The analyst’s view

- The long-term investment case for China remains compelling. The Chinese government is now encouraging the transition from an economic model dependent on property sector expansion, to one led by innovative, so-called ‘new productive forces’ intended to increase the country’s self-sufficiency across various sectors. Companies with exposure to renewable energy, advanced semiconductors, industrial automation and other cutting-edge technologies are set to benefit.

- Economic growth, while weaker than before the pandemic, will remain strong compared to most other countries, underpinned in part by fresh government efforts to support the property sector and domestic demand.

- BGCG’s managers expect these factors, combined with very attractive valuations, to bolster equity market demand from foreign and domestic investors and the portfolio is positioned accordingly.

NOT INTENDED FOR PERSONS IN THE EEA

BGCG: Positioned to capitalise on Chinese growth

Early performance hurt by a run of unusual events

Baillie Gifford China Growth (LON:BGCG) aims to use global perspectives and local knowledge to identify the best companies capable of delivering strong growth over an extended time frame. The company’s managers believe their patient, long-term view differentiates them from most Chinese equity market investors, who adopt a very short-term view.

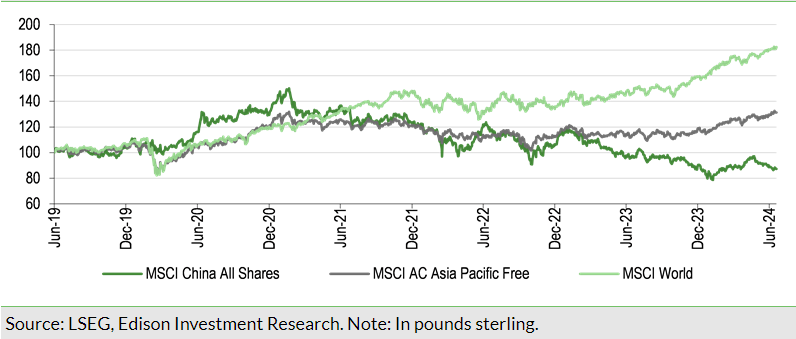

Consistent with this long-term approach, BGCG’s managers ask investors to judge their performance over five years and more. As the trust only adopted its current China-focused strategy in September 2020 (see Fund profile section for details), it is thus still early days to assess the performance of the strategy, especially as BGCG’s launch coincided with a series of unusual, market-disrupting events, including a regulatory crackdown, a marked escalation in geo-political tensions between China and the US, a property sector crisis and the global pandemic, which saw Chinese authorities impose severe restrictions on individuals and economic activity. The country’s sudden, but unexpectedly insipid re-opening, and the government’s perceived failure to provide sufficient stimulative support to lacklustre consumer demand, dealt a further blow to investors, ensuring that Chinese equity markets have been in retreat for most of the past three years. Equity valuations are now at lows not seen for many decades, both in absolute and relative terms. For example, the MSCI China All Shares Index is trading at a forward price/earnings multiple of 9x, significantly below its five- and 10-year averages, less than half that of the US index, and well below world and emerging markets indices.

