The shares of the US fuel cell manufacturer Bloom Energy experienced an incredible surge in November. After a price increase of over 30% by Thursday, an impressive explosion of a further 55% followed on Friday. But what is behind this extraordinary rally?

Strong quarterly figures boost the share price

Bloom Energy recently presented its financial results for the past quarter and surprised the markets with a significant improvement. Although the company continued to report a quarterly loss of almost USD 15 million, this was a dramatic improvement compared to the previous year's loss of USD 170 million.

A key driver of this positive development was the significant improvement in gross margin, which rose from -1.3% to a strong 23.8%.

In addition, Bloom Energy confirmed its forecasts for 2024:

- Expected total revenue: $1.4 to $1.6 billion

- Expected operating profit: $75 to $100 million

The only downer: third-quarter revenue fell by 18% to $330 million.

Major orders continue to fuel the rally

In addition to the positive business figures, two new major orders have fuelled the euphoria:

- SK Eternix (South Korea): Order for fuel cells with a total output of 80 megawatts.

- American Electric Power (NASDAQ:AEP) (USA): framework agreement for fuel cells with a capacity of up to 1 gigawatt – the largest commercial order for fuel cells worldwide to date

The first delivery to AEP includes cells with a capacity of over 100 megawatts, which are specifically designed for AI data centres. These cells are versatile and can be operated with both hydrogen and a mixture of hydrogen and natural gas.

And we believe that this is the most important signal, because it could save Bloom Energy from going under as the only hydrogen company in the US in the green zone just in time before Donald Trump took over the White House and from becoming dependent on government subsidies and funding. In addition, the two major orders clearly show that the demand for alternative energy sources is growing rapidly. The reason for this is the ongoing AI boom and the massive expansion of data centres that this entails. Almost all major players in the US are currently in the same situation. They need to expand computing capacity, but are unable to meet their electricity needs across the board. Bloom Energy offers a sustainable and relatively inexpensive solution to this problem with its solid oxide fuel cells.

We are sticking with the stock

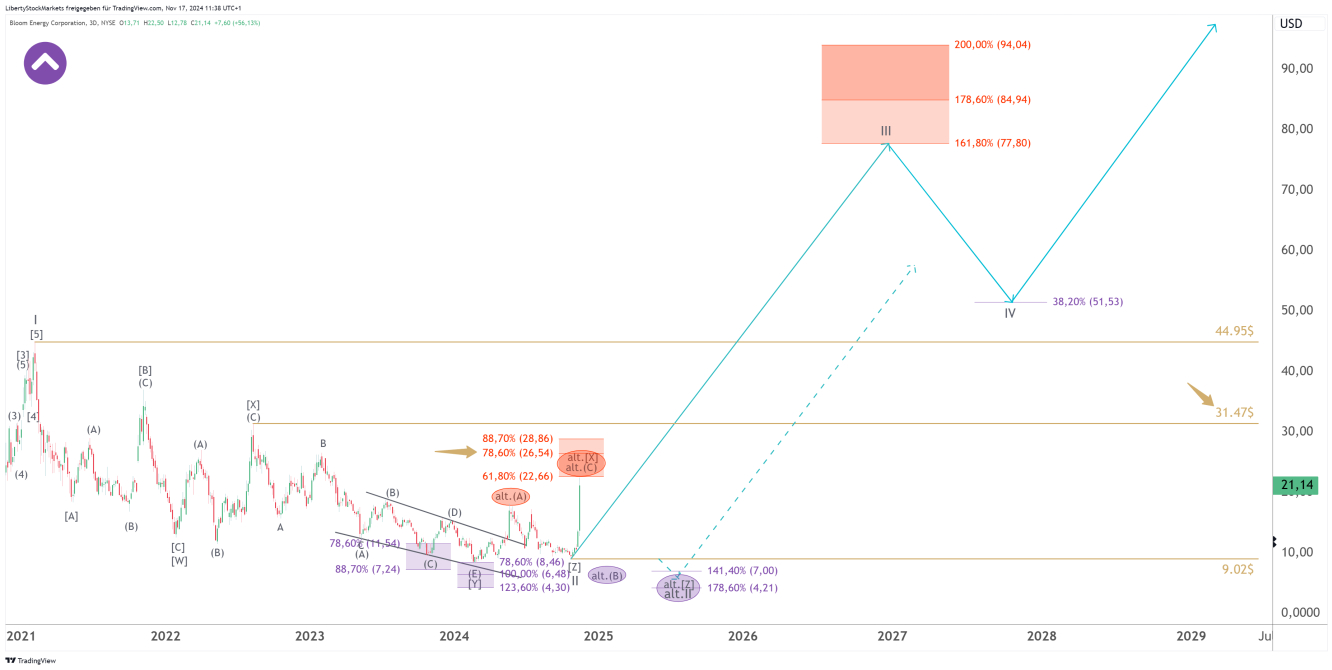

The chart shows the impressive share price performance of the past two trading days. Nevertheless, we cannot yet give the all-clear that the stock is in a sustainable uptrend. To do that, it has to overcome the overall resistance cluster, which we have marked in the chart as a red box at $22.66 to $28.86. If the stock fails there, it can finally drop to the region of the purple circle at $7.00 to $4.21. It is important to watch this closely now.

However, we are optimistic that the stock can finally break free sustainably and is already aligned with the long-term goal of the overarching wave III at $77.80 to $94.04. This is a long way off, but it is mathematically realistic that the stock can continue to grow strongly in the coming years.

We will discuss the short-term conditions for this elsewhere, along with whether and, if so, where there will be another good opportunity to buy. It all comes down to the details. We think it would be risky to simply buy now.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI