Former German Minister for Economic Affairs Sigmar Gabriel (SPD) has strongly criticised the EU-wide ban on combustion engines from 2035. Gabriel warns of the economic consequences, particularly for the automotive supply industry. ‘It is a silent death for suppliers, and politicians seem surprised by the job cuts in the industry, even though it was foreseeable,’ said Gabriel. He considers the ban to be rushed and sees the danger of one of the most important pillars of the German economy being destroyed.

Gabriel also questions whether electric vehicles are actually more environmentally friendly than modern diesel cars over their entire lifespan. Two years ago, the EU decided to ban the registration of new petrol and diesel vehicles from 2035. The only exception will be for vehicles powered by e-fuels, a regulation that was reaffirmed by EU Commission President Ursula von der Leyen. However, representatives of the automotive industry, such as VW boss Oliver Blume, are calling for an end to the discussion in order to give companies planning security.

The planned EU punitive tariffs on electric vehicles from China come at an inopportune time for European carmakers, parallel to the debate on the EU's ban on combustion engines. The statements by the former German minister for economic affairs also hit the nail on the head for the Italian manufacturer Stellantis (LON:0QXR), for example.

We have already pointed out in several articles that although almost all German carmakers are in a serious crisis, we also see opportunities. However, these will only arise for us at a later stage. The shares are still stuck in a strong correction.

But this does not apply to all European carmakers. There is one company that stands out particularly positively. Despite all the problems facing the European automotive industry, neither growing competition from China nor the planned punitive tariffs of the EU nor the impending demise of the combustion engine seems to be harming one company. On the contrary, the shares of this company are only going in one direction: up. We are trading here with an Italian manufacturer.

Ferrari unveils the new F80 supercar and 12Cilindri luxury coupé

Ferrari (NYSE:RACE) has presented its latest super sports car, the F80. The vehicle will be produced in a limited edition and costs around 3.9 million dollars. It combines technology from long-distance racing with modern automotive development and underlines the innovative strength of the Italian luxury carmaker.

In addition to this premiere, Ferrari has also unveiled the new 12Cilindri model, a luxury coupé with a powerful twelve-cylinder engine. As with the Purosangue SUV, Ferrari is avoiding electrification and staying true to its tradition of powerful combustion engines. The design of the 12Cilindri is reminiscent of historic Ferrari models, in particular the legendary 365 GTS 4 Daytona Spyder, known from the TV series ‘Miami Vice’.

The new coupé makes a strong visual impression, with its extremely long bonnet, a passenger compartment located well to the rear and an extraordinary rear design with an electrically opening boot lid and spoilers that unfold over the rear lights. These features make the 12Cilindri a highlight for Ferrari enthusiasts.

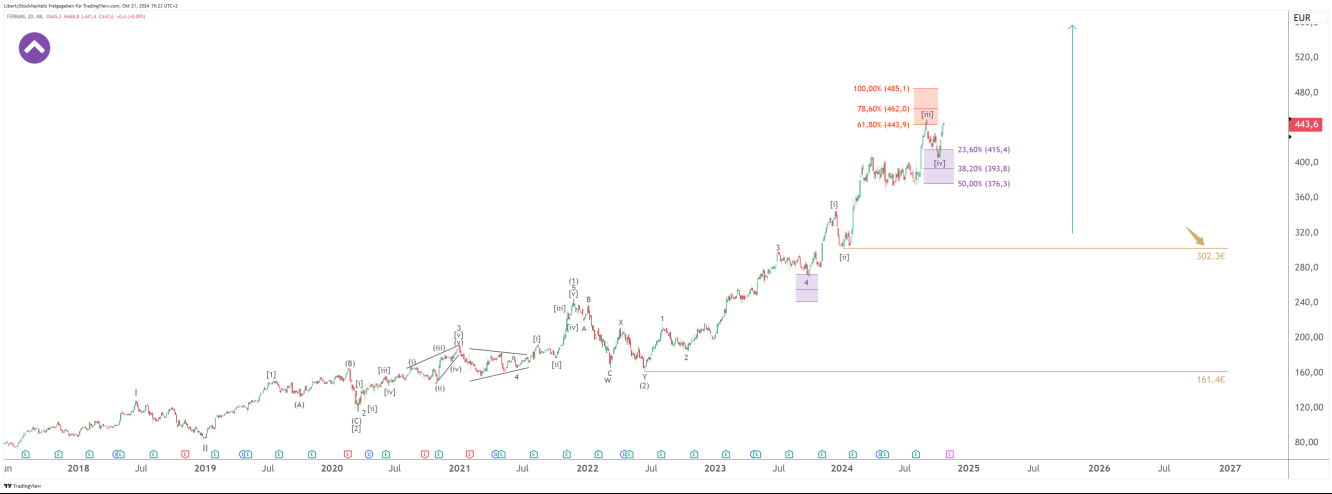

And for us, Ferrari stock is and remains one of the strongest in our portfolio. We should focus on opportunities that really benefit us as investors. Ferrari is one of those high-opportunity stocks. We have already made that clear in numerous articles and our analyses. All our forecasts have come true. The stock is in an extremely strong uptrend that will continue for a long time. Nobody should miss out on this.

The upward trend will push the stock above the €500 mark, with €302.3 representing the long-term floor.

When and where exactly a very good buying opportunity arises is explained on our website in our customer area. Access to this is now even significantly cheaper thanks to our autumn promotion. Use the coupon code LIBERTY and get a 20% discount on all our analysis packages until Sunday, 27 October 2027. With us, every portfolio will be successful. You can access the website via the link above next to my profile picture.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Automotive industry: One share continues to rise without a hitch. Which one?

Published 21/10/2024, 14:37

Automotive industry: One share continues to rise without a hitch. Which one?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.