- Bitcoin defied expectations in May and is now on track for a 12%+ monthly gain.

- Renewed interest in crypto ETFs can be credited for the recent surge.

- Bullish technical signals suggest Bitcoin could break past $70,000 resistance in June.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

After kicking off May on the wrong foot, Bitcoin has defied expectations of a slump and is currently poised to close the month with a 12%+ surge.

This positive performance comes after a period of consolidation in the first quarter, where Bitcoin found solid support at around $61,000 per week. While an upward trend was initially halted by selling pressure near $70,000, the past three weeks have seen that resistance zone tested several times.

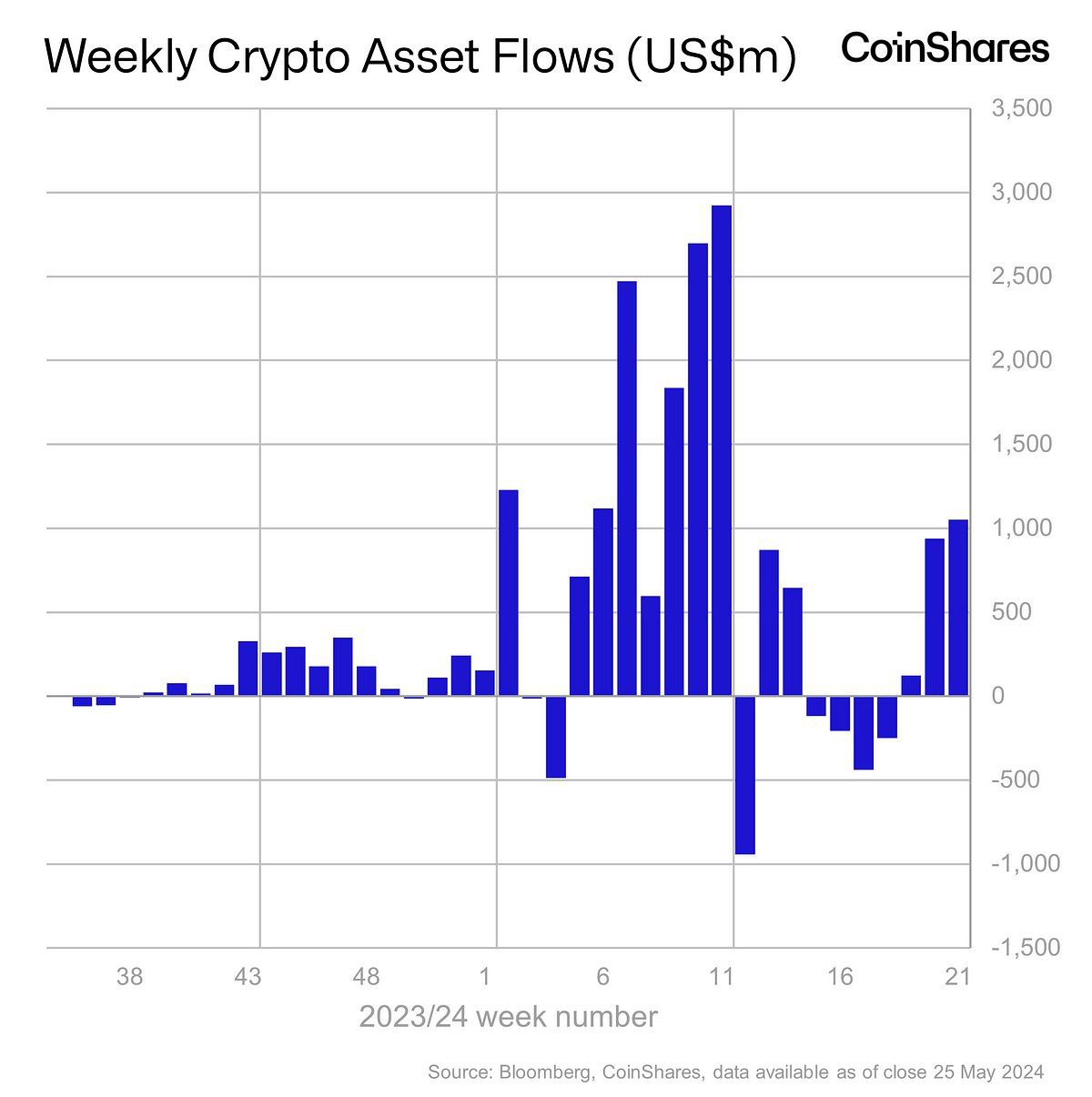

The recent price surge can be largely attributed to renewed interest in crypto ETFs. Since BlackRock's application for a spot Bitcoin ETF last June, the approval and subsequent trading of these instruments have become a major driver of Bitcoin's price. Positive inflows into the latest Bitcoin ETFs are seen as the key factor pushing the cryptocurrency back towards $70,000.

Bullish Signals Emerge for Bitcoin as May Set to Close Strongly

Bitcoin's upward trend in the latter half of May translated into positive signals on the weekly chart. Most notably, the Stochastic RSI, which had dipped into the oversold zone, reversed course and began to climb again, suggesting bullish potential.

This aligns with Bitcoin's price action in 2024, where the last price reversal found support at the mid-channel band during its in-channel climb. Additionally, the price currently sits above the 8-week EMA, and both medium and long-term moving averages continue to trend upwards, further supporting the bullish outlook.

The positive momentum extends to shorter timeframes as well. Despite trading sideways in the past week, Bitcoin managed to close each day above $67,000 and remained positioned above the 21-day EMA. This indicates that the cryptocurrency stayed above its recovery trend throughout May.

Looking ahead to June, Bitcoin appears poised for renewed upward movement with support at the $67,000 level. A retest of the $70,000 resistance zone would further strengthen the bullish signals on its technical indicators.

The oversold Stochastic RSI on the daily chart is mirroring the weekly chart's upward trajectory, a technical situation that reinforces the bullish sentiment. Additionally, short-term EMA values remain ideally aligned, supporting a bullish outlook in the near term.

What Does June Hold for the Crypto?

If the price decisively breaks above the resistance zone of $71,500-$73,000 with clear daily closes, the bullish setup based on the past 3 months' highs and lows could propel the cryptocurrency toward the $77,000-$83,000 range.

However, external factors could disrupt this bullish momentum. Deteriorating economic conditions outside the cryptocurrency sector could dampen investor risk appetite and negatively impact Bitcoin.

Technically, the first line of defense in a potential pullback is at $67,000. A further decline with daily closes below $65,500 would signal a break in the short-term uptrend and could send Bitcoin retreating back down to $61,000.

Crucially, Bitcoin needs to maintain its position above the short-term trend on the daily chart to sustain its upward trajectory.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon codes OAPRO1 and OAPRO2 at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.