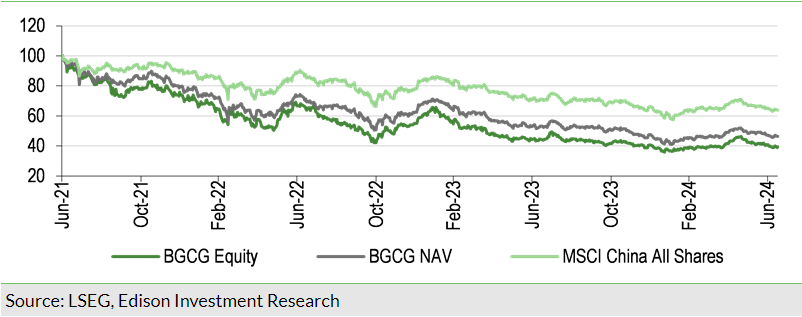

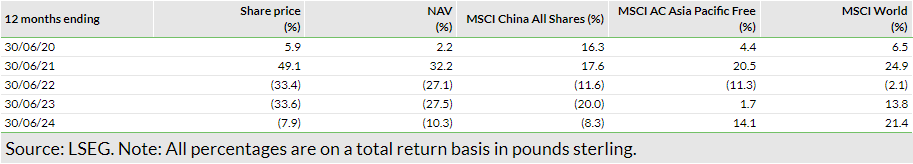

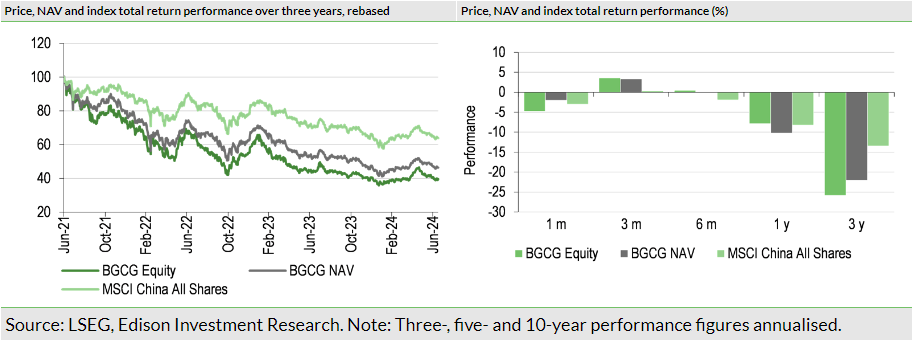

In these especially uncertain times, investors opted for the relative security of defensive sectors such as state-owned energy and utility companies, at the expense of the private sector growth stocks BGCG favours, so early performance has been disappointing. The trust has underperformed a falling benchmark, declining by 25.9% in NAV terms and 22.0% in share price terms in the three years ended 30 June 2024, compared to a 13.4% decline in its benchmark, the MSCI China All Shares Index.

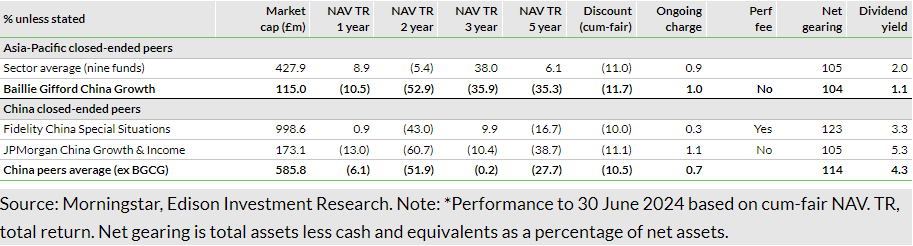

BGCG is not the only China-focused trust to have struggled over recent years. All three of the AIC’s Chinese equities funds shown in Exhibit 4 have suffered declines of a broadly similar magnitude and have underperformed the AIC’s broader closed-ended Asia Pacific sector average over the past couple of years, although performance has been more varied over three years.

Yet BGCG’s portfolio holdings are performing strongly

However, these headline figures do not tell the entire story for BGCG. The protracted market weakness has been driven by macroeconomic and geopolitical factors, rather than underlying company fundamentals. BGCG’s portfolio holdings have continued to perform well, and in some cases exceptionally, at the operational level. They are delivering earnings growth above the index, with resilient characteristics such as net cash, versus the net debt position of the index, and are now at attractive multiples. The trust’s managers cite several holdings with especially impressive earnings growth, including: PDD Holdings, an e-commerce company formerly known as Pinduoduo, which had earnings growth of 90% y-o-y over 2023; Ankor Innovations, a supplier of consumer electronics, which experienced earnings growth of 55% last year; and CATL, a producer of batteries for electrical vehicles (EVs), which saw its earnings rise by 44% over the same period.

