By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

We’ve had a quiet start to a busy trading week for the currency market. The U.S. dollar moved higher against most major currencies despite a weaker-than-expected ISM manufacturing index and surprise drop in construction spending. Instead, investors latched onto comments from Fed President Kaplan who said a September hike “is very much on the table” if data supports it. While Kaplan is not a voting member of the FOMC this year, his views reinforce the less-dovish sentiment of U.S. policymakers. Over the weekend, FOMC voter Dudley said, “it is premature to rule out further monetary policy tightening this year.” Last week’s second-quarter GDP numbers hit the dollar hard and drew everyone’s attention away from the slightly more optimistic FOMC statement. This week, with nonfarm payrolls due on Friday, the relative hawkishness of Fed policy should help keep the dollar bid in the first few days of trade.

Monday evening's big focus was on Japan and how Prime Minister Abe’s fiscal stimulus plan will be allocated. If the package is greater than 28 trillion yen, or the supplementary budget receives significant allocation, the yen will fall and the Nikkei will rise. However widespread reports have indicated that real fiscal spending will be a quarter of the headline number with a fraction allocated to the supplemental budget. After the big disappointment from the Bank of Japan last week, investors have become extremely skeptical of the government’s ability and will to bolster the economy. The yen is strong and corporate activity is faltering as a direct result of weak domestic and foreign demand. As the yen rises, it puts greater pressure on Japanese corporations who have been forced to hedge yen strength more aggressively. If Abe disappointments, we can not only expect USD/JPY to make a run for 100, but many other major currency pairs could be dragged lower as well. Tuesday’s U.S. personal income and personal spending reports will most certainly take a backseat to what is announced in Japan.

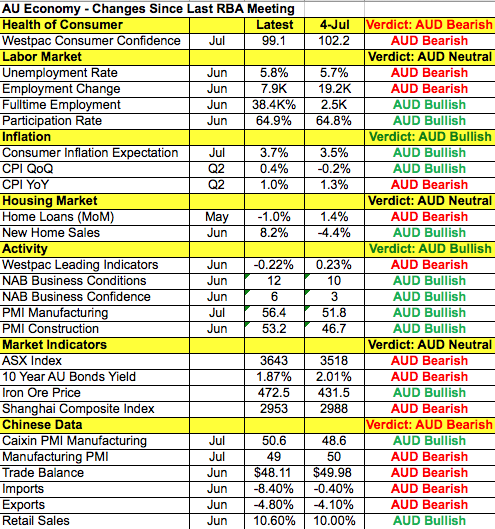

The Reserve Bank of Australia also has a monetary policy announcement and the majority of economists surveyed expect the RBA to cut interest rates by 25bp but we feel that a rate cut is not a done deal. The last time we heard from the RBA, it sounded open to the idea of easing if data supports it but since the last meeting in July, manufacturing activity accelerated, consumer prices increased, full-time job growth rebounded, business confidence improved and the participation rate is up as shown in the table below. Granted, consumer confidence is down and the unemployment rate ticked up, but we’re not sure if this is enough for the RBA to pull the trigger on easing in August. The AIG Manufacturing Index rose to 56.4 vs. 51.8 previous. Chinese PMI numbers were mixed. The official manufacturing PMI showed a decline from 50 to 49.9. The Caixin Manufacturing PMI reading registered an increase in activity, coming in at 50.6 vs. 48.9 expected. Australia’s trade balance and building approvals report will be released pre-RBA, but the rate decision will be key. If the RBA cuts, AUD/USD will drop below 0.75 cents quickly. But if they hold rates steady, we should see Monday’s high of 0.7615 recaptured. Meanwhile a steep drop in oil prices extended losses for the Canadian dollar. Oil prices dropped by over 3% with crude trading below $40 for the first time in 4 months. There are no economic reports from Canada Tuesday but New Zealand has a dairy auction.

Softer-than-expected U.K. manufacturing data kept sterling under pressure throughout the North American trading session. This is a big week for the British pound. Four times a year the Bank of England releases its Quarterly Report, where inflation and growth forecasts are updated. This report is often used to telegraph or explain major changes in monetary policy. On Thursday, the Bank of England will provide its assessment of what life looks like after Brexit and given Carney’s grim outlook, we think the forecasts will be grim. On Monday morning, Markit Economics revised down its manufacturing PMI index – factories are taking a big hit, suffering their largest contraction in more than 3 years. Wednesday’s PMI services report is likely to show similar deterioration. Meanwhile, 95% of economists surveyed expect the Bank of England to cut interest rates with some arguing that they will do more by announcing a new round of QE or a larger bond-buying program – with any move that the BoE takes, a pledge to do more will follow. As a result, we expect sterling to fall ahead of and on the back of the central bank’s monetary-policy announcement.

Lastly, euro ended the day virtually unchanged against the greenback. Eurozone data was slightly better than expected with German and Eurozone PMI numbers revised higher. The quiet consolidation in EUR/USD reflects the lack of market-moving Eurozone data this week. For the next 24 hours, EUR/JPY will dictate EUR/USD flows.