Various technical indicators are often used to analyse past market movements. Most indicators trade on the sidelines, but one of these indicators has proven to be particularly accurate, predicting the end of the Bitcoin bull markets in both 2017 and 2021. Anyone who had consistently sold at the high of this indicator would have timed the respective all-time high precisely.

The crucial questions now are: what indicator are we talking about, and where does it stand in the current Bitcoin bull market?

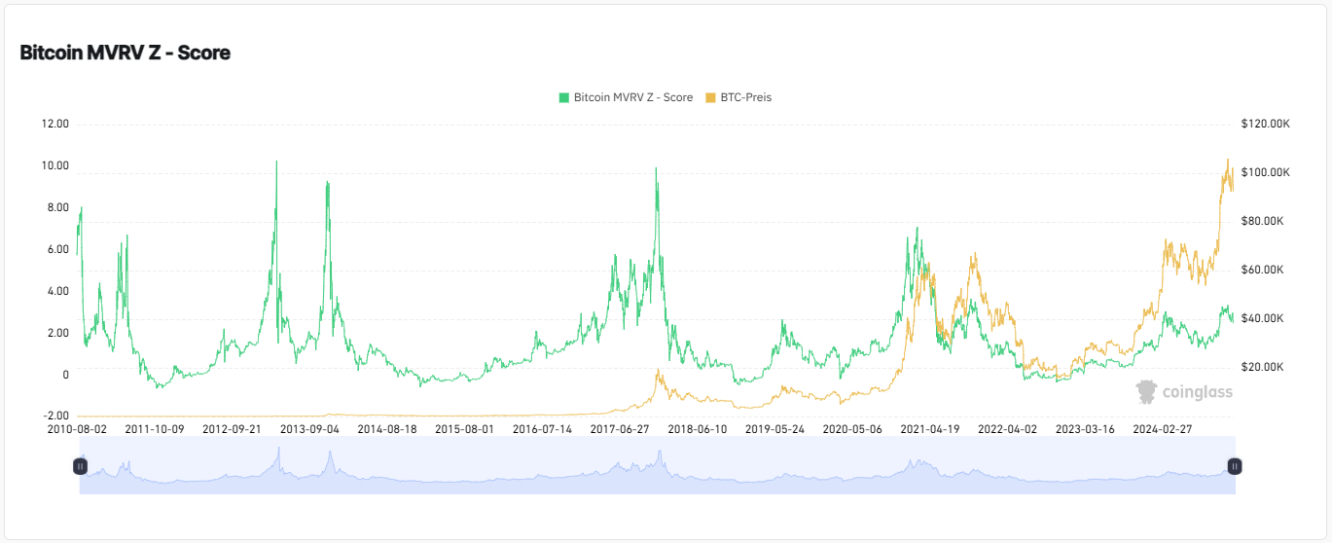

The MVRZ indicator: a reliable signal generator

In the last two bull markets, the MVRZ indicator signalled the end of the uptrend with impressive accuracy. This indicator takes into account the circulating Bitcoin supply as well as the realised market value and calculates the standard deviation of the market capitalisation.

Detecting overvaluation and undervaluation

A high MVRZ indicator value suggests that Bitcoin is overvalued, which usually has a negative impact on the price. By contrast, a low value signals undervaluation, indicating potential price increases.

The indicator formula is:

MVRV-Z-Score = (market capitalisation in circulation – market capitalisation realised) / standard deviation of market capitalisation in circulation

The importance of chart analysis

An analysis of historical chart data shows that the Bitcoin price (shown in orange) always correlated with a peak in the MVRV indicator (shown in green) when an all-time high was reached.

Where does the indicator stand in the current cycle?

The current state of the indicator suggests that the end of the Bitcoin bull market has not yet been reached. Instead, we are probably in a temporary correction phase. The MVRZ indicator shows that there is still room for the price to rise before a potential peak is reached. However, if the indicator rises to levels comparable to those seen in 2017 or 2021, this would be a strong signal that the current bull run is coming to an end.

Falling Bitcoin reserves on exchanges as a further indication

Another indicator pointing to a possible further increase is the falling Bitcoin reserves on crypto exchanges such as Binance or Coinbase (NASDAQ:COIN). This development signals that fewer Bitcoin are available on the exchanges, which points to increased demand and thus potentially rising prices.

Bitcoin will soon leave the current phase of weakness behind and then rise sharply again. We see the upside potential in the next step at a minimum of 40% to a maximum of 60%, before there is another stronger correction phase.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI