- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Bitcoin Holds Firm at $92.4K Support – Eyes Now on $100K as Bulls Remain in Control

- Bitcoin’s consolidation at $92,400 support hints at the potential for renewed momentum toward $100K.

- Declining exchange reserves and strong blockchain trends underscore sustained investor interest.

- Institutional profit-taking could extend consolidation, creating opportunities in altcoins.

- Looking for more actionable trade ideas? Subscribe here for up to 55% off as part of our Bird Black Friday sale!

Bitcoin’s 40% surge in November captured trader optimism, fueled by the so-called “Trump effect.” Yet, despite the rally, the cryptocurrency stalled just shy of the psychological $100K milestone, closing the month in consolidation mode. A profit-taking spree at $98,000 dampened momentum, leaving traders wondering if Bitcoin can overcome this key resistance.

The past week’s movements reveal a complex interplay between selling pressure from long-term investors and fresh buying activity. While whales have capitalized on the rally, selling significant portions of their holdings, blockchain data tells a bullish story. External wallets show growing Bitcoin reserves, while centralized exchanges report declining BTC balances—suggesting many market participants remain optimistic despite temporary headwinds.

$92,400 Support Holds Firm Amid Shifting Market Flows

Selling pressure from profit-takers pushed Bitcoin to test the $92,400 support zone, but a robust bounce at this level indicates the correction might be contained. Meanwhile, institutional flows are reshaping Bitcoin’s short-term trajectory. Spot Bitcoin ETFs saw record monthly inflows, but institutions began taking profits as month-end approached, redirecting gains into altcoins.

This shift highlights a broader market trend. Bitcoin’s dominance dropped from 60% to 57%, as altcoins like Ethereum outperformed. Ethereum posted a 6% weekly gain, dwarfing Bitcoin’s 2% decline, signaling growing investor interest in the broader crypto market.

Macro) Winds Favor Bitcoin, But Catalysts Remain Scarce

Macroeconomic developments have added a subtle tailwind to Bitcoin. Last week’s weaker U.S. dollar, spurred by dovish inflation data and shifting sentiment around proposed Trump tariffs, provided fresh support. As the DXY index faltered, Bitcoin buying picked up from key support levels.

However, a lack of major catalysts could weigh on momentum. With the holiday season ahead, thinner trading volumes might lead to subdued volatility, leaving Bitcoin in a holding pattern unless a significant driver emerges.