And market sentiment and performance have improved recently

The Chinese New Year, celebrated in February 2024, marked an apparent turning point for the market, which has since seen a significant improvement in investor sentiment and share prices. This brighter mood has been supported in part by government efforts to put a floor under stock prices, by encouraging state-owned enterprises (SOEs) to focus on their share prices and investor returns. SOE financial institutions have also been encouraged to purchase stock index funds, and both public and privately owned companies have been undertaking share buybacks to boost shareholder returns. Foreign investors have been quick to respond to this fresh focus on shareholder returns, as Hong Kong-listed shares, which are more accessible to foreign investors, have bounced more than domestic ones over recent months.

The market rebound has also been characterised by a move away from the most defensive sectors into the growth areas favoured by BGCG. The trust has therefore begun to recoup some lost ground. In the three months ended 30 June 2024, it returned 3.3% in NAV terms and 3.6% on a share price basis, compared to the benchmark return of 0.4%.

BGCG should benefit from China’s transition to a new, innovation-led economic model

Looking ahead, BGCG’s managers are ‘cautiously optimistic’ about the longer-term prospects for the market and the trust’s portfolio holdings. While they expect geopolitical considerations to generate persistent headwinds for Chinese equities over the medium term, in their view, the individual growth opportunities and current low market valuations more than compensate for this risk.

One key reason for this positive view is that the Chinese authorities are trying to transition the economy away from its old, property-led, growth model, to a new model of innovation-led growth driven by what the government calls ‘new productive forces’. These efforts are partly politically motivated, as the pandemic, combined with China’s ‘tech wars’ with the US, have served to highlight the nation’s lack of self-sufficiency in energy and technology, specifically its limited access to the most advanced semiconductors it needs to drive machine-learning and large language models.

The government is thus investing heavily in the development of these ‘new productive forces’. It is offering support and encouragement to both public and privately owned companies in areas such as renewable energy sources, new materials, the transition to lower carbon emissions, semiconductors, industrial automation and EVs.

China’s economic growth will still outpace most other markets

The Chinese government’s new focus on fostering greater economic self-sufficiency helps explain its reticence to simply bail-out struggling property developers and pump-prime domestic demand. Nonetheless, the government is mindful of the key role property still plays in consumer confidence and is now taking more decisive steps to improve property market conditions, by loosening restrictions on housing purchases, lowering mortgage rates and cutting reserve ratios. If these measures have their intended effect, Chinese consumers may finally be willing to begin spending at least some of the US$7tn in cash reserves that BGCG estimates are presently held by households.

Despite slowing growth, the Chinese economy will remain one of the fastest growing in the world. Annual GDP is forecast by the IMF to grow at more than twice the pace of developed economies this year and next and is likely to maintain its rapid expansion well into the future, especially if official support for innovation-led growth succeeds.

Exposed to consumer demand and ‘new productive forces’

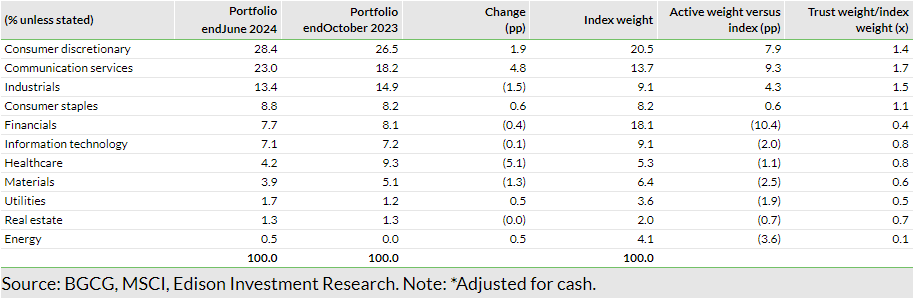

Given China’s favourable medium- to long-term economic prospects, it is not surprising that most of BGCG’s portfolio is focused on the country’s domestic revenue opportunity, which the managers believe will remain a very significant growth driver. For example, they have increased the portfolio’s overweights to the consumer discretionary and consumer staples sectors and maintained the overweight to industrials – sectors set to benefit most from a recovery in Chinese domestic demand. (See the Portfolio positioning sector for further discussion.)

