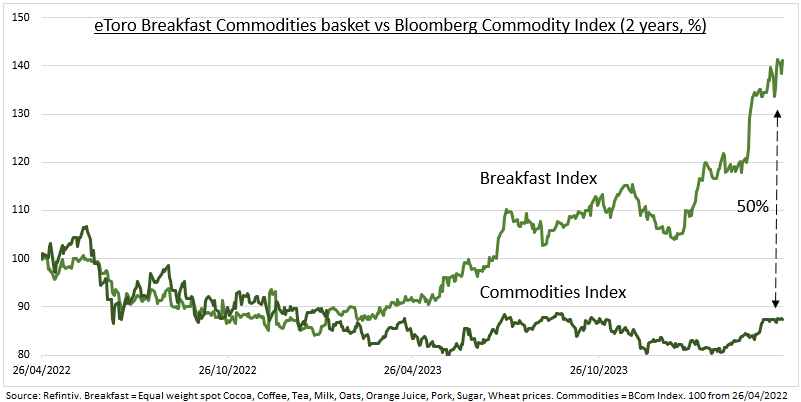

RISES: Our proprietary Breakfast commodity price index has surged by 54% in the past year. As weather-driven supply disruptions have spread, driving cocoa, OJ, and coffee prices higher. This has dramatically outpaced the recent turn up in broader commodity markets (see chart). And will start to flow through into higher consumer supermarket prices in coming months, putting a floor under the recent inflation slowdown. It is a likely benefit for agricultural producers and their suppliers, from Deere (DE) to Mosaic (MOS). But a possible volume and profit margin headwind for food producers, from Kraft (KHC) to Nestle (NESN.ZU).

BREAKFAST INDEX: Our equal-weight index of nine popular breakfast ingredients, from sugar to wheat, has dramatically outpaced broader commodities. Our breakfast index is up 54% the past year versus a 2% gain for the Bloomberg Commodities index. Gains this year have been led by cocoa (+150%), pork (35%), coffee (30%), and orange juice (20%). As supply-side and mainly weather-related shocks, from West Africa to Florida and Brazil, have destabilised many ag markets. These big price gains have more than offset the modest declines across other breakfast commodities like wheat (-9%), milk (-6%), oats (-4%), tea (-5%), and sugar (-3%).

INFLATION: Food prices have led the US and UK inflation slowdown. US food inflation has decelerated from 8.5% to 2.2% in the past year. Whilst in the UK, the latest 4% rise is a fraction of the 19% rate a year ago. We can also see this bottom-up. We examine the average UK supermarket price of a basket of 15 typical breakfast foods. From tea bags and coffee to sliced bread and jam and bacon and eggs. It’s currently £42.26, up by 4% the past year. But with shopping aisle prices starting to move up for the most impacted commodities. With supermarket price rises led by hot chocolate (+18%), granulated sugar (14%), fruit juice (11%), coffee (9%).

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Breakfast commodities are leading the way

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.