Key Levels to Watch

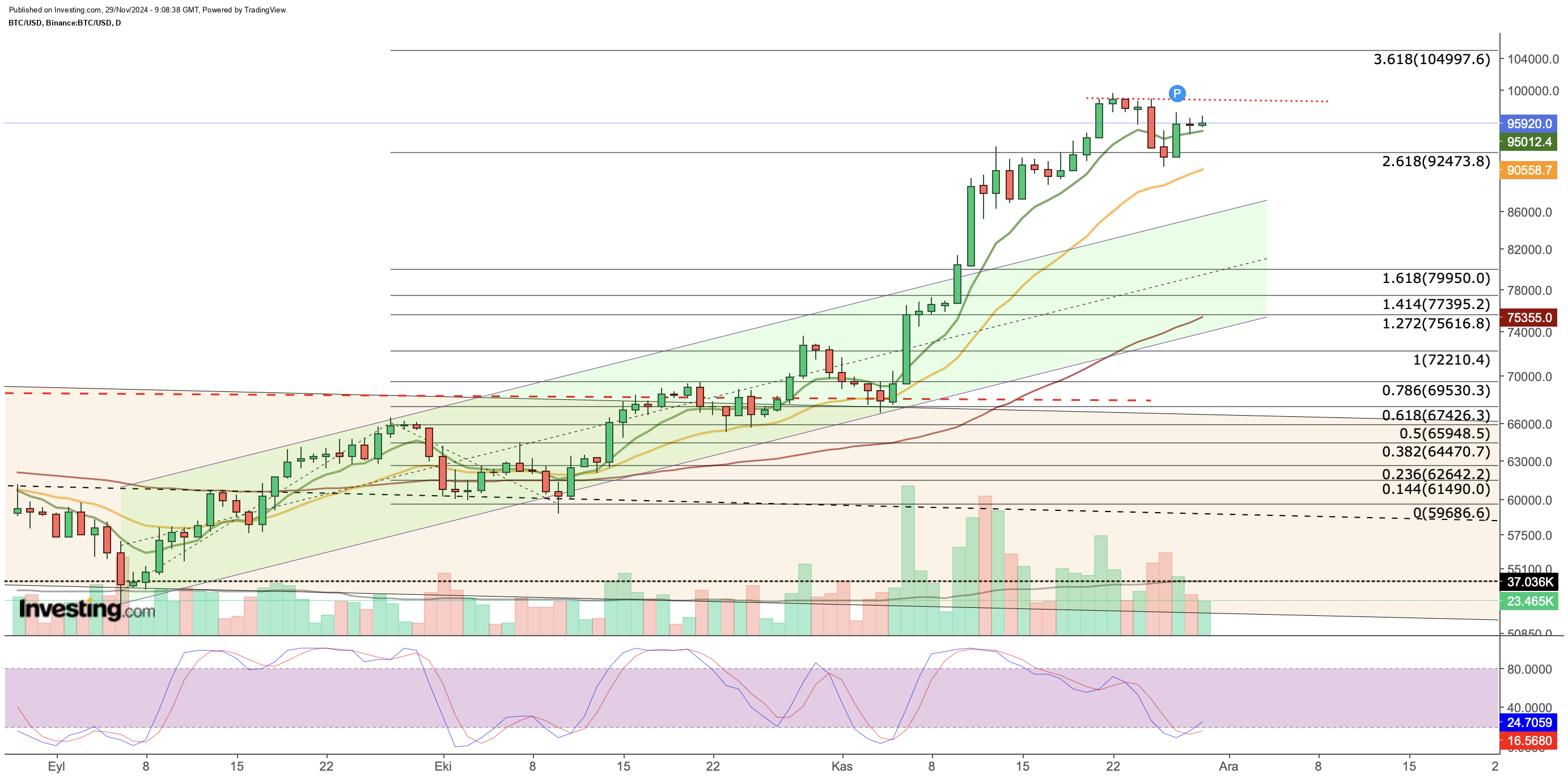

Bitcoin’s technical outlook remains bullish despite recent consolidation. The $92,400 support, aligned with the Fib 2.618 level of September’s rally, has proven resilient and now serves as a key floor. To the upside, $99,000 looms as the next critical resistance. A daily close above this level could open the door to reclaiming $100K and possibly targeting $105K, guided by Fibonacci projections.

Short-term support rests at the 8-day EMA near $95,000, which has consistently held during pullbacks. On a broader scale, Bitcoin remains within a rising weekly channel. The upper boundary at $105K aligns with the Fib 2.618 extension, serving as a potential top for the next leg up.

Still, traders should remain cautious. Breaching the $92,400 support could signal a deeper correction, with $85,000 emerging as the next downside target. For now, all eyes are on Bitcoin’s ability to retake $100K and reignite the rally.

***

Ever wondered how top investors consistently outperform the market? With InvestingPro, you’ll unlock access to their strategies and portfolio insights, giving you the tools to elevate your own investing game.

But that’s not all—our AI-powered analysis delivers several stock recommendations every month, tailored to help you make smarter, faster decisions.

Ready to take your portfolio to the next level? Click here to start today!

***

Disclaimer: This article is for informational purposes only and does not constitute financial advice or a recommendation to invest. Cryptocurrencies are inherently volatile, and any investment decision carries risk. Always conduct thorough research and consult a financial advisor when necessary.

Related Articles

Bitcoin battles key technical levels as it consolidates between $92,000 and $98,000. Macroeconomic factors and a strong dollar shape Bitcoin's outlook heading into 2025. A break...

Bitcoin (BTC) has transformed the financial landscape over the past 15 years from its mysterious beginnings to becoming a trillion-dollar asset class. On the 16th “birthday” of...

Charles Hoskinson, founder of Cardano (ADA), recently discussed possible collaborations with Ripple. In an interview on the YouTube channel Big Pey, he emphasised the potential of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.