The trust also has significant exposure to the ‘new productive forces’ the government is encouraging to improve self-sufficiency in energy and technology. For example, it holds Silergy, a semiconductor producer, and positions in several so-called ‘little giants’ – companies with advanced expertise in strategically important industries. It also owns Longi Green, the world’s biggest maker of solar wafers, and Zijin Mining Group, which produces several minerals, including copper, a component essential to the transition to green energy.

And making the best of opportunities created by low valuations

BGCG’s managers have already begun taking advantage of some of the many other opportunities created by market weakness, and portfolio turnover has increased accordingly, to 15% on an annual basis, almost double the rate for FY24 (ended 31 January 2024). So far this financial year, they have added two new names to the portfolio. Both acquisitions are consumer-focused companies expected to be significant players in their respective markets over next 10 years. Coffee drinking is increasingly popular in China and Luckin Coffee, China’s equivalent to Starbucks (NASDAQ:SBUX), is riding this trend with a data-driven, automated service approach that offers good value to customers. The trust’s managers see this company as part of the broader trend of consumption polarisation, which is simultaneously driving demand for both good-value products, such as those offered by Luckin Coffee, and high-end luxury items such as designer clothing. They have also purchased Fenjiu, a producer of baijiu, a very popular alcoholic, white spirit beverage. This company is a strong provincial brand focused on building national market share. The managers have also added to existing positions in several companies. (See the Portfolio positioning sector for details.)

Investing in on-the-ground resources in China

Baillie Gifford’s confidence in the long-term opportunities available in the Chinese market is reflected in its willingness to commit increasing resources to the country. Baillie Gifford’s Shanghai office, which has a dedicated focus on direct Chinese investments, was opened in 2019 and has added resources every year since. It now has seven investment staff.

This on-the-ground presence in China gives the manager scope to meet the founders and managers of interesting, innovative businesses at early stages of their development, and to nurture longstanding relationships with existing holdings. Such relationships provide BGCG’s analysts with valuable insights into potential opportunities, which flow directly into BGCG’s investment decision making process.

In addition to its increasing commitment to its Shanghai office, following a recent re-organisation, Baillie Gifford has now established a dedicated China Equities team. Linda Lin, the head of this team, now also co-managers BGCG with Sophie Earnshaw, who has managed the trust, previously alongside Roddy Snell, since it adopted its current mandate in 2020. (See the Investment process section for more detail.)

Third-party consultants provide additional expertise

Geopolitical tensions and sudden shifts in the Chinese authorities’ approach to regulation in some sectors have generated significant market volatility and uncertainty in recent years. To provide more in-depth analysis and guidance on such matters, Baillie Gifford engages with a number of third-party consultants including those with policy, regulatory and geopolitical insights. They share the managers’ long-term perspective and provide regular updates, as well as one-off research commissioned by the managers. Their input helps the team spot investment opportunities, for example in companies at the forefront of ESG issues, as well as risks.

