If you wonder why the markets are rallying this morning check the news. Trump said they are close to a trade deal with China. How many times they have said this? Nearly everyday, as long as they talk about a deal the markets will rally. This should not be allowed, it is obvious that the president and his advisers are manipulating the markets to go up.

I hope there is a deal otherwise markets will crash. There is so much good news priced in that if they don’t deliver a deal markets will crash. I don’t feel confident to go short in this environment, when the market is distorted and there are multiple extensions in the rally it is difficult to know where it will end.

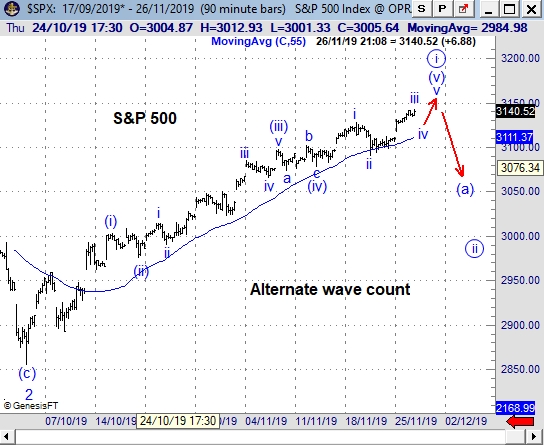

I always say the clearest patterns occur when there is no news, when there is no news affecting the price I feel more confident to go short. Here we have a wave count that is complete or nearly complete but the trade deal is pushing the market higher.

The safest way to go short is to wait until we have an initial decline in five waves. Because the start of the decline will be an impulse wave and this move will be in five waves. The strength of the markets can also be attributed to the Thanksgiving holiday tomorrow, markets tend to rally the day before Thanksgiving.

We also need to focus on the bigger picture, which is a bull market, we know there will be a pullback because markets don’t move in a straight line, then we need to buy because these manipulations will continue into 2020.

The FTSE is not as strong as the S&P which is a better index to short. If you trade pairs you would short the FTSE and buy the S&P. I believe GBP/USD will continue to rally this is why the FTSE will struggle to rally above 7400. I also believe the expected decline will probably start next week, tomorrow is a holiday in the US and Friday the markets will close early (half day). The bearish divergence between FTSE 100 and S&P 500 is an indication the S&P will turn down.