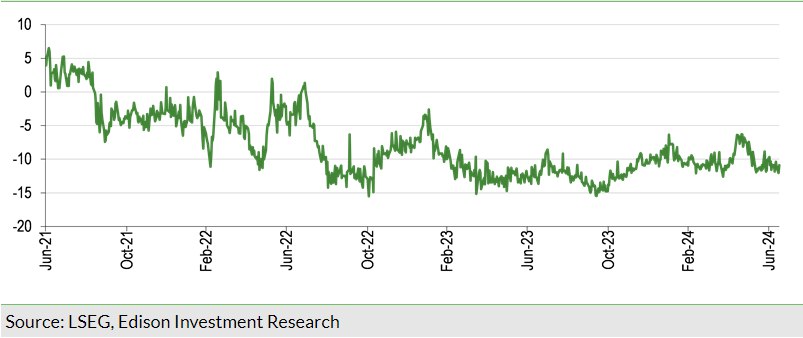

BGCG’s discount is wide by historical standards

BGCG’s discount, shown in Exhibit 5, trended wider over the first two years of its China-only strategy, due in part to the deterioration in sentiment towards China over this period. In addition, discounts have widened across the entire investment trust sector, regardless of regional or strategic focus, and BGCG has not been immune to this trend. However, in an effort to support the share price, the company bought back 160,700 shares in FY24 to 31 January 2024, and a further 1.3m to date in FY25 (as at 20 July 2024) and the discount has stabilised in a range around 10%.

BGCG’s discount has scope to narrow if investor sentiment towards the Chinese market continues to improve. The trust’s shares will also benefit as and when the growth stocks it favours deliver the strong returns the managers anticipate, and performance improves accordingly. Until then, BGCG’s historically wide discount arguably provides an opportunity for investors to access this rapidly growing, vibrant market at an attractive price.

Portfolio positioning

BGCG usually comprises around 60 holdings. In addition to the new acquisitions mentioned above, the managers have added to several existing positions including CATL, the EV battery maker cited above for its recent strong earnings growth. This company’s share price has been hit by concerns about industry capacity, but the managers believe the price does not reflect the company’s technical leadership, which should allow it to maintain margins and grow significantly over time. BGCG’s holdings in Meituan, an online food delivery company, and Tencent (HK:0700), an internet content provider, have also been topped up as valuations have fallen despite strong growth. A meeting with Meituan’s founder in January this year reassured the managers that concerns about competition, especially from ByteDance (another portfolio holding), were overdone. They continue to like Tencent due to its very strong franchise and good fundamentals.

These acquisitions have been funded by reduced exposure to companies with significant US exposure, such as pharma contract R&D providers Wuxi AppTec and Asymchem Laboratories, due in part to concerns that future growth in US demand may be curtailed by regulatory sanctions. The managers have also closed a position in Glodon, a construction software company. This company has a leading market share and has outperformed competitors, but with the property sector still struggling, Glodon will not be able to deliver the strong growth BGCG’s managers require. Holdings of some e-commerce names have also been sold or trimmed due to slowing industry level growth and intense competition.

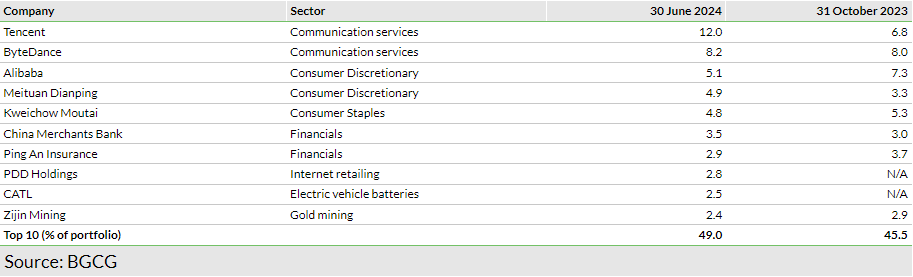

Although turnover has increased in recent months, the company’s top 10 holdings remain mostly unchanged since our last note, published in December last year (Exhibit 6). The portfolio’s bias towards the domestic economy, mentioned above, is clear from Exhibit 7, which shows that the largest active positions are held in consumer discretionary and communication services. These active positions have increased since our last note. The portfolio’s significant overweight to industrials has been reduced a little over this period. BGCG’s most notable underweights, to lower growth financials and energy, and a lesser underweight to real estate, remain broadly unchanged.

BGCG currently has only one unlisted holding, ByteDance, which represented more than 8% of the portfolio at end June 2024, but the managers have scope to hold up to 20% of the portfolio in unlisted stocks. They are keen to have more, but only at the right price.

As at 30 June 2024, gearing (defined as borrowings at book value divided by shareholder funds) was at 4%, slightly higher than the 3% level at end October 2023.

Dividend policy

Since the adoption of BGCG’s new China-focused investment policy, the trust’s objective has been to produce long-term capital growth only. The board’s policy is that any dividend paid will be by way of a final dividend and not less than the minimum required for the company to maintain its investment trust status (retaining not more than 15% of eligible investment income arising during a financial year).

For the financial year ended 31 January 2024 (FY24), revenue per share was 2.42p, up from 2.14p (a rise of 13.1% year-on-year) and the final and only dividend with respect to FY24 will be 2.0p per share, paid in July 2024. This represents a rise of 17.6% from the FY23 dividend of 1.7p per share, paid in July 2023 and a current yield of 1.1%.

Fund profile

Baillie Gifford & Co (BG) took over management of the trust from Witan Investment Services on 16 September 2020, following a period of disappointing performance. The investment strategy was changed to China growth equity from Asia-Pacific growth and income. The benchmark was changed to the MSCI China All Shares Index.

BG has a strong track record of investing in China. The emerging markets team began buying Chinese equities in 1994 and the Baillie Gifford China fund (OEIC) has 18-year history. While Baillie Gifford’s strategy has been challenged by recent market conditions, long-term performance remains ahead of the benchmark. The firm had £17.0bn invested in listed and unlisted Chinese companies across all its funds as at end March 2024.

BGCG has a tiered management fee structure amounting to 0.75% on the first £50m of NAV; 0.65% on the next £250m; and 0.55% thereafter.

Investment process

BGCG’s investment objective is to produce long-term capital growth by investing predominantly in shares of, or depositary receipts representing the shares of, Chinese companies.

Sophie Earnshaw and Roddy Snell co-managed the fund since its strategy was revised in September 2020 but following a decision by the manager to separate its China and Global Emerging Markets teams, Roddy Snell will focus on his emerging market and Asia responsibilities and Linda Lin, a partner at Baillie Gifford, and head of the China Equities team, has joined Sophie as co-portfolio manager of BGCG.

Earnshaw joined Bailie Gifford in 2010. She has been co-manager of the China Fund since 2014 and is also a decision-maker on the China A Share Fund. Lin joined BG in 2014 and worked in Edinburgh until 2019, when she re-located to Shanghai to establish and head up the local investment team. She is a decision-maker on Baillie Gifford’s All China and China A share strategies. Lin became a partner of the company in May 2022 and is now based in Edinburgh. She is a native Mandarin speaker.

The investment managers are supported by substantial Baillie Gifford resources. The China Equities team currently comprises seven investment managers, two analysts and an ESG specialist. Presently, 95 investment professionals from global teams also assess investment opportunities in China and share their views internally. In addition, the managers tap into Baillie Gifford’s Shanghai research platform (created in 2019), other internal teams and third-party specialist research as discussed above. The managers focus on fundamental proprietary research and typically prefer to engage with people who share their long-term perspective. These include industry and other specialist professionals, such as academics and journalists, who help to conduct independent corporate and legal due diligence.

The investment process is collegiate. An idea can come from anywhere within the firm or external network, including companies and corporate contacts. The team’s objective is to identify investments with the capacity to at least double in value within five years. The managers conduct weekly research meetings with their colleagues in Edinburgh and Shanghai, as well as monthly decision-making meetings. Earnshaw and Lin travel to China throughout the year, conducting face-to-face meetings with company executives of current portfolio holdings and potential investments.

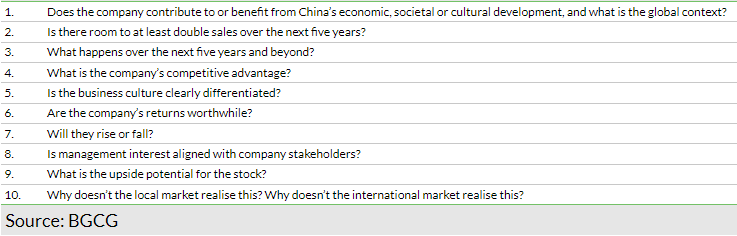

The team uses a fundamental analysis framework, comprising 10 questions, presented in Exhibit 8, to assess each stock’s suitability for the portfolio. This framework serves to assess the scale of the opportunity over the next five to 10 years, along with the cultural and financial factors that will allow the company to capitalise on this opportunity. The framework focuses predominantly on the upside investment case. Given BGCG’s long investment horizon, the framework also considers the sustainability of each company’s business model, including ESG considerations such as the scope for BGCG’s managers to encourage the company to pursue industry best practice in all aspects of its corporate behaviour.

Each stock is also the subject of a due diligence checklist, which is more focused on downside risk management, including ownership structures, financials, the company’s history and more in-depth ESG factors.

ESG considerations have been a core part of the investment process for the past 20–30 years. Baillie Gifford has a dedicated ESG team of 25 people, who perform daily functions, such as voting, administrative activities across the firm and for the emerging markets team. The management team mitigates macro-risks by having close to 30 years’ experience of investing in China and established industry connections, and by ongoing rigorous ESG scrutiny of portfolio holdings by the in-house team and third-party experts. This focus on ESG issues is enhanced by having a dedicated ESG analyst on the ground in Shanghai.

The BGCG portfolio consists of 40–80 listed and unlisted Chinese growth stocks of any size and in any sector. The portfolio weighting of each new holding will reflect the managers’ enthusiasm for the stock, along with its potential upside, the probability ascribed to this upside, and the competition for capital among other portfolio holdings.

Up to 20% of the total assets of the company can be invested in unlisted securities. The team typically invests in later-stage, post-venture capital financing companies. All unlisted research opportunities are displayed on the Baille Gifford internal board, and any fund manager could explore investing into such companies. Gearing is permitted up to 25% of gross asset value, but the board targets it to be below 20%.

Sell decisions are the result of the managers’ frequent re-examination of all portfolio holdings. Any adverse changes in the fundamentals of a business, a loss of confidence in the management, or evidence that market valuations fully reflect the managers’ long-term view will trigger a sale. The managers accept that they make mistakes, and in such cases, they are quick to sell and move on.

Risk is defined as a permanent loss of capital, rather than volatility of returns. Tracking error is an outcome, not a target, and ranges between c 2% and 8%. The team is broadly prepared to tolerate up to two years of underperformance from a stock. The investment managers are incentivised to outperform over the long term, as their remuneration is linked to five-year rolling performance.

The manager claims to offer ‘insurance against a world that’s changing far more quickly than traditional risk models acknowledge.’ The firm believes conventional risk models do not give a good indication of future risk, as they use backward-looking data. The team considers one of the key risks to future investment portfolios is failing to own the best Chinese companies, and therefore being left behind.

Risk monitoring is an ongoing process. On a quarterly basis Baillie Gifford’s investment risk, analytics and research team generates tailored investment risk reports, which analyse themes (concentration of risk), relative risk, portfolio construction characteristics, style biases, realised performance levels and behavioural biases, among others. The investment risk report is presented and discussed with the investment team, with the aim of providing challenge and debate. In addition to this interaction, the investment risk, analytics and research team also meets on an ad hoc basis with the investment managers to discuss added-value quantitative research on aspects such as screening tools, portfolio construction and scenario analysis.

Board

BGCG’s board has five directors, all of whom are non-executive and independent of the manager. Susan Platts-Martin retired from the board on 30 April 2024. Nicholas Pink, who joined the board in September 2023, assumed the chair on 1 May 2024. Sarah MacAulay joined the board on 1 May 2024.

________________________________________________

General disclaimer and copyright

This report has been commissioned by Baillie Gifford China Growth Trust and prepared and issued by Edison, in consideration of a fee payable by Baillie Gifford China Growth Trust. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

| Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

| New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

| United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

| United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom